Form 1040 C U

What is the Form 1040 C U

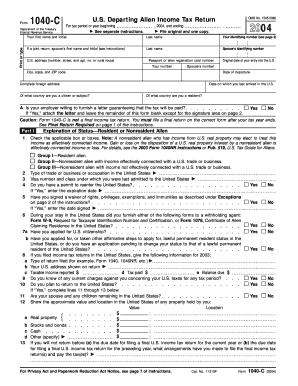

The Form 1040 C U is a tax form used by individuals in the United States to report income and calculate their federal tax liability. This form is specifically designed for self-employed individuals, freelancers, and independent contractors who need to report their earnings and expenses accurately. It allows taxpayers to detail their business income, deductions, and credits, ensuring compliance with IRS regulations. Understanding this form is crucial for those who earn income outside of traditional employment, as it helps in managing tax obligations effectively.

How to use the Form 1040 C U

To use the Form 1040 C U effectively, individuals should first gather all necessary financial documents, including income statements, receipts for business expenses, and any relevant tax documents. After obtaining the form, taxpayers should carefully fill it out by entering their income, deductions, and credits in the appropriate sections. It is important to follow the IRS guidelines closely to ensure accuracy. Once completed, the form can be submitted electronically or by mail, depending on the taxpayer's preference.

Steps to complete the Form 1040 C U

Completing the Form 1040 C U involves several key steps:

- Gather all relevant financial documents, including income records and expense receipts.

- Download the Form 1040 C U from the IRS website or obtain a physical copy.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income from self-employment activities.

- List all eligible business expenses to calculate your net profit or loss.

- Apply any applicable tax credits to reduce your overall tax liability.

- Review the completed form for accuracy before submission.

Key elements of the Form 1040 C U

The Form 1040 C U consists of several key elements that are essential for accurate reporting. These include:

- Income Section: This section requires taxpayers to report all income earned from self-employment.

- Deduction Section: Taxpayers can list business-related expenses that are deductible to reduce taxable income.

- Tax Credits: This part allows individuals to claim any tax credits they may qualify for, further lowering their tax bill.

- Signature Line: A signature is required to certify that the information provided is accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 C U are crucial for compliance with IRS regulations. Typically, the form is due on April fifteenth of each year. However, if this date falls on a weekend or holiday, the deadline may be adjusted. Taxpayers should also be aware of any extensions that may apply, allowing additional time to file without incurring penalties. Keeping track of these important dates ensures that individuals meet their tax obligations promptly.

Penalties for Non-Compliance

Failure to file the Form 1040 C U on time or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate over time. Additionally, underreporting income or claiming ineligible deductions can lead to audits and further penalties. It is essential for taxpayers to ensure that their forms are accurate and submitted on time to avoid these consequences.

Quick guide on how to complete form 1040 c u

Complete [SKS] effortlessly on any device

Online document management has gained immense popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] across any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

How to edit and eSign [SKS] effortlessly

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1040 C U

Create this form in 5 minutes!

How to create an eSignature for the form 1040 c u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1040 C U and who needs it?

Form 1040 C U is a tax form used by sole proprietors to report income and expenses. If you operate a business as a sole proprietor, you will likely need to fill out this form to accurately report your earnings to the IRS.

-

How can airSlate SignNow help with signing Form 1040 C U?

With airSlate SignNow, you can securely eSign Form 1040 C U from anywhere, at any time. Our platform makes it easy to collect signatures electronically, ensuring your document is finalized quickly and hassle-free.

-

What are the pricing options for using airSlate SignNow for Form 1040 C U?

airSlate SignNow offers flexible pricing plans starting from a basic monthly subscription. Each plan provides features that enhance your experience with Form 1040 C U eSigning, making it a cost-effective solution for individuals and businesses alike.

-

Are there any features specifically designed for Form 1040 C U on airSlate SignNow?

Absolutely! airSlate SignNow provides templates specifically for Form 1040 C U, allowing you to fill and sign the document effortlessly. Additionally, you can track the status of your forms and receive notifications when they are signed.

-

Can I integrate airSlate SignNow with other software for managing Form 1040 C U?

Yes, airSlate SignNow offers seamless integration with various accounting and tax software, allowing you to manage Form 1040 C U alongside your other financial documents. This integration streamlines your workflows and enhances productivity.

-

Is airSlate SignNow secure for handling Form 1040 C U?

Yes, airSlate SignNow implements high-level security measures, including encryption and secure access protocols, to ensure that your Form 1040 C U and other sensitive documents are safe. You can trust us to protect your personal information.

-

What are the benefits of using airSlate SignNow for Form 1040 C U?

Using airSlate SignNow for Form 1040 C U simplifies the signing process, saves time, and reduces errors. Our user-friendly interface enhances your experience, making it suitable for both tech-savvy users and those new to electronic signatures.

Get more for Form 1040 C U

Find out other Form 1040 C U

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple