Notice 1036 Rev November Form

What is the Notice 1036 Rev November

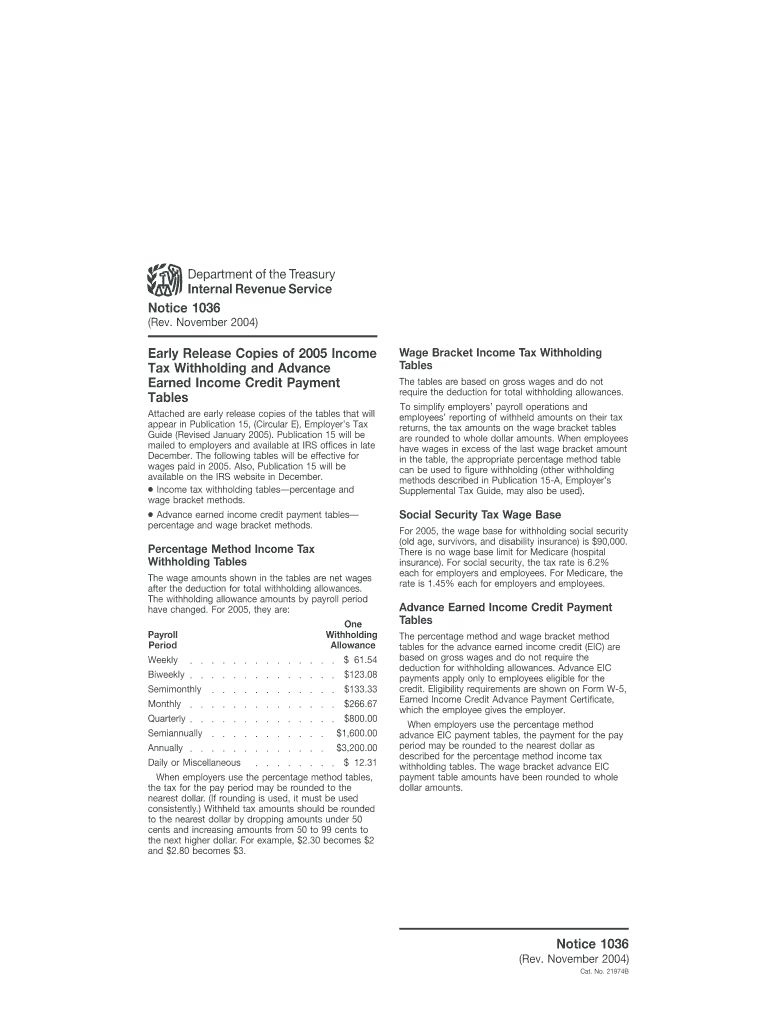

The Notice 1036 Rev November is a document issued by the Internal Revenue Service (IRS) that provides important information regarding tax obligations and compliance for taxpayers. This notice is typically sent to individuals or businesses to inform them about changes in tax laws, deadlines, or specific requirements they must fulfill. Understanding this notice is crucial for ensuring compliance with federal tax regulations and avoiding potential penalties.

How to use the Notice 1036 Rev November

Using the Notice 1036 Rev November involves carefully reviewing the information it contains and taking the necessary actions as outlined. Taxpayers should assess any changes to their tax situation, such as new filing requirements or adjustments in tax rates. It is essential to follow the instructions provided in the notice to ensure proper compliance and to avoid any issues with the IRS.

Steps to complete the Notice 1036 Rev November

Completing the Notice 1036 Rev November requires several key steps:

- Read the notice thoroughly to understand the requirements and deadlines.

- Gather any necessary documents or information that may be required to respond to the notice.

- Fill out any forms or provide information as specified in the notice.

- Review your completed information for accuracy before submission.

- Submit the required documents by the specified deadline to ensure compliance.

Legal use of the Notice 1036 Rev November

The legal use of the Notice 1036 Rev November is critical for maintaining compliance with federal tax laws. Taxpayers must adhere to the instructions provided in the notice to avoid legal repercussions, such as fines or audits. It serves as an official communication from the IRS, and responding appropriately is essential to uphold one's legal obligations.

Filing Deadlines / Important Dates

Filing deadlines and important dates associated with the Notice 1036 Rev November vary depending on the specific requirements outlined in the notice. Taxpayers should pay close attention to these dates to ensure timely submission of any required forms or payments. Missing a deadline could result in penalties or interest charges, making it crucial to stay informed and organized.

Who Issues the Form

The Notice 1036 Rev November is issued by the Internal Revenue Service (IRS), the U.S. government agency responsible for tax collection and enforcement. The IRS utilizes this notice to communicate essential information to taxpayers regarding their tax obligations, changes in tax law, and compliance requirements.

Quick guide on how to complete notice 1036 rev november

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, enabling you to obtain the correct format and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents promptly without hindrances. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign [SKS] with ease

- Locate [SKS] and click Obtain Form to initiate.

- Utilize the utilities we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Finish button to store your modifications.

- Select your preferred method of delivering your form, be it via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunting, or errors requiring new document copies to be printed. airSlate SignNow addresses your needs in document management in a few clicks from any device you choose. Alter and eSign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Notice 1036 Rev November

Create this form in 5 minutes!

How to create an eSignature for the notice 1036 rev november

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Notice 1036 Rev November?

Notice 1036 Rev November is a crucial document that provides guidance on tax-related matters. It is essential for businesses to understand its content to ensure compliance and avoid penalties. With airSlate SignNow, you can streamline the signing process of Notice 1036 Rev November and other important documents.

-

How can airSlate SignNow help with eSigning Notice 1036 Rev November?

airSlate SignNow allows users to eSign Notice 1036 Rev November securely and efficiently. Our platform ensures that all signed documents are legally binding and can be completed in a matter of minutes. Plus, you can track the signing status of your Notice 1036 Rev November in real-time.

-

Is airSlate SignNow cost-effective for signing Notices like 1036 Rev November?

Yes, airSlate SignNow offers a cost-effective solution for signing notices such as Notice 1036 Rev November. Our pricing plans are designed to fit various budgets, making it accessible for businesses of all sizes. You can get the best value while ensuring you meet all your document signing needs.

-

What features does airSlate SignNow offer for Notice 1036 Rev November?

airSlate SignNow provides a range of features tailored for handling Notice 1036 Rev November and similar documents. These include customizable templates, secure storage, and integration with popular applications. Our user-friendly interface simplifies the eSigning process, making it ideal for busy professionals.

-

Can I integrate airSlate SignNow with other software for managing Notice 1036 Rev November?

Absolutely! airSlate SignNow easily integrates with various software solutions to help you manage Notice 1036 Rev November more effectively. These integrations enhance workflow efficiency and streamline document management. You can connect with CRMs, project management tools, and more.

-

What benefits does airSlate SignNow provide for businesses handling Notice 1036 Rev November?

By using airSlate SignNow for handling Notice 1036 Rev November, businesses can enjoy enhanced efficiency and reduced turnaround times. The platform ensures compliance with legal standards while offering a secure environment for document handling. This leads to improved productivity and cost savings over time.

-

How does airSlate SignNow ensure the security of Notice 1036 Rev November?

The security of your documents, including Notice 1036 Rev November, is a top priority for airSlate SignNow. We utilize advanced encryption and secure access protocols to safeguard your information. This guarantees that your sensitive documents remain confidential and protected from unauthorized access.

Get more for Notice 1036 Rev November

- Allergy and anaphylaxis emergency plan form

- Transcript release req form ccv

- Pca 100 answer sheet form

- Qut abn form

- Junior high and high school student questionnaire solution tree transitions wiki conestogavalley form

- Affidavit of death form texas

- Expanse rpg character generator form

- Einsatzplanung fr arbeitgeber form

Find out other Notice 1036 Rev November

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter