Form 911 Rev March Fill in Version Application for Taxpayer Assistance Order ATAO

What is the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

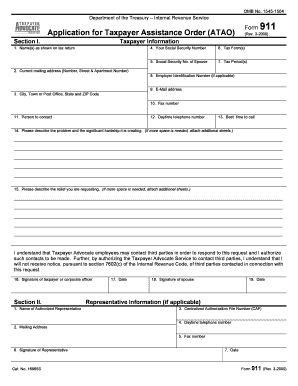

The Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO is an official document used by taxpayers in the United States to request assistance from the Internal Revenue Service (IRS). This form is designed to help individuals who are experiencing financial difficulties and need help resolving their tax issues. By submitting this form, taxpayers can seek a Taxpayer Assistance Order, which may provide relief from certain tax-related problems.

How to use the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

To effectively use the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO, follow these steps:

- Gather necessary information, including personal identification details and specifics about your tax issue.

- Complete the form accurately, ensuring all required fields are filled out.

- Submit the completed form to the appropriate IRS office, either online, by mail, or in person, depending on your preference.

Steps to complete the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

Completing the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO involves several key steps:

- Begin by entering your name, address, and Social Security number on the form.

- Provide details about your tax issue, including any relevant IRS notices or correspondence.

- Clearly state the type of assistance you are requesting and any supporting documentation.

- Review the form for accuracy before submission.

Eligibility Criteria

To qualify for assistance through the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO, taxpayers must meet specific eligibility criteria. Generally, this includes:

- Demonstrating a financial hardship that affects your ability to meet tax obligations.

- Having an existing tax issue that has not been resolved through regular IRS channels.

- Providing necessary documentation to support your claims of hardship.

Required Documents

When submitting the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO, certain documents may be required to support your application. These can include:

- Proof of income, such as pay stubs or tax returns.

- Documentation of expenses, including bills and financial statements.

- Any correspondence from the IRS related to your tax issue.

Form Submission Methods

The Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO can be submitted through various methods, ensuring flexibility for taxpayers. The available submission options include:

- Online submission via the IRS website, if applicable.

- Mailing the completed form to the designated IRS address.

- Delivering the form in person to a local IRS office for immediate processing.

Quick guide on how to complete form 911 rev march fill in version application for taxpayer assistance order atao

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Edit and eSign [SKS] Effortlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Edit and eSign [SKS] while ensuring seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

Create this form in 5 minutes!

How to create an eSignature for the form 911 rev march fill in version application for taxpayer assistance order atao

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

The Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO is a crucial document designed to help taxpayers request assistance from the IRS. This fillable form simplifies the process of claiming taxpayer assistance and ensures users can provide accurate information required for processing.

-

How can airSlate SignNow help me complete the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

airSlate SignNow offers an intuitive platform that allows users to fill out the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO easily. With features such as eSignature and document templates, you can efficiently complete and submit your application, ensuring compliance with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

Yes, airSlate SignNow provides several pricing plans tailored to fit different needs, including options for individual users and businesses. The cost is competitive and offers various features to manage documents effectively, including completing the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO.

-

What features make airSlate SignNow the best choice for the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

AirSlate SignNow offers a user-friendly interface, secure cloud storage, and advanced eSignature capabilities, making it ideal for managing the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO. Additionally, it allows for real-time collaboration, ensuring that all stakeholders can access and approve the form efficiently.

-

Can I integrate airSlate SignNow with other software while working on the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

Absolutely! airSlate SignNow supports various integrations with popular business applications, enhancing your workflow while completing the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO. This ensures that you can streamline processes and manage documents across multiple platforms.

-

How does airSlate SignNow ensure the security of my Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

AirSlate SignNow prioritizes security with industry-standard encryption and secure data storage, protecting your Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO. The platform also complies with all relevant regulations, providing peace of mind when handling sensitive information.

-

What support options are available for completing the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO?

Users of airSlate SignNow have access to a range of support options, including comprehensive guides, FAQs, and customer service representatives. Whether you're new to the platform or need help with the Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO, assistance is readily available.

Get more for Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

- Form coid w as 150te classification of industries pdf

- Persuasive essay graphic organizer doc form

- For work permittrainees france visa vfs france co form

- Everbrite plus form

- Written notice of home care consumer rights colorado form

- Moving forward program 476025291 form

- Equine liability waiver form

- Annual exemption request form

Find out other Form 911 Rev March Fill in Version Application For Taxpayer Assistance Order ATAO

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online