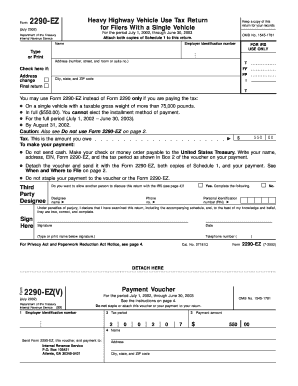

Employer Identification Number Keep a Copy of This Return for Your Records Form

What is the Employer Identification Number?

The Employer Identification Number (EIN) is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses operating in the United States. This number is used for various tax identification purposes, including filing tax returns, reporting employee wages, and opening business bank accounts. It is essential for all types of business entities, including corporations, partnerships, and limited liability companies (LLCs). Keeping a copy of any returns associated with your EIN is crucial for record-keeping and compliance with IRS regulations.

How to Obtain the Employer Identification Number

To obtain an Employer Identification Number, businesses can apply directly through the IRS. The application can be completed online, by mail, or by fax. The online application is the fastest method, allowing businesses to receive their EIN immediately upon completion. When applying, you will need to provide information about your business structure, ownership, and the reason for obtaining the EIN. Ensure that you have all required documentation ready to streamline the process.

Steps to Complete the Employer Identification Number Application

Completing the application for an Employer Identification Number involves several steps:

- Determine your eligibility and the appropriate business structure.

- Gather necessary information, including the legal name of the business, address, and ownership details.

- Choose your application method: online, by mail, or by fax.

- If applying online, visit the IRS website and follow the prompts to fill out the application form.

- Review your application for accuracy before submitting.

- Receive your EIN immediately if applying online, or wait for a confirmation if applying by mail or fax.

Legal Use of the Employer Identification Number

The Employer Identification Number is legally required for various business functions. It is used for tax reporting purposes, including payroll taxes and income taxes. Additionally, businesses need an EIN to apply for business licenses, open bank accounts, and establish credit. Proper use of the EIN ensures compliance with federal and state regulations, helping to avoid penalties or legal issues.

Filing Deadlines and Important Dates

Filing deadlines associated with the Employer Identification Number vary depending on the type of business entity and the specific tax obligations. Generally, businesses must file annual tax returns by March 15 for corporations and April 15 for sole proprietorships. It's important to keep track of these dates to ensure timely submissions and avoid penalties. Businesses should also be aware of quarterly payroll tax deadlines if they have employees.

Required Documents for EIN Application

When applying for an Employer Identification Number, certain documents are required to validate the business entity. These may include:

- Legal formation documents, such as articles of incorporation or partnership agreements.

- Identification for the responsible party, typically a Social Security Number or Individual Taxpayer Identification Number.

- Business address and contact information.

Having these documents ready will facilitate a smoother application process.

Quick guide on how to complete employer identification number keep a copy of this return for your records

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS, and enhance your document-centric processes today.

How to modify and eSign [SKS] without hassle

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form lookups, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Employer Identification Number Keep A Copy Of This Return For Your Records

Create this form in 5 minutes!

How to create an eSignature for the employer identification number keep a copy of this return for your records

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of my Employer Identification Number?

Your Employer Identification Number (EIN) is crucial for tax reporting and identification purposes. It helps in managing your business taxes effectively. Remember to keep a copy of this return for your records to facilitate any future tax needs.

-

How does airSlate SignNow support the use of EINs in document signing?

airSlate SignNow enables you to securely incorporate your Employer Identification Number in signed documents. This feature ensures that your business identity is protected while complying with regulation standards. Keeping a copy of this return for your records will help you track your submissions.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers several pricing plans tailored to different business needs, including basic and premium options. Each plan includes support for essential features such as electronic signing and document management. Investing in a plan is a step toward ensuring your Employer Identification Number and other records are handled efficiently.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow seamlessly integrates with various software tools, enhancing your workflow and document handling capabilities. This integration allows you to manage documents that contain your Employer Identification Number effectively. Always remember to keep a copy of this return for your records when using integrations.

-

What security features does airSlate SignNow offer?

Security is a top priority at airSlate SignNow, with features such as encryption and two-factor authentication. These measures protect your sensitive documents, including those with your Employer Identification Number. It's essential to keep a copy of this return for your records to safeguard your business information.

-

How can I ensure compliance with tax regulations using airSlate SignNow?

Using airSlate SignNow, you can easily generate, sign, and store documents needed for tax compliance, including those with your Employer Identification Number. The platform helps to simplify the documentation process, making it easier to maintain accurate records. Always keep a copy of this return for your records to meet compliance needs.

-

Is it easy to eSign documents containing sensitive information?

Yes, eSigning documents that contain sensitive information, such as your Employer Identification Number, is straightforward with airSlate SignNow. The platform is designed for ease of use, ensuring that your data remains protected while you sign and share documents. Don't forget to keep a copy of this return for your records post-signing.

Get more for Employer Identification Number Keep A Copy Of This Return For Your Records

Find out other Employer Identification Number Keep A Copy Of This Return For Your Records

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement