Form 8453 P Fill in Version U S Partnership Declaration and Signature for Electronic Filing

What is the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

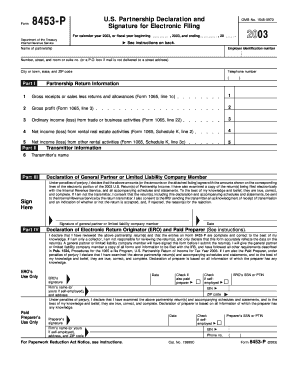

The Form 8453 P is a crucial document for partnerships filing electronically with the Internal Revenue Service (IRS). This form serves as a declaration and signature for electronic filing, ensuring that the partnership's tax return is submitted accurately and in compliance with IRS regulations. It is specifically designed for partnerships that choose to e-file their tax returns, providing a way to authenticate the submission and confirm the partnership's agreement with the information provided on the return.

How to use the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

Using the Form 8453 P involves several straightforward steps. First, ensure that all required information is accurately filled out on the form. This includes details about the partnership, such as its name, address, and Employer Identification Number (EIN). Once the form is completed, it must be signed by an authorized partner. After signing, the form should be submitted electronically along with the partnership's tax return. It is important to retain a copy of the signed form for your records, as it serves as proof of the electronic filing.

Steps to complete the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

Completing the Form 8453 P involves the following steps:

- Gather necessary information, including the partnership's name, address, and EIN.

- Access the fillable version of the Form 8453 P, ensuring you have the latest version.

- Fill in the required fields accurately, paying close attention to detail.

- Have an authorized partner review and sign the form to validate the information.

- Submit the completed form electronically along with the partnership's tax return.

- Keep a copy of the signed form for your records.

Key elements of the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

The Form 8453 P includes several key elements that are essential for its validity:

- Partnership Information: This section requires the name, address, and EIN of the partnership.

- Authorized Partner Signature: An authorized partner must sign the form to confirm the accuracy of the information.

- Tax Year: Indicating the tax year for which the return is being filed is necessary for proper processing.

- Electronic Filing Declaration: This statement confirms that the partnership is filing electronically and agrees to the terms set forth by the IRS.

Legal use of the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

The legal use of the Form 8453 P is governed by IRS regulations. It is required for partnerships that file their tax returns electronically, ensuring that the submission is legally binding and compliant with federal tax laws. Failure to submit this form when required can result in penalties or delays in processing the tax return. It is advisable for partnerships to familiarize themselves with the legal implications of electronic filing and to maintain accurate records of all submitted forms.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines when submitting their tax returns along with the Form 8453 P. Generally, the deadline for filing a partnership return is the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is essential to stay informed of any changes to these deadlines, as late submissions can incur penalties and interest on any taxes owed.

Quick guide on how to complete form 8453 p fill in version u s partnership declaration and signature for electronic filing

Easily Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Modify and Electronically Sign [SKS] Effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal standing as a traditional wet ink signature.

- Review all the details and select the Done button to save your modifications.

- Select your preferred method for sharing your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

Create this form in 5 minutes!

How to create an eSignature for the form 8453 p fill in version u s partnership declaration and signature for electronic filing

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing?

The Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing is a document that allows partnerships to electronically submit their tax returns with a signed declaration. This form verifies the authenticity of the submission and is vital for compliance with IRS requirements. By using the Fill In version, users can complete the form digitally, ensuring accuracy and ease of filing.

-

How does airSlate SignNow simplify the signing process for Form 8453 P?

airSlate SignNow streamlines the signing process for the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing by providing a user-friendly interface. Users can easily upload, fill out, and send the form for signature through a secure platform. This not only saves time but also enhances the overall filing experience.

-

What are the advantages of using airSlate SignNow for Form 8453 P?

Using airSlate SignNow for the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing offers several benefits. It allows for quick digital signatures, secure storage of documents, and easy access from anywhere. Additionally, it minimizes the risk of errors and ensures timely submission of important tax documents.

-

Is there a cost associated with using airSlate SignNow for this form?

Yes, there is a cost associated with using airSlate SignNow for the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing. However, the pricing is competitive and provides value through a robust set of features designed to facilitate document management and e-signature processes. Check our pricing page for detailed information on plans and features.

-

Can I integrate airSlate SignNow with other tools for filing the Form 8453 P?

Absolutely! airSlate SignNow offers integrations with various tools and software to enhance your filing process for the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing. This includes accounting software, CRM systems, and other apps, ensuring that your workflow remains efficient and seamless.

-

What security measures does airSlate SignNow implement for sensitive forms like the Form 8453 P?

airSlate SignNow prioritizes the security of your documents, including the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing. The platform employs industry-standard encryption, secure data storage, and strict compliance with data protection regulations to protect sensitive information and ensure your documents are safe.

-

Can multiple signers complete the Form 8453 P using airSlate SignNow?

Yes, multiple signers can easily complete the Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing using airSlate SignNow. The platform supports sequential and simultaneous signing, allowing collaboration among partners and making it convenient to gather all necessary signatures efficiently.

Get more for Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

- Ma cool smart residential rebate application nstar form

- Pwd 790 form

- Socalgas continuous service agreement form

- Sadeh lok housing application form

- Ap nativity application form

- Southeastern assistance in healthcare inc aih form

- 450b form indiana

- Application for ministerial determination bcea6 new pdf form

Find out other Form 8453 P Fill In Version U S Partnership Declaration And Signature For Electronic Filing

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy

- Sign Maine Leave of Absence Agreement Safe

- Sign Massachusetts Leave of Absence Agreement Simple

- Sign Connecticut Acknowledgement of Resignation Fast

- How To Sign Massachusetts Resignation Letter

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy