1545 1007 Department of the Treasury Internal Revenue Service Attachment Sequence No Form

Understanding the Department Of The Treasury Internal Revenue Service Attachment Sequence No

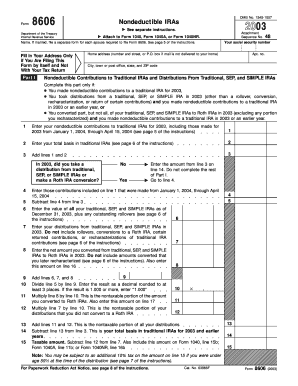

The form, issued by the Department of the Treasury Internal Revenue Service, is primarily used for reporting specific tax-related information. This form is essential for taxpayers who need to provide additional details concerning their income, deductions, or credits. It serves as an attachment to other tax forms, helping to clarify or expand upon the information submitted in the primary filing. Understanding the purpose and requirements of this form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Department Of The Treasury Internal Revenue Service Attachment Sequence No

Completing the form involves several key steps:

- Gather necessary documents, including any relevant income statements, receipts, and prior tax returns.

- Carefully read the instructions provided with the form to understand what information is required.

- Fill out the form accurately, ensuring that all information is complete and matches your supporting documents.

- Review the completed form for any errors or omissions before submission.

- Attach the form to your primary tax return and ensure it is submitted by the appropriate deadline.

Legal Use of the Department Of The Treasury Internal Revenue Service Attachment Sequence No

The legal use of the form is governed by IRS regulations. This form must be used by taxpayers who are required to provide additional information to support their tax filings. Failure to include this form when necessary can lead to delays in processing your return or potential penalties. It is important to understand the legal implications of submitting this form, including the requirement for accuracy and completeness, as any discrepancies may result in audits or further inquiries from the IRS.

Key Elements of the Department Of The Treasury Internal Revenue Service Attachment Sequence No

Key elements of the form include:

- Taxpayer identification information, such as name and Social Security number.

- Details regarding income sources, deductions, or credits being claimed.

- Any additional documentation that supports the information provided on the form.

- Signature and date to certify the accuracy of the information submitted.

Filing Deadlines for the Department Of The Treasury Internal Revenue Service Attachment Sequence No

Filing deadlines for the form align with the deadlines for your primary tax return. Typically, individual tax returns are due on April fifteenth of each year, unless an extension is filed. It is essential to submit the form by this deadline to avoid penalties and ensure timely processing of your tax return. If you are unable to meet the deadline, consider filing for an extension to provide additional time for submission.

Examples of Using the Department Of The Treasury Internal Revenue Service Attachment Sequence No

Examples of situations where the form may be used include:

- Claiming additional deductions for business expenses that require detailed documentation.

- Reporting income from multiple sources, such as freelance work or rental properties.

- Providing clarification on tax credits that need further explanation.

In each of these cases, the form helps to ensure that the IRS has all necessary information to accurately assess your tax situation.

Quick guide on how to complete 1545 1007 department of the treasury internal revenue service attachment sequence no

Effortlessly Complete 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No on Any Gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without any hurdles. Manage 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No on any gadget using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The Simplest Method to Edit and eSign 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No with Ease

- Find 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No and guarantee exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 1545 1007 department of the treasury internal revenue service attachment sequence no

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No.?

The 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. is a specific identifier used for IRS documentation. This form helps ensure that tax returns and associated documents are correctly processed. Understanding this attachment sequence is key for tax compliance.

-

How does airSlate SignNow assist with the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No.?

airSlate SignNow simplifies the process of completing and securely signing documents, including those associated with the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. Users can effortlessly upload, sign, and send these documents directly through our platform, ensuring compliance and efficiency.

-

What are the pricing options for airSlate SignNow when handling IRS forms like the 1545 1007?

airSlate SignNow offers competitive pricing plans aimed at businesses of all sizes, making handling IRS forms like the 1545 1007 affordable. Our plans include various features designed to streamline document workflows while being budget-friendly. Visit our pricing page for more details.

-

What features does airSlate SignNow include for managing IRS forms?

With airSlate SignNow, you gain access to features such as eSigning, document templates, and audit trails, all essential for managing IRS forms like the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. These tools ensure that your documents are handled securely and efficiently.

-

Can airSlate SignNow integrate with other software for tax filing?

Yes, airSlate SignNow offers integrations with various accounting and tax software to streamline the process of filing IRS documents, including the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. This compatibility allows for a smoother workflow and reduces the chances of errors.

-

How secure is airSlate SignNow for sending sensitive IRS documents?

airSlate SignNow takes security seriously, employing encryption and advanced security measures to protect sensitive documents, including the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. Our platform ensures that all transmitted data is secure and compliant with industry standards.

-

What benefits can businesses expect from using airSlate SignNow for IRS form management?

By using airSlate SignNow for IRS form management, businesses can expect faster turnaround times, decreased paperwork, and improved compliance with documentation like the 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No. Our solution simplifies document management and enhances productivity.

Get more for 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No

- New patient forms tri county eye clinic

- Mary g porter traditional school application form

- Ach authorization agreement form wells fargo advisors

- Change of address ymca retirement fund yretirement form

- Monroe county local rider to as is residential contract form

- Svat invoice format

- Rent deposit agreement template form

- Rent forgiveness agreement template form

Find out other 1545 1007 Department Of The Treasury Internal Revenue Service Attachment Sequence No

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer