Form 8809 Rev December Fill in Version Request for Extension of Time to File Information Returns

What is the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

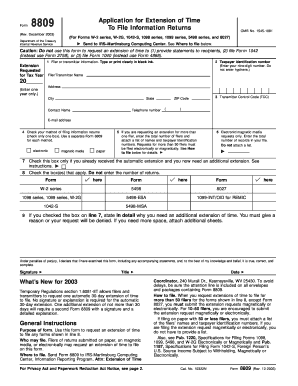

The Form 8809 Rev December is a crucial document used by businesses and organizations in the United States to request an extension of time to file information returns. This form is particularly relevant for entities that need additional time beyond the standard filing deadlines for forms such as W-2s, 1099s, and other related tax documents. By submitting this form, filers can avoid potential penalties associated with late submissions while ensuring compliance with Internal Revenue Service (IRS) regulations.

How to use the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

To effectively use the Form 8809 Rev December, filers should first ensure they have the correct version of the form. The form can be filled out digitally or printed for manual completion. It requires basic information about the filer, including the name, address, and Employer Identification Number (EIN). Once completed, the form should be submitted to the IRS by the specified deadline to ensure the extension is granted. It is essential to retain a copy of the submitted form for your records.

Steps to complete the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

Completing the Form 8809 Rev December involves several key steps:

- Obtain the latest version of the form from the IRS website or a reliable source.

- Fill in the required fields, including your name, address, and EIN.

- Indicate the type of information returns for which you are requesting an extension.

- Sign and date the form to certify the information provided is accurate.

- Submit the form to the IRS by mail or electronically, depending on your preference.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8809 Rev December are critical to avoid penalties. Typically, the form must be submitted by the due date of the information returns for which the extension is requested. For most information returns, this is generally January thirty-first. However, if the due date falls on a weekend or holiday, the deadline may be adjusted. It is advisable to check the IRS guidelines for any updates or changes to these dates.

Legal use of the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

The legal use of the Form 8809 Rev December is governed by IRS regulations. Filing this form correctly allows businesses to obtain a valid extension for filing information returns, thereby mitigating the risk of penalties for late submissions. It is important to ensure that the form is completed accurately and submitted on time to maintain compliance with federal tax laws. Failure to do so may result in significant fines and complications with the IRS.

Eligibility Criteria

Eligibility to file the Form 8809 Rev December is generally open to all entities required to submit information returns to the IRS. This includes corporations, partnerships, and sole proprietors. However, the request for an extension must be made for valid reasons, such as unforeseen circumstances that hinder timely filing. Understanding the eligibility criteria ensures that filers can effectively utilize this form without facing unnecessary complications.

Quick guide on how to complete form 8809 rev december fill in version request for extension of time to file information returns

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, edit, and eSign your documents swiftly without any holdups. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The simplest way to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of your documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

Create this form in 5 minutes!

How to create an eSignature for the form 8809 rev december fill in version request for extension of time to file information returns

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns?

The Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns is a form used by businesses to request an extension of time to file various information returns with the IRS. This form is essential for ensuring compliance with tax regulations and avoiding penalties for late submissions.

-

How can airSlate SignNow assist with the Form 8809 Rev December Fill in Version?

airSlate SignNow simplifies the process of completing and submitting the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns. Our platform allows you to fill out the form electronically, ensuring accuracy and efficiency, plus securely sign and send it directly to the IRS.

-

Is there a cost associated with using airSlate SignNow for the Form 8809?

Yes, there is a subscription fee for using airSlate SignNow, which varies based on the features you choose. However, the investment in our solution is cost-effective given the time saved and the reduced risk of errors in processes such as submitting the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns.

-

What features does airSlate SignNow offer for completing the Form 8809?

airSlate SignNow offers various features that enhance the experience of filling out the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns, including templates, real-time collaboration, and electronic signature capabilities. These features streamline your workflow and ensure compliance with IRS requirements.

-

Can I integrate airSlate SignNow with other software for handling the Form 8809?

Absolutely! airSlate SignNow integrates seamlessly with various software platforms, allowing you to manage your documents and information returns efficiently. This means you can connect your existing systems to simplify your workflow around completing the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including saving time, reducing paperwork, and minimizing errors. By leveraging our platform for forms like the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns, businesses can focus more on growth rather than administrative tasks.

-

Is airSlate SignNow secure for submitting sensitive information like the Form 8809?

Yes, security is a top priority for airSlate SignNow. We use advanced encryption and security protocols to ensure that all information submitted, including the Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns, is kept confidential and protected from unauthorized access.

Get more for Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

Find out other Form 8809 Rev December Fill in Version Request For Extension Of Time To File Information Returns

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement