Form W 8ECI Rev December Fill in Version Certificate of Foreign Person's Claim for Exemption from Withholding on Income Eff

Understanding the Form W-8ECI

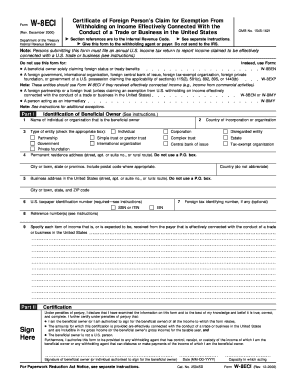

The Form W-8ECI, officially titled the Certificate of Foreign Person's Claim for Exemption From Withholding on Income Effectively Connected With the Conduct of a Trade or Business in the United States, is a crucial document for foreign entities and individuals. This form is primarily used to certify that the income received is effectively connected with a trade or business conducted in the U.S. By submitting this form, foreign persons can claim an exemption from U.S. withholding tax on certain types of income.

How to Use the Form W-8ECI

To effectively utilize the Form W-8ECI, a foreign person must complete it accurately and submit it to the withholding agent or payer. This form is not submitted directly to the IRS. Instead, it should be provided to the entity that is responsible for withholding tax on the income. The withholding agent uses the information provided to determine the correct amount of withholding tax, if any, that applies to the income. It is essential to ensure that all information is current and correct to avoid any issues with tax compliance.

Steps to Complete the Form W-8ECI

Completing the Form W-8ECI involves several key steps:

- Provide your name and address in the appropriate fields.

- Identify the type of entity or individual submitting the form.

- Include your U.S. taxpayer identification number (if applicable) or foreign tax identifying number.

- Specify the income that is effectively connected with a U.S. trade or business.

- Sign and date the form to certify that the information provided is accurate.

It is advisable to review the instructions provided by the IRS for any specific requirements or updates related to the form.

Legal Use of the Form W-8ECI

The Form W-8ECI is legally binding and must be used in accordance with IRS regulations. It is intended for foreign persons who receive income that is effectively connected with a U.S. trade or business. Failure to use this form correctly may result in improper withholding of taxes, leading to potential penalties. Understanding the legal implications of this form is essential for compliance and to ensure that the correct tax treatment is applied.

Key Elements of the Form W-8ECI

Several key elements must be included when completing the Form W-8ECI:

- Name of the foreign person: This should match the name on the tax identification documents.

- Address: A permanent address outside the U.S. must be provided.

- Entity type: Specify whether the submitter is an individual, corporation, partnership, etc.

- Tax identification numbers: Include any applicable U.S. or foreign tax identification numbers.

- Signature: The form must be signed and dated by the individual or authorized representative.

Eligibility Criteria for the Form W-8ECI

To be eligible to use the Form W-8ECI, the individual or entity must be a foreign person receiving income from sources in the U.S. that is effectively connected with a trade or business. This includes non-resident aliens and foreign corporations. It is important to assess whether the income falls under the category of effectively connected income, as this determines the necessity of filing the form. Understanding the eligibility criteria helps ensure compliance and proper tax treatment.

Quick guide on how to complete form w 8eci rev december fill in version certificate of foreign persons claim for exemption from withholding on income

Effortlessly prepare [SKS] on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and simplify any document-based task today.

The most efficient way to edit and eSign [SKS] seamlessly

- Access [SKS] and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from a device of your choosing. Modify and eSign [SKS] while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8eci rev december fill in version certificate of foreign persons claim for exemption from withholding on income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8ECI Rev December Fill in Version Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connected With The Conduct Of A Trade Or Business In The United States?

The Form W 8ECI Rev December Fill in Version Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Effectively Connected With The Conduct Of A Trade Or Business In The United States is a necessary IRS form that foreign investors must complete to claim exemption from withholding tax on income that is effectively connected with their U.S. business activities. This form helps facilitate proper tax compliance and ensures that the right amount of taxes are withheld.

-

How does airSlate SignNow help with the Form W 8ECI Rev December Fill in Version?

airSlate SignNow simplifies the completion and submission of the Form W 8ECI Rev December Fill in Version by providing a user-friendly platform for electronic signatures and document management. With our solution, users can fill in, sign, and send the form securely, streamlining the process and reducing the chances of errors or delays.

-

Is the use of airSlate SignNow secure for handling Form W 8ECI Rev December Fill in Version?

Yes, airSlate SignNow ensures that handling the Form W 8ECI Rev December Fill in Version is secure through advanced encryption protocols and secure cloud storage. Our platform is compliant with industry standards, assuring users that their sensitive information remains protected at all times.

-

What pricing plans are available for airSlate SignNow when processing the Form W 8ECI Rev December Fill in Version?

airSlate SignNow offers various pricing plans that cater to different business needs when processing the Form W 8ECI Rev December Fill in Version. Each plan provides access to a range of features, including document management and e-signatures, making it a cost-effective solution for companies looking to streamline their paperwork.

-

Can I integrate airSlate SignNow with other tools while using the Form W 8ECI Rev December Fill in Version?

Absolutely! airSlate SignNow offers seamless integrations with numerous third-party applications, allowing users to manage the Form W 8ECI Rev December Fill in Version alongside their existing business tools. This flexibility enhances workflow efficiency and ensures that all relevant documents are easily accessible.

-

What benefits does airSlate SignNow provide for businesses managing the Form W 8ECI Rev December Fill in Version?

Using airSlate SignNow for managing the Form W 8ECI Rev December Fill in Version provides numerous benefits, including reduced processing time, improved accuracy, and enhanced compliance. Our platform facilitates quick collaboration and allows multiple users to work on the document, ensuring that regulatory requirements are met efficiently.

-

How quickly can I complete the Form W 8ECI Rev December Fill in Version using airSlate SignNow?

With airSlate SignNow, you can complete the Form W 8ECI Rev December Fill in Version much faster than traditional methods. The intuitive interface and streamlined processes allow users to fill in their information and obtain required signatures promptly, ensuring a quicker turnaround time for your business needs.

Get more for Form W 8ECI Rev December Fill in Version Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Eff

Find out other Form W 8ECI Rev December Fill in Version Certificate Of Foreign Person's Claim For Exemption From Withholding On Income Eff

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter