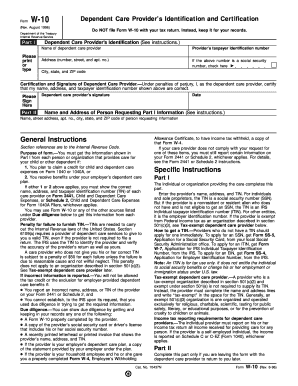

City, State, and ZIP Code Provider's Taxpayer Identification Number If the above Number is a Social Security Number, Check Form

Understanding the City, State, And ZIP Code Provider's Taxpayer Identification Number

The City, State, And ZIP Code Provider's Taxpayer Identification Number is a crucial component for individuals and businesses engaging in dependent care services. This number serves as an official identification for tax purposes, especially when the provider uses a Social Security Number. It is essential for ensuring compliance with federal tax regulations and for accurately reporting income earned from providing care services.

When filling out forms related to dependent care, this identification number helps the IRS track payments made to service providers. It is vital for both the provider and the taxpayer claiming the care expenses, as it establishes legitimacy and accountability in financial transactions.

Steps to Complete the Certification and Signature of Dependent Care Provider

Completing the certification and signature section of the dependent care provider form involves several straightforward steps:

- Gather necessary information, including the provider's name, address, and taxpayer identification number.

- If the provider uses a Social Security Number, check the appropriate box to indicate this.

- Ensure all information is accurate and complete to avoid delays or issues with processing.

- Sign and date the form, confirming that the information provided is true and correct.

Following these steps carefully helps in maintaining compliance with IRS requirements and ensures that the taxpayer can claim any eligible deductions without complications.

Legal Use of the Taxpayer Identification Number

The legal use of the City, State, And ZIP Code Provider's Taxpayer Identification Number is primarily for tax reporting and compliance. This number is required when filing tax returns that include dependent care expenses. It ensures that both the provider and the taxpayer are adhering to IRS regulations.

Moreover, using this identification number helps prevent fraud and misuse of Social Security Numbers. It is a safeguard for both parties involved in the transaction, ensuring that all reported income is accurately tracked and taxed accordingly.

How to Obtain the Taxpayer Identification Number

Obtaining the City, State, And ZIP Code Provider's Taxpayer Identification Number can be done through several methods:

- If the provider is an individual, they may use their Social Security Number.

- For businesses, applying for an Employer Identification Number (EIN) through the IRS is necessary.

- Providers can also consult with a tax professional to ensure they are using the correct identification number for their specific situation.

It is essential to keep this number secure and only share it when necessary, as it is sensitive information that can be misused if it falls into the wrong hands.

Examples of Using the Taxpayer Identification Number

When filing taxes, the City, State, And ZIP Code Provider's Taxpayer Identification Number is used in various scenarios:

- A taxpayer claims dependent care expenses on their tax return, requiring the provider's identification number for verification.

- Employers may need the provider's number to report payments made for care services on tax forms.

- In the event of an audit, having this number readily available helps substantiate claims made on tax returns.

These examples illustrate the importance of having the correct taxpayer identification number readily available for both providers and taxpayers to ensure compliance and facilitate smooth transactions.

Required Documents for Certification

To complete the certification and signature of the dependent care provider, certain documents may be required:

- Proof of identity for the provider, such as a driver's license or Social Security card.

- Documentation of the provider's taxpayer identification number, whether it is a Social Security Number or an EIN.

- Any relevant contracts or agreements outlining the terms of the dependent care services provided.

Having these documents on hand can streamline the process and ensure that all necessary information is accurately reported to the IRS.

Quick guide on how to complete city state and zip code providers taxpayer identification number if the above number is a social security number check here

Effortlessly complete [SKS] on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly and without interruptions. Manage [SKS] on any gadget using the airSlate SignNow applications for Android or iOS and streamline any document-related procedure today.

The simplest way to revise and electronically sign [SKS] effortlessly

- Find [SKS] and click on Obtain Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or conceal sensitive data with tools specifically available through airSlate SignNow for such purposes.

- Create your signature using the Sign tool, which requires just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Finished button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in mere clicks from any device you prefer. Revise and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to City, State, And ZIP Code Provider's Taxpayer Identification Number If The Above Number Is A Social Security Number, Check

Create this form in 5 minutes!

How to create an eSignature for the city state and zip code providers taxpayer identification number if the above number is a social security number check here

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of providing a City, State, And ZIP Code Provider's Taxpayer Identification Number?

The City, State, And ZIP Code Provider's Taxpayer Identification Number is essential for identifying dependent care providers for tax purposes. When you use airSlate SignNow, you can easily input this information for certifications or signatures required for tax deductions related to childcare expenses.

-

How does airSlate SignNow handle sensitive information like Social Security Numbers?

airSlate SignNow prioritizes the security of your data, including Social Security Numbers. When you check the box for 'City, State, And ZIP Code Provider's Taxpayer Identification Number If The Above Number Is A Social Security Number, Check Here Certification And Signature Of Dependent Care Provider,' this information is encrypted to ensure confidentiality and compliance with legal standards.

-

What features does airSlate SignNow offer for managing dependent care provider documents?

AirSlate SignNow offers features like eSigning, document templates, and automated workflow processes for managing dependent care provider documents. This streamlines the collection of the City, State, And ZIP Code Provider's Taxpayer Identification Number and other necessary certifications, making the process quicker and easier.

-

Is there a pricing plan for small businesses using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans tailored for small businesses. These plans include a variety of features, including collecting the City, State, And ZIP Code Provider's Taxpayer Identification Number if applicable, making it a cost-effective solution for your documentation needs.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow provides seamless integration with various third-party applications, enhancing productivity. By integrating your existing systems with airSlate SignNow, you can efficiently manage documents, including those requiring the City, State, And ZIP Code Provider's Taxpayer Identification Number and dependent care certifications.

-

What benefits can I expect from using airSlate SignNow for document management?

Using airSlate SignNow allows for faster document turnaround, reduces paperwork, and enhances compliance. By efficiently managing documents that include the City, State, And ZIP Code Provider's Taxpayer Identification Number, you can save time and resources while ensuring accuracy in your dependent care claims.

-

How can I ensure compliance with tax requirements using airSlate SignNow?

AirSlate SignNow includes built-in compliance features that help you adhere to tax requirements when collecting information like the City, State, And ZIP Code Provider's Taxpayer Identification Number. The software tracks necessary signatures and documentation, ensuring you stay compliant with IRS regulations for dependent care benefits.

Get more for City, State, And ZIP Code Provider's Taxpayer Identification Number If The Above Number Is A Social Security Number, Check

Find out other City, State, And ZIP Code Provider's Taxpayer Identification Number If The Above Number Is A Social Security Number, Check

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple