October Department of the Treasury Internal Revenue Service 8283 Noncash Charitable Contributions Attach to Your Tax Return If Y Form

Understanding the IRS Form 8283 for Noncash Charitable Contributions

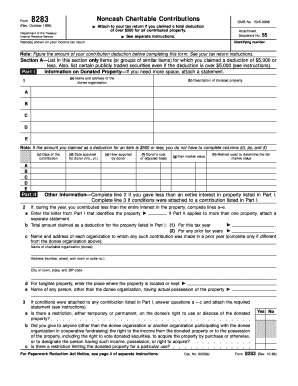

The October Department of the Treasury Internal Revenue Service 8283 form is essential for taxpayers who claim a total deduction exceeding $500 for noncash charitable contributions. This form allows individuals to report the value of property donated to qualified charitable organizations. It is crucial for ensuring compliance with IRS regulations, as it provides detailed documentation of the contributions made, which may include items such as clothing, vehicles, or real estate.

Steps to Complete IRS Form 8283

Completing the IRS Form 8283 involves several steps to ensure accuracy and compliance. First, gather all necessary documentation regarding the donated property, including receipts and appraisals if applicable. Next, fill out the form by providing details about the donor, the charity, and the description of the property. Ensure that the fair market value is accurately reported. Finally, sign and date the form, and attach it to your tax return when filing.

Required Documentation for IRS Form 8283

When filing IRS Form 8283, certain documents are required to substantiate your claims. These may include:

- Written acknowledgment from the charitable organization.

- Receipts for the donated items, especially for items valued over $250.

- An appraisal for property valued over $5,000, if applicable.

Having these documents ready will help ensure a smooth filing process and protect against potential audits.

IRS Guidelines for Noncash Charitable Contributions

The IRS has specific guidelines regarding noncash charitable contributions that taxpayers must follow. Contributions must be made to qualified organizations, and the value of the donated property must be determined based on fair market value. Additionally, the IRS requires that the donor provide detailed descriptions of the items donated, including their condition and any relevant information that supports the valuation.

Filing Deadlines for IRS Form 8283

It is important to adhere to filing deadlines when submitting IRS Form 8283. Generally, the form must be attached to your tax return, which is due on April 15 for most taxpayers. If you file for an extension, ensure that Form 8283 is included with your extended return. Missing the deadline may result in penalties or complications with your tax filings.

Penalties for Non-Compliance with IRS Form 8283

Failure to comply with the requirements of IRS Form 8283 can result in significant penalties. If the IRS determines that the fair market value of the contributions was overstated, taxpayers may face adjustments to their tax returns, leading to additional taxes owed. In some cases, penalties for negligence or fraud may also apply, emphasizing the importance of accurate reporting and documentation.

Quick guide on how to complete october department of the treasury internal revenue service 8283 noncash charitable contributions attach to your tax return if

Complete [SKS] effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to edit and eSign [SKS] seamlessly

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, cumbersome form searches, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to October Department Of The Treasury Internal Revenue Service 8283 Noncash Charitable Contributions Attach To Your Tax Return If Y

Create this form in 5 minutes!

How to create an eSignature for the october department of the treasury internal revenue service 8283 noncash charitable contributions attach to your tax return if

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the October Department Of The Treasury Internal Revenue Service 8283 form?

The October Department Of The Treasury Internal Revenue Service 8283 form is used to report noncash charitable contributions that exceed $500. This form is crucial for taxpayers who wish to claim a deduction for donated property. When you file your tax return, you must attach this form if you claimed a total deduction of over $500 for all contributed property.

-

How does airSlate SignNow facilitate noncash charitable contribution documentation?

airSlate SignNow offers a seamless way to prepare, sign, and manage documents related to noncash charitable contributions. Users can easily fill out the October Department Of The Treasury Internal Revenue Service 8283 form digitally, ensuring that all necessary information is captured and correctly formatted. This efficiency simplifies your tax filing process when you need to attach the form to your return.

-

Is airSlate SignNow cost-effective for individual users?

Yes, airSlate SignNow provides a cost-effective solution for individuals, including those needing to file the October Department Of The Treasury Internal Revenue Service 8283 form. With various pricing plans, users can choose the option that best fits their needs without compromising on essential features. This makes it easy to manage documentation for charitable contributions without incurring excessive costs.

-

Can airSlate SignNow integrate with other accounting software?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software, making it easier to manage your charitable contributions. This functionality helps you automate processes related to the October Department Of The Treasury Internal Revenue Service 8283 form, ensuring that all necessary tax documents are synchronized and accessible.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, particularly the October Department Of The Treasury Internal Revenue Service 8283 form, provides numerous benefits. It streamlines the process of preparing tax documents, enhances collaboration with eSignatures, and reduces the risk of errors. This allows users to focus on maximizing their deductions for noncash contributions.

-

How do I access and complete the October 8283 form using airSlate SignNow?

To access the October 8283 form using airSlate SignNow, simply log into your account and search for tax forms. You can then select the October Department Of The Treasury Internal Revenue Service 8283 form to begin filling it out. The platform offers user-friendly tools and templates to ensure all required information is correctly included.

-

What support options does airSlate SignNow offer for users?

airSlate SignNow provides various support options, including a comprehensive knowledge base, live chat, and email support. Whether you have questions about the October Department Of The Treasury Internal Revenue Service 8283 form or need assistance with using the platform, their dedicated support team is ready to help you navigate the process effectively.

Get more for October Department Of The Treasury Internal Revenue Service 8283 Noncash Charitable Contributions Attach To Your Tax Return If Y

Find out other October Department Of The Treasury Internal Revenue Service 8283 Noncash Charitable Contributions Attach To Your Tax Return If Y

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast