May Department of the Treasury Internal Revenue Service Exemption from Withholding on Investment Income of Foreign Governments a Form

Understanding the Exemption from Withholding on Investment Income

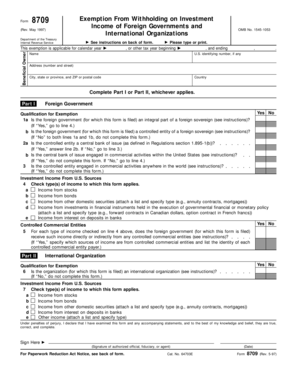

The May Department of the Treasury Internal Revenue Service Exemption from Withholding on Investment Income of Foreign Governments and International Organizations is a significant provision for entities engaged in international finance. This exemption allows certain foreign governments and international organizations to receive investment income without the burden of U.S. tax withholding. It is essential for these entities to understand the criteria and eligibility requirements to benefit from this provision.

Steps to Complete the Exemption Form

Filling out the exemption form involves several critical steps:

- Gather necessary information, including the entity's name, address, and taxpayer identification number.

- Ensure that the entity qualifies under the IRS guidelines for exemption from withholding.

- Complete the form accurately, providing all required details as specified in the instructions.

- Sign and date the form to validate the information provided.

- Submit the form to the appropriate IRS office as directed in the instructions.

Legal Use of the Exemption Form

The exemption from withholding on investment income is legally binding when properly executed. It is crucial for foreign governments and international organizations to comply with the IRS regulations to maintain their exempt status. Misuse or failure to adhere to the guidelines may result in penalties or the revocation of the exemption.

Eligibility Criteria for the Exemption

To qualify for the exemption from withholding, entities must meet specific eligibility criteria set by the IRS. Generally, this includes being recognized as a foreign government or an international organization under U.S. law. Additionally, the entity must provide documentation proving its status and confirm that the income in question is eligible for exemption.

Required Documents for Submission

When submitting the exemption form, it is essential to include all required documentation. This typically involves:

- Proof of the entity's status as a foreign government or international organization.

- Tax identification number or equivalent documentation.

- Any additional forms or attachments specified in the instructions.

Form Submission Methods

The completed exemption form can be submitted through various methods, including:

- Online submission via the IRS website, if applicable.

- Mailing the form to the designated IRS office.

- In-person submission at local IRS offices, if necessary.

Quick guide on how to complete may department of the treasury internal revenue service exemption from withholding on investment income of foreign governments

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained tremendous traction among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the essential tools to create, modify, and electronically sign your documents swiftly and without setbacks. Manage [SKS] on any device using airSlate SignNow's applications for Android or iOS and enhance any document-related task today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools available to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow.

- Generate your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you would like to send your form, whether via email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] while ensuring exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments A

Create this form in 5 minutes!

How to create an eSignature for the may department of the treasury internal revenue service exemption from withholding on investment income of foreign governments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations?

The May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations allows eligible entities to potentially avoid withholding taxes on certain investment income. This exemption is crucial for foreign governments and international organizations as it helps optimize their investment strategies, ensuring they retain more capital for their purposes. For specific qualifications and procedures, you should refer to the detailed instructions on the back of the form.

-

How does airSlate SignNow help with the May Department Of The Treasury Internal Revenue Service Exemption process?

airSlate SignNow streamlines the process of preparing and submitting the necessary documents related to the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations. Our platform provides easy access to eSigning and document management tools, ensuring compliance and accuracy throughout the process. By simplifying workflows, airSlate SignNow helps entities efficiently manage their exemption documentation.

-

What features does airSlate SignNow offer that support the May Department Of The Treasury Internal Revenue Service Exemption?

airSlate SignNow offers features such as document templates, eSignature capabilities, and customizable workflows that are highly beneficial when dealing with the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations. These features enhance the efficiency of document preparation and submission, allowing organizations to focus on their core activities while ensuring compliance. Additionally, our platform provides secure storage for all your important documents.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans designed to accommodate different business needs, including those processing the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations. Our plans range from basic solutions for small entities to advanced features for larger organizations handling extensive documentation requirements. You can choose a plan that best fits your team's size and requirements, ensuring cost-effective access to our comprehensive eSignature solutions.

-

Is airSlate SignNow compliant with regulatory requirements related to the May Department Of The Treasury Internal Revenue Service Exemption?

Yes, airSlate SignNow is fully compliant with various regulatory requirements, making it a trusted platform for documentation related to the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations. Our commitment to data security and legal compliance ensures that your documents maintain their integrity and legality during the signing process. We continuously update our platform to comply with the latest regulations.

-

Can I integrate airSlate SignNow with other software for handling exemptions?

Absolutely! airSlate SignNow supports integration with various third-party applications, enabling seamless workflows for handling the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations. By connecting with your preferred tools like CRM systems or document management software, you can enhance productivity and ensure your exemption processes are well-coordinated. This interoperability helps organizations maximize their efficiency.

-

What are the benefits of using airSlate SignNow for the exemption process?

Using airSlate SignNow for the May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments And International Organizations provides numerous benefits, including improved efficiency and reduced processing times. Our platform allows for quick and secure document handling, enabling you to manage necessary submissions without hassle. Furthermore, the ability to track document status ensures you stay informed throughout the exemption process.

Get more for May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments A

Find out other May Department Of The Treasury Internal Revenue Service Exemption From Withholding On Investment Income Of Foreign Governments A

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document