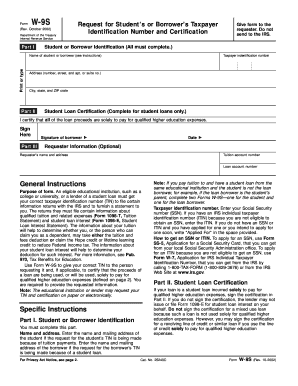

Taxpayer Indentification Number Name of Student or Borrower See Instructions Print or Type Address Number, Street, and Apt Form

What is the Taxpayer Identification Number?

The Taxpayer Identification Number (TIN) is a unique identifier assigned to individuals and entities for tax purposes. It is essential for students and borrowers to provide their TIN accurately when filling out forms related to financial aid, loans, or tax returns. This number helps the Internal Revenue Service (IRS) track tax obligations and ensure compliance with federal tax laws. For students, the TIN may be their Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), depending on their residency status.

How to Use the Taxpayer Identification Number

When completing forms that require a Taxpayer Identification Number, it is crucial to enter the number exactly as it appears on official documents. This includes ensuring that there are no missing digits or incorrect formatting. The TIN is often required on applications for federal student aid, loan applications, and tax filings. It serves as a means to verify identity and eligibility, helping to streamline the processing of applications and documents.

Steps to Complete the Taxpayer Identification Number Section

To accurately fill out the section for the Taxpayer Identification Number, follow these steps:

- Locate your TIN, which may be your SSN or ITIN.

- Carefully print or type your name as it appears on your tax documents.

- Enter your TIN in the designated field, ensuring all digits are included.

- Double-check for accuracy, as errors can delay processing.

- Provide your address, including the street number, street name, and apartment number if applicable.

Legal Use of the Taxpayer Identification Number

The Taxpayer Identification Number is legally required for various financial transactions and tax-related documents. It is used to report income, claim tax benefits, and verify eligibility for federal assistance programs. Misuse or failure to provide a TIN can result in penalties or delays in processing applications. It is important to safeguard your TIN to prevent identity theft and unauthorized use.

Required Documents for Obtaining a Taxpayer Identification Number

To obtain a Taxpayer Identification Number, individuals may need to provide specific documents, including:

- Proof of identity, such as a birth certificate or passport.

- Documentation of residency status for non-citizens.

- Completed application forms, such as Form W-7 for ITINs.

Gathering these documents ensures a smooth application process and helps avoid delays in receiving your TIN.

Examples of Using the Taxpayer Identification Number

Students and borrowers may encounter various scenarios where a Taxpayer Identification Number is necessary:

- Applying for federal student aid through the Free Application for Federal Student Aid (FAFSA).

- Filing tax returns to report income earned from part-time jobs or internships.

- Completing loan applications for educational or personal loans.

Each of these situations requires accurate reporting of your TIN to ensure compliance with tax regulations and eligibility for financial assistance.

Quick guide on how to complete taxpayer indentification number name of student or borrower see instructions print or type address number street and apt

Complete [SKS] effortlessly on any device

Online document management has risen in popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Taxpayer Indentification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt

Create this form in 5 minutes!

How to create an eSignature for the taxpayer indentification number name of student or borrower see instructions print or type address number street and apt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Taxpayer Identification Number and why is it important?

A Taxpayer Identification Number (TIN) is essential for tax purposes, and it allows students or borrowers to identify themselves to the IRS. Including the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. is crucial for accurate tax reporting and benefits. Ensuring that this information is correctly provided can simplify many financial processes.

-

How does airSlate SignNow help with Taxpayer Identification Numbers?

airSlate SignNow simplifies the document signing process by ensuring that the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. can be easily included in all necessary forms. With our platform, users can securely sign and send documents that require TINs without hassle. This feature enhances compliance and accuracy in documentation.

-

What are the pricing options for using airSlate SignNow?

Our pricing plans are designed to fit various business needs, starting with a free trial to explore features like handling the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. The paid plans offer additional features such as advanced integrations and security options. This flexibility allows all users to find a suitable plan.

-

Is airSlate SignNow user-friendly for new users?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible even for beginners. Users can easily navigate the platform to input necessary information, including the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. With straightforward guides and support, anyone can get started with ease.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions, enhancing your workflow. You can integrate your tools to ensure that the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. is communicated effectively across platforms. This improves efficiency and enhances collaboration.

-

What security measures does airSlate SignNow provide?

Security is a priority at airSlate SignNow. We implement advanced encryption and authentication measures to protect your data, including sensitive information like the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. Our compliant systems ensure that your documents remain safe while being signed and shared.

-

What are the benefits of using airSlate SignNow for schools or educational institutions?

Educational institutions can greatly benefit from airSlate SignNow by streamlining administrative processes. The ability to manage documents requiring the Taxpayer Identification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt. helps maintain accurate records and promotes efficiency. Our platform supports schools in reducing paper waste and improving speed in document management.

Get more for Taxpayer Indentification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt

- Translation reflection rotation dilation worksheet form

- Utility will serve letter template form

- Multiple worksite report bls 3020 5727187 form

- Model contract donatie form

- Drapery work order template 400439459 form

- Wedding rehearsal information worksheet love notes weddings

- New jersey police crash investigation report form

- Gmit repeat exams form

Find out other Taxpayer Indentification Number Name Of Student Or Borrower see Instructions Print Or Type Address number, Street, And Apt

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy

- Sign Utah Legal Living Will Easy

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now