1545 0142 Department of the Treasury Internal Revenue Service Employer Identification Number Name Note in Most Cases, the Corpor Form

Understanding the Form

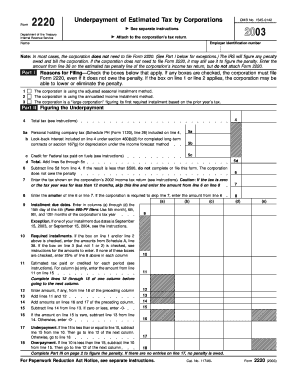

The form, officially known as the Department of the Treasury Internal Revenue Service Employer Identification Number Name Note, is a critical document for businesses operating in the United States. This form serves as a means for corporations to apply for an Employer Identification Number (EIN), which is essential for tax reporting and identification purposes. In most cases, corporations do not need to file Form 2220, which relates to underpayment of estimated tax by corporations. Understanding the nuances of the form can help businesses navigate their tax obligations effectively.

Steps to Complete the Form

Completing the form involves several key steps. First, gather all necessary information, including the legal name of the business, the type of entity, and the reason for applying for an EIN. Next, accurately fill out the form, ensuring that all details are correct to avoid delays. After completing the form, review it thoroughly for any errors. Finally, submit the form through the appropriate channels, either online or by mail, depending on your preference.

How to Obtain the Form

The form can be obtained directly from the Internal Revenue Service (IRS) website or through authorized tax professionals. The IRS provides the form in a downloadable format, making it easy for businesses to access and complete. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Legal Use of the Form

The legal use of the form is primarily for obtaining an Employer Identification Number, which is necessary for various business functions, including tax reporting and compliance with federal regulations. Proper use of this form ensures that businesses can operate legally and meet their tax obligations without facing penalties. It is essential for corporations to understand the legal implications of the information provided on this form.

Key Elements of the Form

Key elements of the form include the business's legal name, address, and type of entity. Additionally, the form requires information about the responsible party, which is typically an individual who controls the funds and assets of the business. Understanding these elements is crucial for accurate completion and compliance with IRS requirements.

Filing Deadlines and Important Dates

Filing deadlines for the form can vary based on the business's tax year and specific circumstances. Generally, businesses are encouraged to apply for their EIN as soon as they establish their entity. Being aware of important dates related to tax filings can help ensure that businesses remain compliant and avoid potential penalties.

Examples of Using the Form

Examples of using the form include new businesses seeking to establish their EIN for tax purposes, existing businesses that have changed their structure, or those that need a new EIN due to changes in ownership. Understanding these scenarios can help businesses determine when and how to utilize this form effectively.

Quick guide on how to complete 1545 0142 department of the treasury internal revenue service employer identification number name note in most cases the

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to alter and eSign [SKS] without breaking a sweat

- Obtain [SKS] and then click Get Form to proceed.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with specialized tools available from airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about missing or lost documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number Name Note In Most Cases, The Corpor

Create this form in 5 minutes!

How to create an eSignature for the 1545 0142 department of the treasury internal revenue service employer identification number name note in most cases the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number?

The 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number is used to identify a business entity for tax purposes. This number is essential for various tax filings and compliance requirements. It provides the IRS with the necessary information to track a company's financial activities.

-

Do I need to file Form 2220 if I have the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number?

In most cases, the corporation does not need to file Form 2220 if it meets certain criteria regarding underpayments. This includes ensuring that sufficient tax payments are made throughout the year to avoid penalties. However, businesses should review their specific situations or consult a tax professional for guidance.

-

What features does airSlate SignNow provide for businesses requiring documentation management?

airSlate SignNow offers a variety of features such as eSigning, document tracking, and automated workflows. These features streamline the process of sending and signing documents, ensuring compliance with legal standards. This creates a more efficient way for businesses to manage their documentation needs, especially those related to the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number.

-

How does airSlate SignNow help in reducing paperwork when managing Employer Identification Numbers?

By using airSlate SignNow, businesses can signNowly reduce paperwork by digitizing the management of documents related to the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number. This allows for easy access to necessary forms and ensures all documents are securely stored and easily retrievable when needed. Digitization lowers the risk of losing important records and enhances overall efficiency.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to different business needs, ensuring affordability and accessibility. Businesses can choose from several tiers based on features required, allowing them to find a plan that offers value while managing documentation related to the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number. Custom enterprise solutions are also available.

-

Can airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow supports integrations with various software solutions such as CRMs, document management tools, and accounting software. These integrations facilitate seamless workflows and data transfers, especially for managing information linked to the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number. This connectivity enhances overall productivity across platforms.

-

What benefits does airSlate SignNow offer for eSigning documents?

AirSlate SignNow provides numerous benefits for eSigning documents, including enhanced security, legal compliance, and time savings. By offering a quick and easy way to electronically sign documents, businesses can effectively manage their agreements and related forms associated with the 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number. This means faster turnaround times for critical business processes.

Get more for 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number Name Note In Most Cases, The Corpor

Find out other 1545 0142 Department Of The Treasury Internal Revenue Service Employer Identification Number Name Note In Most Cases, The Corpor

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast