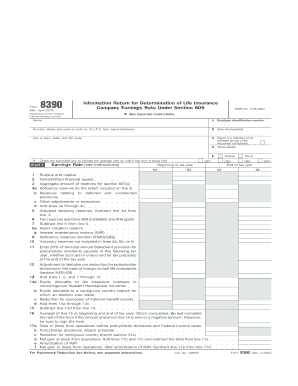

Form 8390 Rev April Information Return for Determination of Life Insurance Company Earnings Rate under Section 809

Understanding Form 8390 Rev April

The Form 8390 Rev April is an essential document used by life insurance companies in the United States. This information return is specifically designed for the determination of earnings rates under Section 809 of the Internal Revenue Code. The form helps ensure that life insurance companies report their earnings accurately, which is crucial for tax purposes. By completing this form, companies can comply with federal regulations and maintain transparency in their financial reporting.

How to Obtain Form 8390 Rev April

To obtain the Form 8390 Rev April, businesses can visit the official IRS website, where the form is available for download in PDF format. Additionally, companies may request a physical copy by contacting the IRS directly. It is important to ensure that the most current version of the form is used, as outdated forms may not be accepted during filing.

Steps to Complete Form 8390 Rev April

Completing the Form 8390 Rev April involves several key steps:

- Gather necessary financial information, including earnings data and relevant tax documentation.

- Carefully fill out each section of the form, ensuring accuracy in reporting earnings rates.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline to avoid penalties.

Following these steps can help ensure that the form is completed correctly and efficiently.

Legal Use of Form 8390 Rev April

The legal use of Form 8390 Rev April is governed by the Internal Revenue Code, specifically Section 809. Life insurance companies are required to file this form to report their earnings accurately. Failure to comply with these legal requirements can result in penalties and interest on unpaid taxes. It is essential for companies to understand their obligations under the law to avoid potential legal issues.

Filing Deadlines for Form 8390 Rev April

Filing deadlines for Form 8390 Rev April are crucial for compliance. Typically, the form must be submitted by the due date of the tax return for the year being reported. Companies should be aware of these deadlines to ensure timely filing and avoid penalties. Keeping track of important dates can help businesses maintain compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the requirements of Form 8390 Rev April can lead to significant penalties. These may include monetary fines and interest on unpaid taxes. It is important for life insurance companies to understand the implications of failing to file or inaccurately reporting earnings. Being aware of these penalties can motivate timely and accurate submissions.

Quick guide on how to complete form 8390 rev april information return for determination of life insurance company earnings rate under section 809

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, modify, and electronically sign your documents without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS, and improve any document-based process today.

The Easiest Method to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Identify important sections of the documents or redact sensitive information using specialized tools provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require new document prints. airSlate SignNow meets your document management needs within a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8390 rev april information return for determination of life insurance company earnings rate under section 809

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809?

The Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809 is a tax document used by life insurance companies to report earnings for tax purposes. This form is crucial for determining the appropriate earnings rate that affects the company’s tax obligations.

-

How can airSlate SignNow help with the Form 8390 Rev April Information Return?

airSlate SignNow streamlines the process of completing and submitting the Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809. Our platform allows you to easily eSign and send necessary documents, ensuring compliance and efficiency.

-

What features does airSlate SignNow offer for managing documents related to Form 8390?

With airSlate SignNow, you gain access to features like template creation, document tracking, and team collaboration. These tools are extremely useful for managing your Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809 efficiently and effectively.

-

Is airSlate SignNow a cost-effective solution for handling Form 8390 submissions?

Yes, airSlate SignNow provides a cost-effective solution for handling Form 8390 Rev April Information Return submissions. Our pricing plans are designed to accommodate businesses of all sizes while ensuring that you can manage important documents without overspending.

-

What integrations does airSlate SignNow support that can assist with Form 8390 processes?

airSlate SignNow supports numerous integrations with popular business applications, enhancing your workflow efficiency. These integrations can help streamline the completion and submission of the Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809.

-

Can airSlate SignNow assist with compliance related to Form 8390?

Absolutely! airSlate SignNow offers tools that simplify compliance with the requirements related to the Form 8390 Rev April Information Return. By utilizing our platform, you can ensure that your submissions are accurate and meet all necessary tax regulations.

-

What are the benefits of using airSlate SignNow for Form 8390?

Using airSlate SignNow for your Form 8390 Rev April Information Return allows for faster processing and improved accuracy. Our user-friendly platform reduces paperwork hassles and helps you focus on what matters most: managing your life insurance company’s earnings effectively.

Get more for Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809

Find out other Form 8390 Rev April Information Return For Determination Of Life Insurance Company Earnings Rate Under Section 809

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template