When They Receive Any Employer Identification Number EIN from the IRS, They Will Be Pre Enrolled in EFTPS so They Can Make All T Form

Understanding the Employer Identification Number (EIN) and EFTPS Enrollment

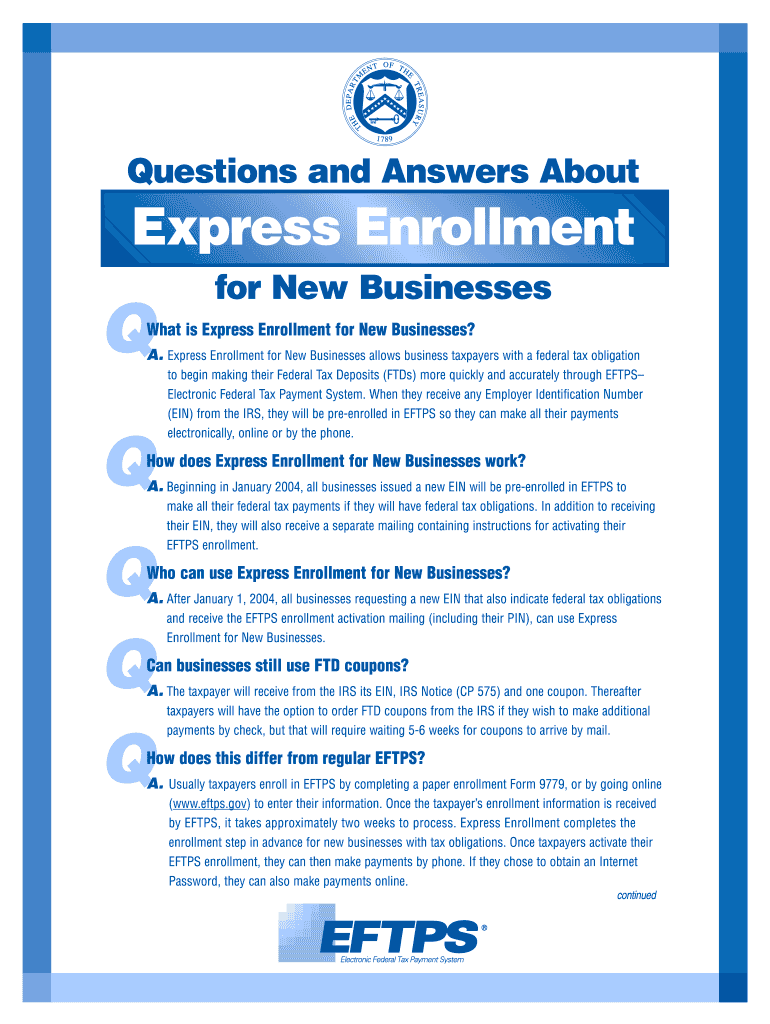

The Employer Identification Number (EIN) is a unique identifier assigned by the IRS to businesses for tax purposes. When a business receives its EIN, it is automatically pre-enrolled in the Electronic Federal Tax Payment System (EFTPS). This system allows businesses to make all their federal tax payments electronically, either online or by phone. The pre-enrollment in EFTPS simplifies the payment process, ensuring that businesses can meet their tax obligations efficiently and securely.

Using the EIN for EFTPS Payments

Once a business has its EIN and is pre-enrolled in EFTPS, it can start making payments. To use EFTPS, businesses need to log in to their EFTPS account using their EIN and the PIN they received during enrollment. Payments can be scheduled in advance, which helps in managing cash flow and ensuring timely tax payments. Additionally, businesses can view their payment history, making it easier to track compliance and financial planning.

Obtaining an Employer Identification Number (EIN)

To obtain an EIN, businesses must complete Form SS-4, which can be submitted online, by mail, or by fax. The online application is the quickest method, providing an EIN immediately upon completion. It is essential to provide accurate information on the form to avoid delays. Once the IRS processes the application, the EIN will be issued, and the business will be pre-enrolled in EFTPS, streamlining future tax payments.

Steps to Complete the Form SS-4 for EIN

Completing Form SS-4 involves several key steps:

- Provide the legal name of the business and any trade names.

- Indicate the type of entity (e.g., corporation, partnership, sole proprietorship).

- Supply the responsible party's name and Social Security Number.

- Detail the business address and the reason for applying for an EIN.

- Submit the form through your chosen method (online, mail, or fax).

Ensuring all information is accurate and complete will facilitate a smoother application process.

Legal Use of EIN and EFTPS

The EIN is a critical component for compliance with federal tax regulations. Businesses must use their EIN when filing tax returns and making payments. EFTPS provides a secure method for fulfilling tax obligations electronically, which is legally recognized by the IRS. Utilizing EFTPS helps businesses avoid penalties associated with late payments and ensures adherence to tax laws.

IRS Guidelines for EIN and EFTPS

The IRS provides specific guidelines regarding the use of EIN and EFTPS. Businesses should familiarize themselves with these guidelines to ensure compliance. The IRS outlines the types of payments that can be made through EFTPS, including employment taxes, estimated taxes, and corporate taxes. Understanding these guidelines helps businesses navigate their tax responsibilities effectively.

Eligibility Criteria for EIN and EFTPS

Most businesses operating in the United States are eligible to obtain an EIN. This includes sole proprietorships, partnerships, corporations, and nonprofit organizations. Additionally, any business that pays employees or is required to file certain tax returns must apply for an EIN. Once an EIN is obtained, the business is automatically pre-enrolled in EFTPS, allowing for electronic payment of taxes.

Quick guide on how to complete when they receive any employer identification number ein from the irs they will be pre enrolled in eftps so they can make all

Complete When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to modify and eSign When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T with ease

- Locate When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhaustive form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the when they receive any employer identification number ein from the irs they will be pre enrolled in eftps so they can make all

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for enrolling in EFTPS after receiving an EIN?

When they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone. To utilize this service, they must ensure their business details are correctly registered in the IRS database. This enables seamless online or phone payments.

-

How does airSlate SignNow facilitate electronic payments?

airSlate SignNow ensures that when they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone. The platform allows users to eSign documents related to payments effortlessly, making the entire process more efficient and user-friendly.

-

What are the primary benefits of using airSlate SignNow with EFTPS?

The main benefits include enhanced efficiency and convenience. When they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone, simplifying tax payments and document management.

-

Are there any costs associated with using airSlate SignNow for electronic payments?

airSlate SignNow offers a cost-effective solution for businesses. When they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone, eliminating unnecessary fees typically associated with traditional payment methods.

-

Can airSlate SignNow be integrated with other accounting software?

Yes, airSlate SignNow can integrate with various accounting software platforms. This integration allows users to streamline their workflows, especially since when they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone, simplifying financial management.

-

How secure is the payment process via EFTPS using airSlate SignNow?

The payment process using airSlate SignNow is highly secure. When they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone, with advanced encryption and security measures to protect sensitive information.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides various features for efficient document management, including eSigning and customizable templates. When they receive any Employer Identification Number EIN from the IRS, they will be pre-enrolled in EFTPS so they can make all their payments electronically, online or by the phone, ensuring that all documentation is correctly handled.

Get more for When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T

- Ammetlife surrender form

- Form 15h in hindi format no download needed

- Cdca renewal ohio form

- Bastrop county and sheriffs office application form

- Birth certificate of dependents form

- Workers compensation process flowchart form

- Samantha smith ptsa cash box tally sheet total form

- Purchase deposit agreement template form

Find out other When They Receive Any Employer Identification Number EIN From The IRS, They Will Be Pre enrolled In EFTPS So They Can Make All T

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later