December Certificate of Foreign Intermediary, Foreign Flow through Entity, or Certain U Form

What is the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

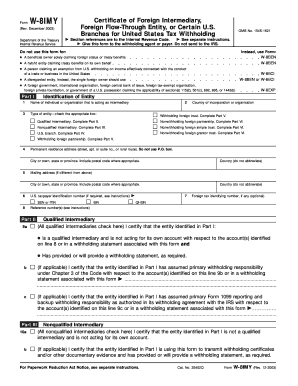

The December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is a crucial document for U.S. tax compliance. This form is primarily used by foreign entities to certify their status for tax purposes, ensuring that they are recognized appropriately under U.S. tax law. It helps determine the correct withholding tax rates on payments made to these entities, which can include dividends, interest, and royalties. Understanding this certificate is essential for both foreign entities and U.S. businesses engaging in international transactions.

How to use the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Utilizing the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U involves several key steps. First, the foreign entity must complete the form accurately, providing all required information, including the entity's name, address, and taxpayer identification number. Once completed, the certificate should be submitted to the U.S. withholding agent or financial institution handling the payments. This ensures that the correct withholding tax rates are applied based on the entity's certified status.

Steps to complete the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Completing the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the foreign entity, including its legal name and address.

- Identify the type of entity and its classification under U.S. tax law.

- Fill out the form, ensuring all sections are completed accurately.

- Review the completed form for any errors or omissions.

- Submit the form to the appropriate U.S. withholding agent or financial institution.

Legal use of the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

The legal use of the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U is paramount for compliance with U.S. tax regulations. This certificate serves as a declaration that the foreign entity meets specific criteria for reduced withholding rates or exemptions. By providing this certificate, entities can avoid over-withholding on payments, which can significantly impact cash flow. It is essential that the certificate is used correctly to prevent legal and financial repercussions.

Key elements of the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Several key elements must be included in the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U to ensure its validity:

- The entity's legal name and address.

- Tax identification number or equivalent for foreign entities.

- Classification of the entity under U.S. tax law.

- Signature of an authorized representative of the entity.

- Date of signing the certificate.

Filing Deadlines / Important Dates

Filing deadlines for the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U are critical for compliance. Typically, the form should be submitted before any payments are made to the foreign entity to ensure the correct withholding tax rates are applied. It is advisable to check for any specific deadlines that may apply based on the nature of the payments or the type of entity involved, as these can vary.

Quick guide on how to complete december certificate of foreign intermediary foreign flow through entity or certain u

Complete [SKS] effortlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to generate, modify, and eSign your documents quickly without delays. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

The easiest method to modify and eSign [SKS] seamlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to save your adjustments.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

Create this form in 5 minutes!

How to create an eSignature for the december certificate of foreign intermediary foreign flow through entity or certain u

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

The December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. is a crucial document for entities involved in foreign investments. It certifies your status as a foreign intermediary or flow-through entity, ensuring compliance with U.S. tax regulations. Understanding its requirements can help you avoid potential penalties and facilitate smoother transactions.

-

How can airSlate SignNow assist with the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

airSlate SignNow provides an intuitive platform for eSigning and managing your December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. documentation. With its straightforward interface, you can send documents for review and eSignature quickly, reducing time and stress. Our solution ensures that your documents are securely handled and legally binding.

-

What are the pricing options for airSlate SignNow regarding the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

airSlate SignNow offers flexible pricing plans to cater to different business needs when handling the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. documentation. Whether you're a small business or a large enterprise, you'll find a plan that fits your budget. Pricing tiers include advanced features to enhance your document management experience.

-

What features does airSlate SignNow provide for processing the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Our platform includes a range of features designed for efficient document management, such as customizable templates for the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. You can track document status in real-time, set reminders for deadlines, and securely store files in the cloud. These features enhance collaboration and ensure compliance throughout the signing process.

-

Are there any benefits to using airSlate SignNow for the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Using airSlate SignNow to handle the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. offers numerous benefits. It saves time by streamlining the signing process, enhances security through encryption, and increases compliance with tax regulations. This allows your business to operate smoothly while ensuring all documentation is handled professionally.

-

Does airSlate SignNow integrate with other software for handling the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications, making it easier to manage your December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. documents. You can connect with CRM systems, project management tools, and cloud storage services for improved efficiency. These integrations help centralize your document workflow and improve collaboration across teams.

-

Is it possible to access airSlate SignNow from mobile devices for the December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U.?

Absolutely! airSlate SignNow is designed for mobility, allowing you to access and manage your December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U. documents from mobile devices. Our mobile app provides the same features as the desktop version, enabling you to send, sign, and manage documents on the go. This flexibility boosts productivity for busy professionals.

Get more for December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

- Overtime claim form excel

- Flood questionnaire form

- Maryland unclaimed property form

- Haj bhawan post matric scholarship forn form

- Application for admission application form himalayan institute

- Ameriprise financial durable power of attorney form

- 1040 quickfinder handbook pdf form

- Chronic low back pain questionnaire images form

Find out other December Certificate Of Foreign Intermediary, Foreign Flow Through Entity, Or Certain U

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF