Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

What is the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

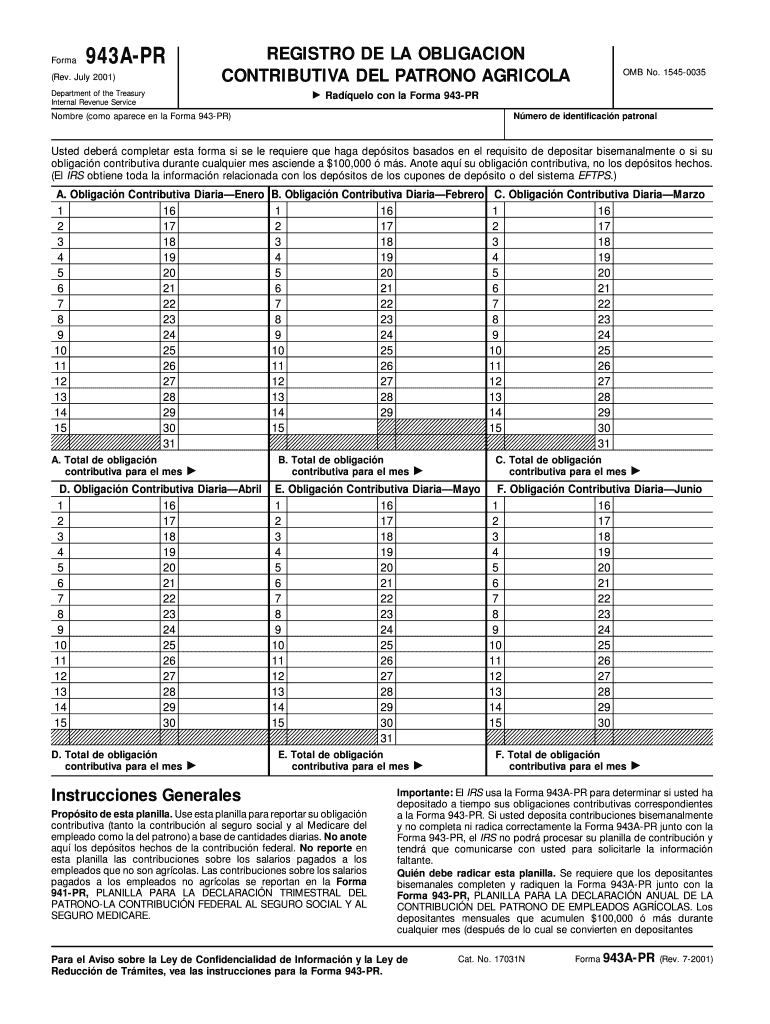

The Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola is a tax form used by agricultural employers in Puerto Rico to report and pay their employment taxes. This form is essential for ensuring compliance with federal tax obligations related to agricultural workers. Employers must accurately complete this form to reflect the wages paid and the taxes withheld from their employees. Understanding this form is crucial for maintaining proper records and fulfilling legal responsibilities as an employer in the agricultural sector.

How to use the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

Using the Form 943A PR Rev July involves several steps to ensure accurate reporting of employment taxes. Employers should begin by gathering all necessary information about their agricultural employees, including wages paid and tax withholdings. The form requires specific details about the employer, such as the employer identification number and contact information. After filling out the form, employers must review it for accuracy before submission. This process helps avoid potential penalties and ensures compliance with tax regulations.

Steps to complete the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

Completing the Form 943A PR Rev July involves a systematic approach:

- Gather all relevant employee wage records and tax information.

- Fill in the employer's identification details, including the employer identification number.

- Report total wages paid to agricultural employees during the reporting period.

- Calculate the total taxes withheld from employee wages.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or via mail, adhering to the specified deadlines.

Filing Deadlines / Important Dates

Employers must be aware of the specific filing deadlines associated with the Form 943A PR Rev July. Typically, this form is due annually, with the deadline falling on January thirty-first of the following year. Employers should ensure that they submit the form on time to avoid penalties and interest on unpaid taxes. Staying informed about these important dates is crucial for maintaining compliance with federal tax regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form 943A PR Rev July can result in significant penalties. Employers may face fines for late submissions, inaccuracies, or failure to file altogether. The IRS imposes these penalties to encourage timely and accurate reporting of employment taxes. Understanding the potential consequences of non-compliance can motivate employers to prioritize the proper completion and submission of this form.

Digital vs. Paper Version

Employers have the option to submit the Form 943A PR Rev July in either digital or paper format. The digital version allows for quicker processing and easier record-keeping. However, some employers may prefer the traditional paper format for various reasons, including personal preference or lack of access to digital tools. Regardless of the chosen method, it is essential to ensure that the form is accurately completed and submitted by the deadline.

Quick guide on how to complete form 943a pr rev july registro de la obligation contributiva del patrono agricola

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that function.

- Create your signature with the Sign feature, which takes only seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, frustrating form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

Create this form in 5 minutes!

How to create an eSignature for the form 943a pr rev july registro de la obligation contributiva del patrono agricola

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola?

The Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola is a mandatory document that employers in the agricultural sector in Puerto Rico must submit. This form helps to report the employer’s contributions to the social security system. Utilizing airSlate SignNow can streamline the process of completing and submitting this essential document.

-

How does airSlate SignNow simplify the submission of Form 943A PR Rev July?

AirSlate SignNow offers a user-friendly interface that enables businesses to easily complete and eSign the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola. The platform allows you to fill out the form electronically, ensuring accuracy and compliance with regulatory requirements while saving time.

-

Are there any costs associated with using airSlate SignNow for the Form 943A PR Rev July?

Yes, there are subscription options available for airSlate SignNow that cater to different business needs. Pricing is competitive, and the platform provides a cost-effective solution for electronically signing forms, including the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola. Check our pricing page for details on plans and features.

-

Can I track the status of my Form 943A PR Rev July once submitted via airSlate SignNow?

Absolutely! AirSlate SignNow allows users to track the status of the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola after submission. You will receive notifications, so you can easily monitor the document's progress through completion and filing.

-

What features does airSlate SignNow offer for completing the Form 943A PR Rev July?

With airSlate SignNow, users can benefit from features such as customizable templates, electronic signatures, and document sharing. These tools help streamline the completion of the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola, making the process more efficient and less prone to errors.

-

Is airSlate SignNow compatible with other software for managing the Form 943A PR Rev July?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to manage the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola alongside your existing tools. This interoperability enhances your workflow by enabling efficient data transfer and document management.

-

What are the benefits of using airSlate SignNow for Form 943A PR Rev July?

Using airSlate SignNow for the Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola provides numerous benefits, including enhanced efficiency, reduced paperwork, and simplified compliance tracking. The platform also enhances collaboration by allowing multiple users to access and sign documents from anywhere.

Get more for Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

Find out other Form 943A PR Rev July Registro De La Obligation Contributiva Del Patrono Agricola

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed

- How Do I Sign Delaware Legal Warranty Deed

- Sign Delaware Legal LLC Operating Agreement Mobile

- Sign Florida Legal Job Offer Now

- Sign Insurance Word Ohio Safe

- How Do I Sign Hawaii Legal Business Letter Template

- How To Sign Georgia Legal Cease And Desist Letter

- Sign Georgia Legal Residential Lease Agreement Now

- Sign Idaho Legal Living Will Online

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe