Pub 596 Worksheet 1 Form

What is the Pub 596 Worksheet 1

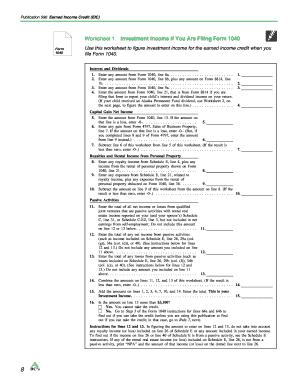

The Pub 596 Worksheet 1 is a crucial document provided by the IRS that assists taxpayers in determining their eligibility for certain tax credits related to the Earned Income Tax Credit (EITC). This worksheet is part of IRS Publication 596, which outlines the guidelines for claiming the EITC. The worksheet helps individuals and families assess their income, filing status, and qualifying children, ensuring they receive the appropriate benefits available to them.

How to use the Pub 596 Worksheet 1

Using the Pub 596 Worksheet 1 involves several steps that guide taxpayers through the process of evaluating their eligibility for the EITC. First, gather necessary documents, including income statements and Social Security numbers for qualifying children. Next, follow the instructions on the worksheet, answering each question carefully. The worksheet will prompt users to calculate their earned income and compare it against the required thresholds. Completing this worksheet accurately is essential for a successful EITC claim.

Steps to complete the Pub 596 Worksheet 1

Completing the Pub 596 Worksheet 1 requires a systematic approach:

- Start by entering your filing status at the top of the worksheet.

- Provide information about your qualifying children, including their names and Social Security numbers.

- Calculate your total earned income by adding up all sources of income, such as wages and self-employment earnings.

- Refer to the EITC income limits for the current tax year to determine if your income qualifies.

- Follow any additional prompts to finalize your eligibility assessment.

Legal use of the Pub 596 Worksheet 1

The legal use of the Pub 596 Worksheet 1 is essential for ensuring compliance with IRS regulations. When properly completed, the worksheet serves as a supporting document for your tax return, validating your claim for the EITC. It is important to retain a copy of the completed worksheet for your records, as it may be requested by the IRS during audits or reviews. Adhering to the guidelines set forth in IRS Publication 596 is crucial for maintaining legal standing when claiming tax credits.

Key elements of the Pub 596 Worksheet 1

Several key elements are essential to understanding the Pub 596 Worksheet 1:

- Filing Status: Identifies whether you are single, married filing jointly, or another status.

- Qualifying Children: Details necessary for determining eligibility, including age and relationship.

- Income Calculation: A section dedicated to calculating total earned income from various sources.

- EITC Income Limits: Guidelines that specify the maximum income thresholds for eligibility.

IRS Guidelines

The IRS provides specific guidelines on how to utilize the Pub 596 Worksheet 1 effectively. These guidelines include detailed instructions on filling out the worksheet, eligibility criteria for the EITC, and the importance of accurate reporting. It is advisable to consult the latest version of IRS Publication 596 to ensure compliance with any updates or changes in tax law. Following these guidelines helps taxpayers maximize their benefits while adhering to legal requirements.

Quick guide on how to complete pub 596 worksheet 1

Prepare Pub 596 Worksheet 1 effortlessly on any device

Digital document management has gained immense popularity among businesses and individuals. It offers a great environmentally friendly substitute for conventional printed and signed forms, as you can easily locate the necessary document and securely store it online. airSlate SignNow equips you with all the tools needed to generate, modify, and eSign your documents promptly without delays. Handle Pub 596 Worksheet 1 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Pub 596 Worksheet 1 effortlessly

- Obtain Pub 596 Worksheet 1 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal status as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tiresome document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Pub 596 Worksheet 1 and guarantee exceptional communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pub 596 worksheet 1

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the publication 596 worksheet 1 and how does it relate to airSlate SignNow?

The publication 596 worksheet 1 is a critical tool that helps businesses manage IRS tax forms efficiently. airSlate SignNow integrates this worksheet into its document management system, allowing users to eSign and share necessary tax forms directly, streamlining the filing process.

-

How can airSlate SignNow help me complete the publication 596 worksheet 1?

airSlate SignNow offers seamless templates and eSigning capabilities specifically for the publication 596 worksheet 1. This ensures that your documents are completed accurately and can be signed digitally, saving time and enhancing compliance with IRS regulations.

-

What pricing plans are available for using airSlate SignNow with the publication 596 worksheet 1?

airSlate SignNow provides flexible pricing plans, making it accessible for both individuals and businesses. These plans include various features tailored for those needing to work with the publication 596 worksheet 1, ensuring you can find a plan that suits your budget and needs.

-

Are there any benefits to using airSlate SignNow for the publication 596 worksheet 1?

Yes, using airSlate SignNow for the publication 596 worksheet 1 offers numerous benefits, such as improved efficiency and enhanced security in document management. The platform enables you to track signatures, manage versions, and ensures compliance, making your tax preparation process smoother.

-

Can I integrate airSlate SignNow with other applications when using the publication 596 worksheet 1?

Absolutely! airSlate SignNow offers integrations with various applications, enabling seamless workflow for those using the publication 596 worksheet 1. This allows you to connect with popular tools, enhancing collaboration and data management for your business.

-

Is it easy to navigate the airSlate SignNow platform for the publication 596 worksheet 1?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy to navigate when working with the publication 596 worksheet 1. The intuitive interface ensures that users can quickly find the tools they need to create and manage their documents without any hassle.

-

What types of documents can I eSign using airSlate SignNow besides the publication 596 worksheet 1?

In addition to the publication 596 worksheet 1, airSlate SignNow allows you to eSign a variety of document types. This includes contracts, agreements, and consent forms, making it a versatile choice for your document signing needs.

Get more for Pub 596 Worksheet 1

- To release copies of form

- General instructions for dhs 8015 submit this form with your cms 1500 claim form med quest

- Professional claim form

- 01 gl 4 form

- Silverscript pa form 471656576

- Quick reference card providers amerigroup form

- Financial screening form doctors community hospital

- Patient registration form fastmed urgent care 387376045

Find out other Pub 596 Worksheet 1

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement