Form 706 NA Rev January

What is the Form 706 NA Rev January

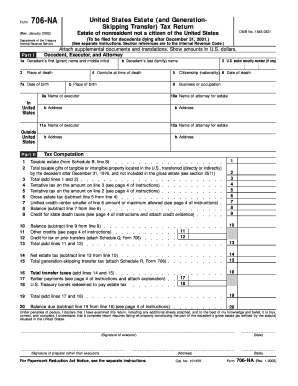

The Form 706 NA Rev January is a tax form used in the United States to report the estate tax for non-resident aliens. This form is essential for the Internal Revenue Service (IRS) to assess the tax liability of an estate that includes U.S. assets. The form captures important information regarding the decedent's estate, including the value of assets, deductions, and any applicable credits. Understanding this form is crucial for executors and beneficiaries involved in estate planning and settlement.

How to use the Form 706 NA Rev January

Using the Form 706 NA Rev January involves several steps to ensure accurate reporting and compliance with IRS regulations. First, gather all necessary financial documents related to the decedent's estate, including asset valuations, debts, and prior tax returns. Next, complete the form by entering the required information, ensuring that all figures are accurate and reflect the current value of the estate. After completing the form, review it for any errors before submission to avoid delays or penalties.

Steps to complete the Form 706 NA Rev January

Completing the Form 706 NA Rev January involves a systematic approach:

- Gather necessary documentation, including appraisals of assets and records of debts.

- Fill out the basic information section, including the decedent's name, date of death, and identifying details.

- Report the total value of the estate by listing all assets and their fair market value.

- Include any deductions, such as funeral expenses, debts, and taxes owed.

- Calculate the estate tax owed based on the reported values and applicable tax rates.

- Sign and date the form, ensuring it is filed within the required timeframe.

Filing Deadlines / Important Dates

The filing deadline for the Form 706 NA Rev January is typically nine months after the date of the decedent's death. It is crucial to adhere to this timeline to avoid penalties and interest charges. In certain circumstances, an extension may be available, but it must be requested before the original deadline. Keeping track of these important dates ensures compliance with IRS regulations and helps facilitate smoother estate administration.

Legal use of the Form 706 NA Rev January

The Form 706 NA Rev January serves a legal purpose in the estate settlement process for non-resident aliens. It is used to determine the estate tax liability and ensure that the appropriate taxes are paid to the IRS. Executors and administrators of estates must use this form to comply with federal tax laws. Failure to file the form correctly or on time can result in legal repercussions, including fines and penalties.

Required Documents

To complete the Form 706 NA Rev January accurately, several documents are required:

- Death certificate of the decedent.

- Asset valuations, including appraisals for real estate and personal property.

- Records of debts owed by the decedent at the time of death.

- Previous tax returns, if applicable, to provide context for the estate's financial situation.

- Documentation of any deductions or credits claimed on the form.

Quick guide on how to complete form 706 na rev january

Complete [SKS] effortlessly on any device

Online document administration has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Utilize the resources we provide to submit your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] while ensuring excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706 NA Rev January

Create this form in 5 minutes!

How to create an eSignature for the form 706 na rev january

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of Form 706 NA Rev January?

Form 706 NA Rev January is used to report the estate tax for non-resident aliens. This form allows the IRS to assess the value of the estate, taking into account deductions and credits. Understanding the purpose of this form is crucial for proper estate planning.

-

How can airSlate SignNow help with completing Form 706 NA Rev January?

airSlate SignNow provides an intuitive platform for electronically signing and managing documents like Form 706 NA Rev January. With easy templates and seamless editing features, you can ensure that your form is filled out accurately and signed quickly, saving you time and effort.

-

What are the pricing options for using airSlate SignNow for Form 706 NA Rev January?

airSlate SignNow offers various pricing plans to suit different business needs. Whether you're an individual needing to eSign Form 706 NA Rev January or a large business requiring multiple user licenses, you can find a cost-effective solution that meets your requirements. Visit our pricing page for detailed information.

-

Are there any integrations available for Form 706 NA Rev January with airSlate SignNow?

Yes, airSlate SignNow integrates with several popular applications to streamline the process of managing Form 706 NA Rev January. This includes integrations with CRM systems, cloud storage platforms, and more, allowing you to enhance your workflow and ensure documents are easily accessible.

-

What security measures does airSlate SignNow implement for Form 706 NA Rev January?

When using airSlate SignNow for Form 706 NA Rev January, you can trust that your documents are secure. We implement industry-standard encryption protocols and offer secure cloud storage to keep your sensitive information protected throughout the signing process.

-

Can I track the status of Form 706 NA Rev January sent through airSlate SignNow?

Absolutely! With airSlate SignNow, you can easily track the status of Form 706 NA Rev January. Our platform provides real-time notifications and updates, so you always know when your document has been viewed, signed, or completed.

-

Is there support available for completing Form 706 NA Rev January using airSlate SignNow?

Yes, airSlate SignNow offers dedicated support for users needing help with Form 706 NA Rev January. Our support team is readily available through various channels, ensuring that you receive timely assistance whenever you have questions or require guidance.

Get more for Form 706 NA Rev January

- Absence request form colyton grammar school

- Doterra product order form 43471283

- Maternity leave application form for teachers pdf

- Spoc chart 5 11 years form

- Ksrevenue form

- Report of death of an american citizen abroad form

- Complaint efiling accepted for complaint type attc form

- Codice fiscale consolato londra form

Find out other Form 706 NA Rev January

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application

- eSignature Georgia Junior Employment Offer Letter Later