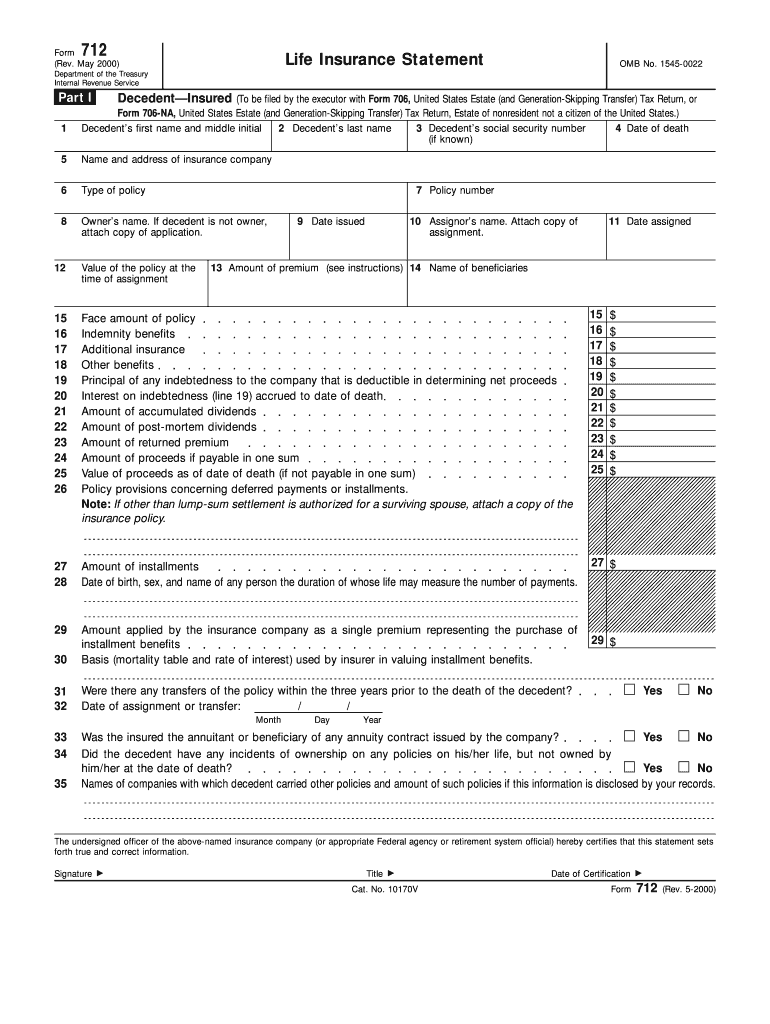

Decedent's First Name and Middle Initial 2 Decedent's Last Name 3 Decedent's Social Security Form

Understanding the Decedent's Information

The decedent's first name and middle initial, last name, and social security number are critical identifiers in various legal and administrative processes following a person's death. This information is essential for settling the decedent's estate, managing financial matters, and ensuring that any benefits or claims are appropriately addressed. The first name and middle initial help to distinguish the decedent from others with similar names, while the last name provides a familial connection. The social security number is a unique identifier that links the decedent to their official records, making it crucial for legal documentation and financial transactions.

How to Obtain the Decedent's Information

To obtain the decedent's first name and middle initial, last name, and social security number, family members or legal representatives typically need to access official documents. These may include the death certificate, which contains the decedent's full name and may also list their social security number. Additionally, financial institutions and government agencies may require proof of authority, such as a will or letters of administration, to release sensitive information. It is advisable to gather all necessary documents before making requests to ensure a smooth process.

Steps to Complete the Required Information

Filling out forms that require the decedent's first name and middle initial, last name, and social security number involves several steps:

- Gather all relevant documents, including the death certificate and any legal paperwork.

- Ensure that you have the correct spelling of the decedent's name and their social security number.

- Fill out the required forms accurately, ensuring that all information matches the official documents.

- Double-check for any errors or omissions before submitting the forms.

- Submit the completed forms through the appropriate channels, whether online, by mail, or in person.

Legal Uses of the Decedent's Information

The decedent's first name and middle initial, last name, and social security number are used in various legal contexts. These include probate proceedings, where the decedent's estate is settled, and in claims for life insurance benefits. Additionally, this information is often required when transferring assets, closing bank accounts, or settling debts. Accurate documentation is crucial to comply with legal requirements and to protect the rights of beneficiaries and heirs.

Key Elements of the Decedent's Information

When documenting the decedent's first name and middle initial, last name, and social security number, several key elements must be considered:

- Accuracy: Ensure that all names are spelled correctly and match official records.

- Completeness: Include all necessary components, such as middle initials, to avoid confusion.

- Confidentiality: Handle the social security number with care to protect the decedent's privacy.

- Relevance: Use this information only for legitimate legal and administrative purposes.

Examples of Using the Decedent's Information

There are several scenarios in which the decedent's first name and middle initial, last name, and social security number are utilized:

- Filing a claim for life insurance benefits, which requires the decedent's full name and social security number.

- Applying for a death certificate, where accurate personal information is essential.

- Settling the estate through probate court, necessitating precise identification of the decedent.

- Transferring property titles, which often requires the decedent's social security number for verification.

Quick guide on how to complete decedents first name and middle initial 2 decedents last name 3 decedents social security

Effortlessly prepare [SKS] on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight essential sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to retain your modifications.

- Choose your preferred method to send your form, whether it be via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Decedent's First Name And Middle Initial 2 Decedent's Last Name 3 Decedent's Social Security

Create this form in 5 minutes!

How to create an eSignature for the decedents first name and middle initial 2 decedents last name 3 decedents social security

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security?

airSlate SignNow is an electronic signature platform that allows users to securely sign and send documents online. When dealing with sensitive information like Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security, the platform ensures that all data is encrypted and handled with care, maintaining compliance with legal standards.

-

How does airSlate SignNow ensure security when handling Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security?

Security is a top priority at airSlate SignNow. We use industry-leading encryption methods to protect documents that include Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security. Additionally, our platform allows for role-based access, ensuring that only authorized personnel can view or edit sensitive information.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to meet various business needs. Our plans give users access to features designed for efficiently managing documents, including those containing Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security. You can choose from monthly or yearly subscriptions, and we also provide discounts for annual commitments.

-

Can I integrate airSlate SignNow with other software for processing Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security?

Yes, airSlate SignNow can be seamlessly integrated with many other applications and platforms. This allows you to automate workflows and manage documents that contain Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security efficiently. Popular integrations include CRM systems, cloud storage, and project management tools.

-

What features does airSlate SignNow provide to manage documents with sensitive information?

airSlate SignNow offers a range of features tailored for managing sensitive documents, including those with Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security. Features such as customizable templates, audit trails, and in-person signing help to streamline the process while ensuring compliance and security.

-

How can airSlate SignNow benefit my business when working with sensitive documents?

Using airSlate SignNow can greatly enhance your business operations by streamlining the process of sending and signing documents. For documents that include Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security, our platform provides a secure, user-friendly environment. This can save you time, reduce paper usage, and enhance customer satisfaction.

-

Is there a free trial available for airSlate SignNow, especially for working with Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security?

Yes, we offer a free trial for users to experience the capabilities of airSlate SignNow. During the trial, you can test features relevant to working with documents that contain Decedent's First Name And Middle Initial, Decedent's Last Name, and Decedent's Social Security without any risk. This allows you to evaluate our platform before making a financial commitment.

Get more for Decedent's First Name And Middle Initial 2 Decedent's Last Name 3 Decedent's Social Security

- 84 lumber donation form

- Out of state petitioner alcoholdrug evaluation uniform report 2013

- Illinois petitioner investigative alcoholdrug evaluation form

- Divorce papers oregon form

- Unmarried parents custody parenting time child support form

- Wisconsin disclosure form

- Omb no 1845 0102 form

- Re evaluation statement for fccpt form

Find out other Decedent's First Name And Middle Initial 2 Decedent's Last Name 3 Decedent's Social Security

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free