Form 1041 N Rev March U S Income Tax Return for Electing Alaska Native Settlement Trusts

What is the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

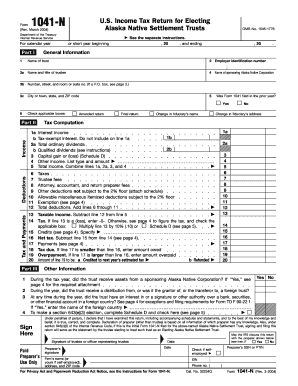

The Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts is a tax form specifically designed for Alaska Native Settlement Trusts that elect to be treated as a pass-through entity for federal income tax purposes. This form allows these trusts to report their income, deductions, and other tax-related information to the Internal Revenue Service (IRS). It is crucial for ensuring compliance with U.S. tax laws while providing a mechanism for the trusts to manage their tax obligations effectively.

How to use the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

Using the Form 1041 N involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents related to the trust's income and expenses. Next, fill out the form with the required information, including the trust's name, address, and Employer Identification Number (EIN). It is essential to accurately report all income and deductions to avoid penalties. Once completed, the form can be submitted to the IRS either electronically or by mail, depending on the trust's preference and eligibility.

Steps to complete the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

Completing the Form 1041 N requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial records, including income statements and expense receipts.

- Obtain the latest version of Form 1041 N from the IRS website or other authorized sources.

- Fill in the trust's identifying information, including the name, address, and EIN.

- Report all income received by the trust, including dividends, interest, and capital gains.

- Detail any deductions the trust is eligible for, such as administrative expenses.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the designated deadline.

Legal use of the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

The legal use of Form 1041 N is essential for Alaska Native Settlement Trusts seeking to comply with federal tax regulations. By completing this form, trusts can ensure they are reporting their income correctly and fulfilling their tax obligations. Failure to use the form appropriately may result in penalties or legal issues. It is advisable for trustees to consult with tax professionals familiar with trust law and IRS guidelines to navigate the complexities of tax compliance effectively.

Key elements of the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

Key elements of the Form 1041 N include:

- Trust identification information, such as name and EIN.

- Income reporting sections for various types of income.

- Deductions applicable to the trust, including administrative costs.

- Signature section for the trustee to certify the accuracy of the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1041 N are critical for compliance. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the trust's tax year. For trusts operating on a calendar year, this means the deadline is typically April 15. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important for trustees to mark these dates on their calendars to avoid late filing penalties.

Quick guide on how to complete form 1041 n rev march u s income tax return for electing alaska native settlement trusts

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among companies and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the correct form and securely keep it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your document.

- Select relevant parts of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

Create this form in 5 minutes!

How to create an eSignature for the form 1041 n rev march u s income tax return for electing alaska native settlement trusts

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

The Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts is designed to report income, deductions, and credits related to qualified Alaska Native Settlement Trusts. It ensures compliance with federal tax laws while facilitating the management of trust funds for beneficiaries.

-

How can airSlate SignNow help me with filing Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

airSlate SignNow simplifies the process of preparing and submitting the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our platform allows you to easily collect signatures and manage documents digitally, reducing the hassle associated with traditional filing methods.

-

What features does airSlate SignNow offer for managing tax documents like Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

AirSlate SignNow provides a host of features for managing tax documents, including document templates, electronic signatures, and secure storage. These capabilities streamline the preparation and filing of Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts, making the entire process efficient and organized.

-

Is airSlate SignNow a cost-effective solution for filing Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Yes, airSlate SignNow offers a cost-effective solution for businesses and individuals looking to file the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our pricing plans are designed to cater to various budgets while ensuring access to essential features that facilitate easy document management.

-

Can I integrate airSlate SignNow with other software for handling Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Absolutely! airSlate SignNow seamlessly integrates with popular software solutions, enhancing your ability to manage the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts. This integration allows you to automate workflows and improve overall efficiency.

-

What are the benefits of using airSlate SignNow for Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

Using airSlate SignNow for the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts offers numerous benefits, including time savings, enhanced security, and improved compliance. Our platform allows you to manage your tax obligations with ease while ensuring that all information is safely stored and easily accessible.

-

How secure is airSlate SignNow when handling sensitive tax documents like Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts?

AirSlate SignNow prioritizes security, implementing robust measures to protect sensitive tax documents, including the Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts. Our platform uses encryption, secure access controls, and compliance with industry standards to safeguard your information.

Get more for Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

Find out other Form 1041 N Rev March U S Income Tax Return For Electing Alaska Native Settlement Trusts

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word