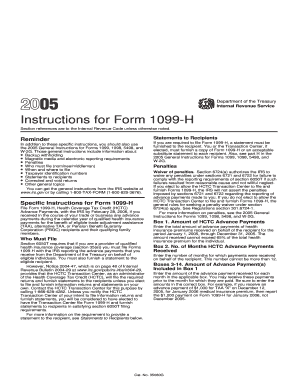

Instructions for Form 1099 H Health Coverage Tax Credit HCTC Advance Payments

Understanding Form 1099-H for Health Coverage Tax Credit Advance Payments

The Instructions for Form 1099-H are essential for individuals who receive advance payments for the Health Coverage Tax Credit (HCTC). This form is specifically designed to report the amount of HCTC advance payments that a taxpayer received during the tax year. It is crucial for eligible individuals, particularly those who are receiving benefits due to job loss or who are retirees receiving pension benefits from the PBGC. The form helps ensure that taxpayers accurately report their income and claim the appropriate tax credits.

Steps to Complete Form 1099-H

Completing Form 1099-H involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including any notices received regarding advance payments. Next, fill out the form by providing personal information, such as your name, address, and taxpayer identification number. Then, report the total amount of advance payments received in the designated box on the form. Finally, review the completed form for any errors before submitting it to the IRS.

Eligibility Criteria for HCTC Advance Payments

To qualify for HCTC advance payments, individuals must meet specific eligibility criteria. Generally, eligible taxpayers include those who are receiving benefits from the Pension Benefit Guaranty Corporation (PBGC) or those who have been displaced due to trade-related job losses. Additionally, individuals must meet income requirements and have health insurance coverage that qualifies under the HCTC guidelines. It is important to verify eligibility before applying for advance payments to avoid complications during tax filing.

Filing Deadlines for Form 1099-H

Filing deadlines for Form 1099-H are critical to ensure compliance with IRS regulations. Generally, the form must be submitted to the IRS by the end of January following the tax year in which the advance payments were received. Additionally, recipients of the form should receive their copy by the same deadline. It is essential to adhere to these deadlines to avoid potential penalties and ensure that all tax credits are accurately claimed.

Required Documents for Filing Form 1099-H

When preparing to file Form 1099-H, certain documents are necessary to support the information reported. Taxpayers should have their Social Security number or taxpayer identification number readily available. Additionally, any notices or statements received regarding HCTC advance payments should be collected. Keeping records of health insurance premiums paid and any other relevant financial documents will also assist in accurately completing the form.

Form Submission Methods for 1099-H

Form 1099-H can be submitted to the IRS using various methods. Taxpayers have the option to file the form electronically or by mail. Electronic filing is often recommended for its speed and efficiency, especially for those who are submitting multiple forms. If filing by mail, ensure that the form is sent to the correct IRS address and that it is postmarked by the filing deadline. It is advisable to keep a copy of the submitted form for personal records.

IRS Guidelines for Form 1099-H

The IRS provides specific guidelines for completing and submitting Form 1099-H. These guidelines outline the requirements for reporting advance payments and detail the information that must be included on the form. Taxpayers should refer to the IRS instructions for Form 1099-H to ensure compliance with all reporting requirements. Understanding these guidelines can help prevent errors and ensure that taxpayers receive the credits they are entitled to.

Quick guide on how to complete instructions for form 1099 h health coverage tax credit hctc advance payments

Complete [SKS] effortlessly on any device

Web-based document administration has become increasingly favored by businesses and private users. It offers a superb eco-friendly substitute for traditional printed and signed documents, allowing you to access the proper form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage [SKS] on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to alter and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select essential parts of your documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on Done to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow efficiently manages your document needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 1099 h health coverage tax credit hctc advance payments

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments?

The Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments provide guidance on how to fill out this specific tax form. This form is essential for individuals who have received advance payments for health coverage tax credits. It outlines requirements, deadlines, and relevant information needed to ensure accurate filing.

-

How can airSlate SignNow assist me with the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments?

airSlate SignNow can help streamline the process of signing and sending your tax documents, including the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments. Our easy-to-use platform allows for quick eSigning and document management, saving you time during tax season.

-

What features does airSlate SignNow offer to simplify the tax filing process?

airSlate SignNow offers features like customizable templates, automated workflows, and secure document storage which are crucial for managing tax forms efficiently. These features can be particularly helpful when dealing with complex forms like the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments, ensuring you have everything you need at your fingertips.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers flexible pricing models tailored to meet various business needs. The affordable plans are designed to provide excellent value while ensuring you can seamlessly manage tasks related to the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow provides integrations with popular financial and tax preparation software to enhance your workflow. This connectivity allows for easy access to documents related to the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments, ensuring a smoother filing process.

-

What benefits can I expect from using airSlate SignNow for 1099 filing?

Using airSlate SignNow for your 1099 filing not only simplifies document signing but also enhances security and compliance. With features designed for quick collaboration, you can confidently manage the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments without the usual stress associated with tax season.

-

How does signing the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments with airSlate SignNow ensure compliance?

Signing documents like the Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments with airSlate SignNow incorporates legally binding eSignatures, ensuring compliance with federal regulations. Our platform also keeps a detailed audit trail for each document, providing proof of compliance and records for your reference.

Get more for Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments

- Aftercare for eyelash extensions form

- Crystal cruises guest visitor request visitor request form

- Axa reimbursement form 25989891

- Police vetting appeal letter form

- Asme p4 form filled out example

- Gloucester county public schools medication consent form gets gc k12 va

- 5l0380r application circuit form

- Notary form 4528150

Find out other Instructions For Form 1099 H Health Coverage Tax Credit HCTC Advance Payments

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free