Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return for Distributions

What is the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

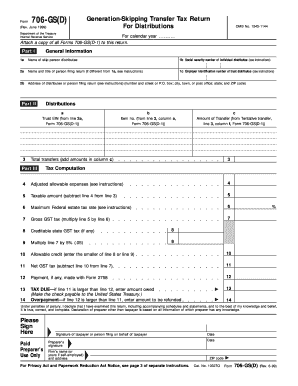

The Form 706GSD Rev June is a tax return specifically designed for reporting generation-skipping transfers, which are transfers of property to beneficiaries who are more than one generation below the transferor. This form is essential for ensuring compliance with the Generation-Skipping Transfer Tax (GSTT) regulations set forth by the Internal Revenue Service (IRS). The fill-in version allows users to complete the form electronically, facilitating easier submission and record-keeping.

How to use the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

To effectively use the Form 706GSD Rev June, individuals must first gather all necessary information regarding the transfers made to beneficiaries. This includes details about the property transferred, the relationship of the beneficiaries to the transferor, and the value of the property at the time of transfer. Once this information is compiled, users can fill out the form electronically, ensuring that all fields are completed accurately to avoid delays in processing.

Steps to complete the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

Completing the Form 706GSD Rev June involves several key steps:

- Begin by entering the transferor's information, including name, address, and taxpayer identification number.

- Provide details about the generation-skipping transfer, including the date of transfer and the type of property involved.

- List all beneficiaries receiving the property, along with their relationship to the transferor and their respective shares.

- Calculate the total value of the transfer and any applicable deductions or exemptions.

- Review the completed form for accuracy before submission.

Key elements of the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

Important elements of the Form 706GSD Rev June include:

- Transferor Information: Essential details about the person making the transfer.

- Beneficiary Details: Information about each recipient of the transfer.

- Property Description: A clear description of the property being transferred.

- Value of Transfer: The fair market value of the property at the time of transfer.

- Tax Calculation: An area for calculating the GSTT owed based on the transfer.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form 706GSD Rev June. Generally, the form must be filed within nine months of the date of the generation-skipping transfer. Extensions may be available, but they require timely submission of the appropriate request forms. Missing the deadline can result in penalties and interest on any taxes owed.

Penalties for Non-Compliance

Failure to file the Form 706GSD Rev June or inaccuracies in the information provided can lead to significant penalties. The IRS may impose fines for late filing, and additional penalties may apply for underreporting the value of the transfer or failing to pay the GSTT owed. It is essential to ensure compliance to avoid these financial repercussions.

Quick guide on how to complete form 706gsd rev june fill in version generation skipping transfer tax return for distributions

Finalize [SKS] effortlessly on any gadget

Digital document administration has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can find the necessary template and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your paperwork swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented activity today.

The optimal method for modifying and electronically signing [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your documentation.

- Emphasize important sections of the documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional signed document.

- Review the details and click on the Done button to save your changes.

- Choose how you want to share your form, via email, SMS, or a link, or download it to your computer.

Eliminate concerns about lost or misplaced paperwork, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and assure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

Create this form in 5 minutes!

How to create an eSignature for the form 706gsd rev june fill in version generation skipping transfer tax return for distributions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

The Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions is a specialized tax return used to report generation-skipping transfers to the IRS. It helps ensure compliance with tax regulations regarding distributions to beneficiaries from trusts and estates. Understanding this form is crucial for effective estate planning and tax management.

-

How does airSlate SignNow assist with the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

airSlate SignNow simplifies the process of preparing and eSigning the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions. With its user-friendly interface, you can easily fill out the form, add signatures, and share it securely with relevant parties. This streamlines document management and enhances your efficiency.

-

What are the pricing options for using airSlate SignNow for the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including templates for the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions. Subscriptions typically include features such as unlimited document signing and storage, making it a cost-effective solution for businesses handling estate planning and tax returns.

-

Are there any specific features for the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

Yes, airSlate SignNow provides features like customizable templates, real-time collaboration, and automated reminders, specifically tailored for the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions. These features help users streamline their processes, reduce errors, and ensure timely submissions.

-

Is it easy to integrate airSlate SignNow with other tools for managing the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

Absolutely! airSlate SignNow offers seamless integrations with various popular tools and platforms, making it convenient for users to manage their workflows related to the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions. This means you can combine it with your existing software for a more cohesive experience.

-

What benefits does airSlate SignNow provide for managing Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions?

Using airSlate SignNow for the Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions brings several benefits such as reduced processing time, improved accuracy, and enhanced security for sensitive documents. By leveraging eSigning technology, you can expedite the finalization of tax returns and keep better records.

-

Can I track the status of my Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions when using airSlate SignNow?

Yes, airSlate SignNow provides tracking capabilities for your Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions. You can easily monitor who has viewed or signed the document, which helps ensure that your tax filings are completed on time and that everyone involved stays informed.

Get more for Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

Find out other Form 706GSD Rev June Fill in Version Generation Skipping Transfer Tax Return For Distributions

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT