Form 1065 B Fill in Version U S Return of Income for Electing Large Partnerships

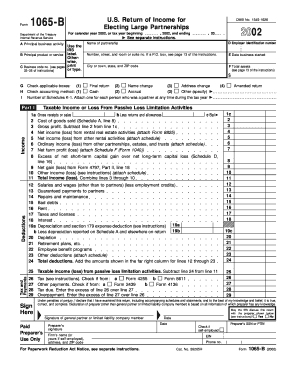

Understanding Form 1065 B: U.S. Return of Income for Electing Large Partnerships

Form 1065 B is specifically designed for electing large partnerships to report their income, deductions, gains, losses, and other relevant information. This form allows partnerships with specific qualifications to elect a special tax treatment under the Internal Revenue Code. By using Form 1065 B, partnerships can streamline their reporting process and ensure compliance with IRS regulations. This form is essential for partnerships that have chosen to be taxed as large partnerships, which typically have over 100 partners and meet other criteria set by the IRS.

Steps to Complete Form 1065 B

Completing Form 1065 B involves several key steps:

- Gather Required Information: Collect all necessary financial data, including income, deductions, and partner information.

- Fill Out the Form: Input the gathered information into the appropriate sections of the form, ensuring accuracy and completeness.

- Review for Errors: Carefully review the completed form for any mistakes or omissions that could lead to penalties.

- Sign and Date: Ensure that the form is signed by an authorized partner before submission.

- Submit the Form: Choose the appropriate method for submission, whether online or via mail, based on your preference.

Obtaining Form 1065 B

Form 1065 B can be obtained directly from the IRS website or through various tax preparation software programs. The IRS provides the latest version of the form, along with instructions for filling it out. It is important to ensure that you are using the most current version to avoid any compliance issues. Additionally, tax professionals can assist in obtaining and completing this form if needed.

Legal Use of Form 1065 B

Form 1065 B is legally required for partnerships that elect to be treated as large partnerships under IRS regulations. This form must be filed annually to report the partnership's income and other tax-related information. Failure to file Form 1065 B can result in penalties and interest on any unpaid taxes. It is crucial for partnerships to understand their legal obligations and ensure timely and accurate filing to maintain compliance.

Key Elements of Form 1065 B

Key elements of Form 1065 B include:

- Partner Information: Details about each partner, including their share of income and deductions.

- Income Reporting: Total income earned by the partnership during the tax year.

- Deductions: Eligible deductions that can be claimed by the partnership.

- Tax Computation: Calculation of any taxes owed based on the partnership's income.

- Signature Section: Required signatures from authorized partners to validate the form.

Filing Deadlines for Form 1065 B

Form 1065 B must be filed by the fifteenth day of the third month after the end of the partnership's tax year. For partnerships operating on a calendar year, this typically means a deadline of March 15. It is important for partnerships to be aware of these deadlines to avoid late filing penalties. Extensions may be available, but they must be requested before the original deadline.

Quick guide on how to complete form 1065 b fill in version u s return of income for electing large partnerships

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a remarkable eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your files promptly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign [SKS] with minimal effort

- Find [SKS] and then click Get Form to initiate the process.

- Use the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes moments and carries the same legal significance as a traditional handwritten signature.

- Review the information and then press the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b fill in version u s return of income for electing large partnerships

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships?

Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships is a specific tax form used by partnerships electing to be treated as large partnerships. This form simplifies the reporting process and provides clarity on income allocation. By using airSlate SignNow, businesses can easily fill out and eSign this form, ensuring compliance and accuracy.

-

How can airSlate SignNow help with filling out Form 1065 B?

airSlate SignNow provides a user-friendly platform to fill out Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships. With its intuitive interface, businesses can quickly input necessary information, ensuring that all details are accurately captured. Additionally, the platform supports electronic signatures, streamlining the submission process.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers competitive pricing plans that accommodate different business needs. The cost will depend on the features and functionalities you choose. However, many users find the efficiency gained from using airSlate SignNow to fill in forms like Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships makes it a worthwhile investment.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes various features for effective tax document management, such as customizable templates, automated workflows, and secure storage. These features specifically enhance the process of completing forms like Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships. The platform's focus on simplicity ensures a smooth user experience.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow offers integrations with popular accounting software, making it easier to manage documents like Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships. This integration allows for seamless data transfer, reducing manual entry and minimizing errors in your tax documentation process.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow to complete tax forms like Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships provides numerous benefits. These include increased efficiency in document management, reduced processing time, and enhanced compliance. Additionally, the platform offers robust security features to protect sensitive tax information.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes security by implementing advanced encryption and authentication methods. This ensures that all documents, including Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships, are protected from unauthorized access. The platform also complies with various regulations to give users peace of mind regarding their sensitive information.

Get more for Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships

- Gwinnett county water leak adjustment form

- Geography and history activity answer key form

- Naperville central high school naperville203 form

- Baking competition registration form buchanan county online

- Download financial statement form farm credit

- Pharmacy fair data processing notice form

- Certificate of entry of a birth of an indian citizen embassy of india in riyadh pdf fillers form

- Dimeo crane lift plan form

Find out other Form 1065 B Fill in Version U S Return Of Income For Electing Large Partnerships

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online