Form 1065 B Schedule K 1 Fill in Version

What is the Form 1065 B Schedule K-1 Fill in Version

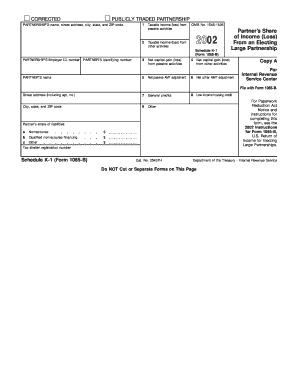

The Form 1065 B Schedule K-1 Fill in Version is a tax document used by partnerships to report the income, deductions, and credits of each partner. This form provides detailed information about each partner's share of the partnership’s income, which is essential for individual tax returns. Each partner receives a Schedule K-1, allowing them to accurately report their income on their personal tax returns. The fillable version of this form simplifies the process, enabling users to enter information directly into the form electronically.

How to use the Form 1065 B Schedule K-1 Fill in Version

To effectively use the Form 1065 B Schedule K-1 Fill in Version, partners must first gather all necessary financial information related to the partnership. This includes total income, deductions, and any credits applicable to each partner. Once the information is compiled, partners can fill in the designated fields on the form. It is important to ensure that all entries are accurate and complete, as this will affect the individual tax filings. After completing the form, partners should retain a copy for their records and provide the original to the partnership for filing purposes.

Steps to complete the Form 1065 B Schedule K-1 Fill in Version

Completing the Form 1065 B Schedule K-1 Fill in Version involves several key steps:

- Collect all necessary financial documents related to the partnership.

- Open the fillable version of the form on your device.

- Enter the partnership's name, address, and tax identification number in the appropriate fields.

- Input each partner's name, address, and tax identification number.

- Fill in the income, deductions, and credits allocated to each partner based on the partnership's financial records.

- Review the completed form for accuracy and completeness.

- Save the document and distribute copies to each partner as needed.

Key elements of the Form 1065 B Schedule K-1 Fill in Version

The key elements of the Form 1065 B Schedule K-1 Fill in Version include:

- Partnership Information: Name, address, and tax identification number of the partnership.

- Partner Information: Name, address, and tax identification number of each partner.

- Income Allocation: Details on the partner's share of income, including ordinary business income, rental income, and capital gains.

- Deductions and Credits: Information on any deductions or credits allocated to the partner.

- Other Information: Additional details that may be relevant for tax reporting purposes.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for completing the Form 1065 B Schedule K-1 Fill in Version. These guidelines outline the requirements for reporting income, deductions, and credits, as well as the deadlines for submission. It is essential for partnerships to adhere to these guidelines to ensure compliance with federal tax regulations. Partners should also be aware of any changes in tax laws that may affect their reporting obligations.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1065 B Schedule K-1 Fill in Version are typically aligned with the partnership's tax return due date. Generally, partnerships must file their Form 1065 by March 15 for calendar year filers. Schedule K-1s must be distributed to partners by the same date. If extensions are filed, the deadlines may be extended, but it is crucial to check the IRS guidelines for specific dates each tax year to avoid penalties.

Quick guide on how to complete form 1065 b schedule k 1 fill in version

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed forms, allowing you to locate the necessary template and securely keep it online. airSlate SignNow equips you with all the features required to create, modify, and electronically sign your documents promptly without any holdups. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

Steps to Modify and eSign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal standing as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1065 B Schedule K 1 Fill in Version

Create this form in 5 minutes!

How to create an eSignature for the form 1065 b schedule k 1 fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1065 B Schedule K 1 Fill in Version?

The Form 1065 B Schedule K 1 Fill in Version is a document that partnerships use to report the income, deductions, and credits of each partner. This fillable version allows for easier data entry and ensures accurate reporting. Utilizing airSlate SignNow can streamline this process with user-friendly tools designed for e-signature and document management.

-

How can I complete the Form 1065 B Schedule K 1 Fill in Version using airSlate SignNow?

To complete the Form 1065 B Schedule K 1 Fill in Version using airSlate SignNow, simply upload your document, fill in the required fields, and use the e-signature feature for approval. Our platform provides intuitive editing tools, making the completion process efficient and straightforward. You can save your progress and access your forms at any time.

-

Is there a cost associated with using the Form 1065 B Schedule K 1 Fill in Version on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including costs for using the Form 1065 B Schedule K 1 Fill in Version. We recommend reviewing our pricing page to find the plan that suits your budget and usage requirements. Investing in our solution can lead to signNow time and resource savings.

-

What are the key features of the Form 1065 B Schedule K 1 Fill in Version on airSlate SignNow?

Key features of the Form 1065 B Schedule K 1 Fill in Version on airSlate SignNow include customizable templates, easy electronic signatures, document storage, and real-time collaboration. These features simplify completing and sharing your forms, ensuring compliance with IRS deadlines. Plus, you can track the status of your documents efficiently.

-

Can the Form 1065 B Schedule K 1 Fill in Version be integrated with other software?

Yes, the Form 1065 B Schedule K 1 Fill in Version can seamlessly integrate with various accounting and business management software. airSlate SignNow supports integrations with popular platforms, enhancing your workflow and data accuracy. This allows you to manage all your documentation and financial records in one place.

-

What benefits does airSlate SignNow provide for handling the Form 1065 B Schedule K 1 Fill in Version?

Using airSlate SignNow for the Form 1065 B Schedule K 1 Fill in Version offers several benefits, including increased efficiency, reduced processing time, and improved accuracy. The e-signature capabilities ensure that all necessary approvals are quick and traceable. Businesses can also streamline communication among partners to enhance collaboration.

-

How secure is the Form 1065 B Schedule K 1 Fill in Version on airSlate SignNow?

The Form 1065 B Schedule K 1 Fill in Version on airSlate SignNow is secured with advanced encryption and compliance with industry standards to protect your sensitive data. We prioritize your confidentiality and ensure that your documents are safely stored and transmitted. Trust our platform for handling your important tax documents with care.

Get more for Form 1065 B Schedule K 1 Fill in Version

- Account verificationauthorization form lincoln casino

- Formulario para datos de empleados

- Editable child care staff health assessment forms and

- St lucia nursing council 250643200 form

- Affidavit of consideration for use by buyer form

- Ash word family form

- Phudi pic 477750331 form

- Sample tcm documentation and flow sheet acponline form

Find out other Form 1065 B Schedule K 1 Fill in Version

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile