November Department of the Treasury Internal Revenue Service Certificate of Alien Claiming Residence in the United States This C Form

Understanding the Certificate of Alien Claiming Residence

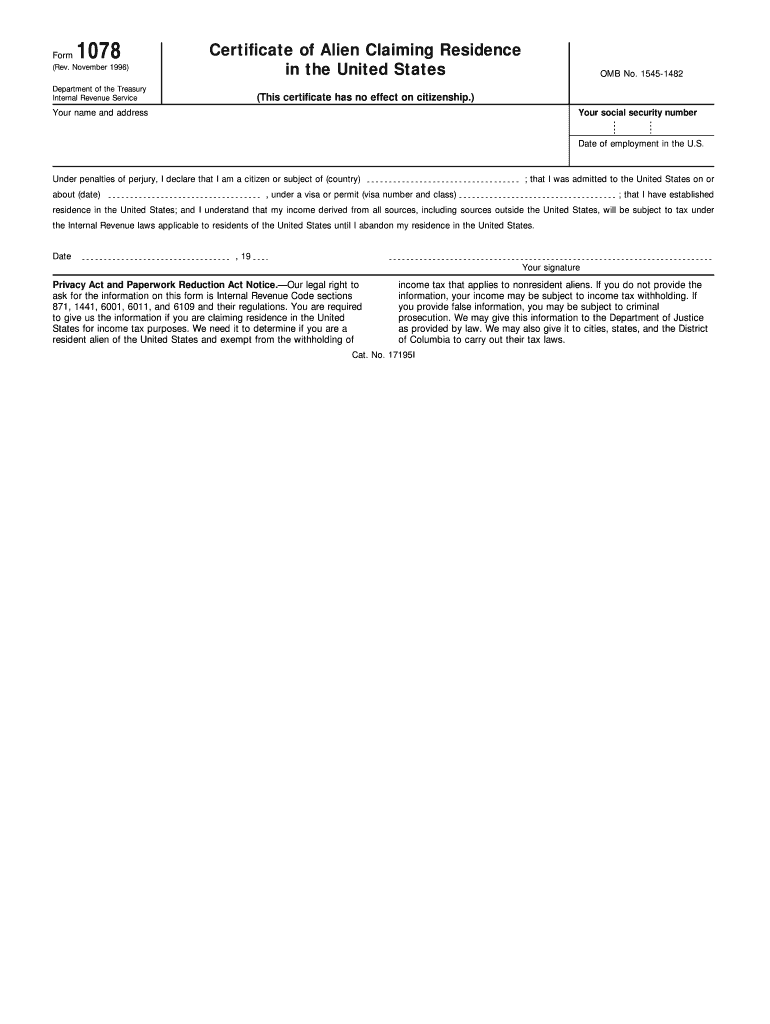

The November Department of the Treasury Internal Revenue Service Certificate of Alien Claiming Residence in the United States is a document that serves to verify the residency status of non-citizens. This certificate is particularly important for individuals who need to establish their tax obligations or eligibility for certain benefits while residing in the U.S. It is essential to note that this certificate does not confer any rights to U.S. citizenship or alter an individual’s immigration status.

How to Obtain the Certificate

To obtain the Certificate of Alien Claiming Residence, individuals must complete the necessary application forms provided by the IRS. This process typically involves submitting documentation that verifies residency status, such as proof of address or immigration documents. It is advisable to check the IRS website or contact their offices for the most current application procedures and requirements.

Steps to Complete the Certificate

Completing the Certificate of Alien Claiming Residence involves several steps:

- Gather required documentation to prove residency, such as utility bills or lease agreements.

- Fill out the application form accurately, ensuring all personal information is correct.

- Submit the completed form along with any supporting documents to the IRS.

- Keep copies of all submitted materials for your records.

Legal Use of the Certificate

The Certificate of Alien Claiming Residence is primarily used for tax purposes. It helps individuals clarify their tax obligations and eligibility for certain tax benefits. It is important to understand that while the certificate is a legal document, it does not grant any immigration benefits or alter an individual's citizenship status.

Key Elements of the Certificate

Key elements of the Certificate of Alien Claiming Residence include:

- Identification information of the applicant, including name and address.

- Details regarding the residency status of the individual.

- A statement clarifying that the certificate does not affect citizenship.

- Signature of the applicant, affirming the accuracy of the information provided.

Eligibility Criteria for the Certificate

Eligibility for the Certificate of Alien Claiming Residence typically includes being a non-citizen residing in the United States. Applicants must provide proof of residency and may need to demonstrate their tax obligations. It is crucial to review the specific eligibility requirements set forth by the IRS to ensure compliance.

Quick guide on how to complete november department of the treasury internal revenue service certificate of alien claiming residence in the united states this

Prepare [SKS] effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage [SKS] on any platform using airSlate SignNow’s apps for Android or iOS and enhance any document-centric procedure today.

The easiest way to edit and electronically sign [SKS] with ease

- Acquire [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious document searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Edit and electronically sign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This C

Create this form in 5 minutes!

How to create an eSignature for the november department of the treasury internal revenue service certificate of alien claiming residence in the united states this

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

The November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship is a document issued by the IRS for aliens who wish to claim residence status in the U.S. This certificate assists individuals in clarifying their status for tax purposes. It is important to understand that holding this certificate does not confer citizenship.

-

How can airSlate SignNow help me manage my November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

AirSlate SignNow offers a streamlined platform to securely store, manage, and eSign documents, including the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship. Our solution simplifies document handling and enhances compliance, ensuring you always have access to important files.

-

Is there a cost associated with obtaining the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

While airSlate SignNow offers a cost-effective solution for managing digital documents, obtaining the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship may involve fees imposed by the IRS or legal advisors. It’s best to consult with a tax professional regarding any associated costs.

-

What features does airSlate SignNow offer for handling tax-related documents like the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

AirSlate SignNow provides features such as electronic signing, audit trails, and document templates that are ideal for handling tax-related documents like the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship. These features enhance efficiency and ensure compliance with legal standards.

-

Can I integrate other software with airSlate SignNow when dealing with the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

Yes, airSlate SignNow allows for seamless integration with various software applications. This includes tools for accounting and other tax-related services, making it easier to manage the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship efficiently. Streamlining these processes can save time and reduce errors.

-

What are the benefits of using airSlate SignNow for documents like the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship?

Using airSlate SignNow for your document management needs offers numerous benefits, including increased security, ease of access, and improved collaboration. With features tailored for handling sensitive documents like the November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship, you can ensure that your important information is protected and readily available.

-

How can I ensure my November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship is valid?

To ensure the validity of your November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This Certificate Has No Effect On Citizenship, it is crucial to follow IRS guidelines and consult with a legal professional as needed. Proper storage and management through platforms like airSlate SignNow can also help maintain its integrity and accessibility.

Get more for November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This C

- Amra report north american mh registry mhreg form

- Medication transfer form

- Fbisd background check form

- South carolina revenue advisory bulletin 02 6 form

- Iowa sales retailers use tax and surcharge return form

- Records certificate authenticity form

- Southark transcript request form

- General accounting expenditure form gax iowa department of dhs state ia

Find out other November Department Of The Treasury Internal Revenue Service Certificate Of Alien Claiming Residence In The United States This C

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation