POLICY the PRP at a GLANCE COVERa GE FEMA Fema Form

Understanding the POLICY THE PRP AT A GLANCE COVERAGE FEMA

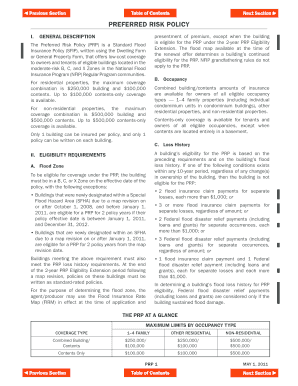

The POLICY THE PRP AT A GLANCE COVERAGE FEMA provides essential information about the National Flood Insurance Program (NFIP) and its offerings. This policy is designed to help property owners understand their flood insurance coverage options and the implications of the policy. It outlines the types of coverage available, including building and contents coverage, and the specific terms and conditions that apply to each. Understanding this policy is crucial for homeowners in flood-prone areas, as it helps them make informed decisions regarding their insurance needs.

How to Use the POLICY THE PRP AT A GLANCE COVERAGE FEMA

To effectively use the POLICY THE PRP AT A GLANCE COVERAGE FEMA, property owners should first familiarize themselves with the key components of the policy. This includes understanding the coverage limits, deductibles, and exclusions. Homeowners can review the policy details to determine what is covered in the event of a flood and what steps they need to take to file a claim. It is also beneficial to consult with an insurance agent who specializes in flood insurance to clarify any uncertainties and ensure that the policy meets individual needs.

Steps to Complete the POLICY THE PRP AT A GLANCE COVERAGE FEMA

Completing the POLICY THE PRP AT A GLANCE COVERAGE FEMA involves several important steps:

- Review the coverage options to determine which best suits your property.

- Gather necessary documentation, such as property details and previous insurance records.

- Complete the application form, ensuring all information is accurate and up-to-date.

- Submit the application through the designated channels, whether online or via mail.

- Keep a copy of the submitted application for your records.

Eligibility Criteria for the POLICY THE PRP AT A GLANCE COVERAGE FEMA

Eligibility for the POLICY THE PRP AT A GLANCE COVERAGE FEMA generally depends on the location of the property and its risk of flooding. Properties situated in high-risk flood zones are typically required to have flood insurance, while those in lower-risk areas may have the option to purchase coverage. Additionally, the property must meet specific criteria set by FEMA, including compliance with local building codes and regulations. It is advisable for homeowners to check their flood zone designation to understand their eligibility for coverage.

Required Documents for the POLICY THE PRP AT A GLANCE COVERAGE FEMA

When applying for the POLICY THE PRP AT A GLANCE COVERAGE FEMA, several documents are typically required:

- Proof of property ownership, such as a deed or mortgage statement.

- Previous insurance policies, if applicable.

- Details about the property's location and structure, including elevation certificates.

- Any additional documentation requested by the insurance provider.

Legal Use of the POLICY THE PRP AT A GLANCE COVERAGE FEMA

The POLICY THE PRP AT A GLANCE COVERAGE FEMA is legally binding once accepted by the property owner and the insurance provider. It is essential for homeowners to understand the legal implications of the policy, including their rights and responsibilities. This includes adhering to the terms of the policy, such as timely payment of premiums and accurate reporting of any changes to the property. Failure to comply with these legal requirements may result in denial of claims or cancellation of the policy.

Quick guide on how to complete policy the prp at a glance covera ge fema fema

Complete [SKS] effortlessly on any device

Managing documents online has gained popularity among both companies and individuals. It serves as an excellent environmentally-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Make use of the tools we offer to fill out your form.

- Select pertinent sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow manages all your document handling requirements in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema

Create this form in 5 minutes!

How to create an eSignature for the policy the prp at a glance covera ge fema fema

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema?

The POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema provides an overview of the coverage offered under the National Flood Insurance Program. It is essential for understanding the provisions and benefits associated with flood insurance policies. This resource helps businesses make informed decisions about their flood insurance needs.

-

How much does the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema cost?

Pricing for the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema varies based on the specific coverage amounts and risk factors associated with the property. It is advisable to consult with an insurance agent to get a tailored quote that meets your needs. Generally, the policy offers affordable options for comprehensive flood coverage.

-

What features are included in the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema?

The POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema includes features such as property coverage for buildings and contents, expedited claims processing, and access to resources that help you understand your policy. Additionally, it emphasizes the essentials necessary to navigate flood risks effectively. These features ensure that you are well-protected against potential flood damage.

-

What are the benefits of having the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema?

Having the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema ensures that you are financially protected against flood-related losses. It can help businesses recover quickly after a disaster, minimizing downtime and losses. Moreover, it provides peace of mind knowing that your property is safeguarded against unforeseen flood risks.

-

Can I integrate the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema with other insurance products?

Yes, the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema can often be integrated with other types of insurance products to provide comprehensive coverage. This allows businesses to streamline their insurance management while ensuring all potential risks are addressed. Consult with your insurance provider to explore possible integrations to enhance your overall protection.

-

How do I file a claim under the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema?

To file a claim under the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema, you should contact your insurance agent or the FEMA claims department directly. They will guide you through the necessary steps and documentation required for your claim to be processed. Promptly reporting damage will also expedite the claim process for quicker resolution.

-

Is the POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema suitable for all types of properties?

The POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema is designed to cater to various property types, including residential and commercial. However, eligibility may depend on specific details such as location and building characteristics. It's important to review your property's qualifications with an insurance professional to ensure appropriate coverage.

Get more for POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema

Find out other POLICY THE PRP AT A GLANCE COVERa GE FEMA Fema

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free