Schedule H Form 1120 Fill in Version Section 280H Limitations for a Personal Service Corporation PSC

Understanding the Schedule H Form 1120 for Personal Service Corporations

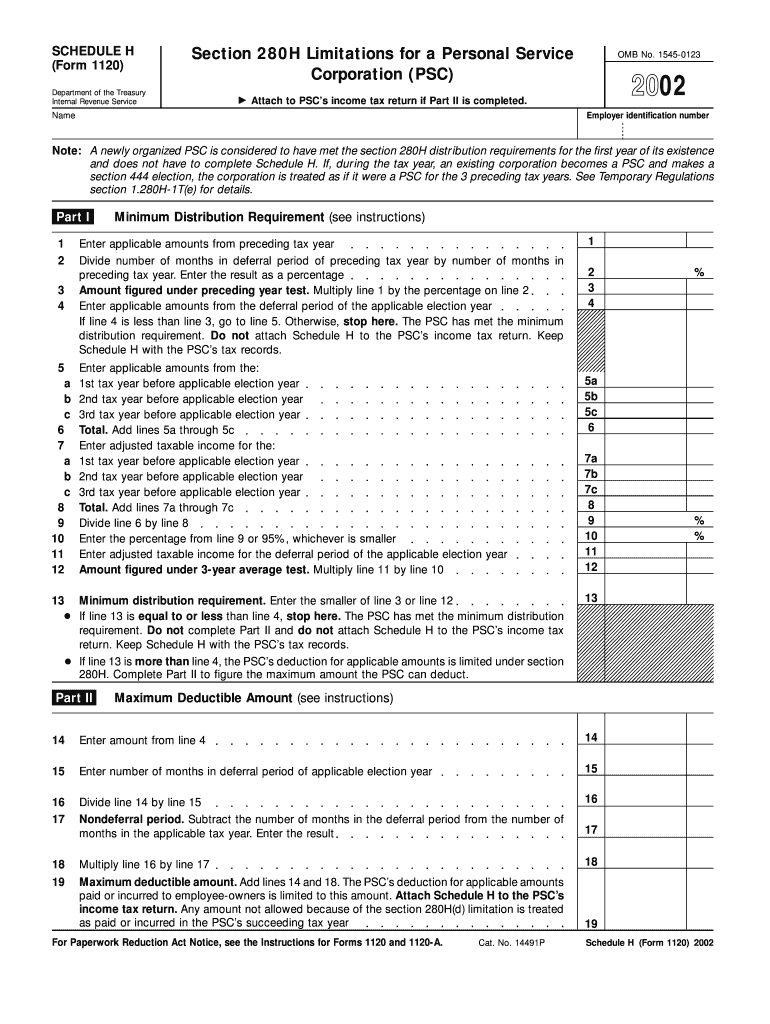

The Schedule H Form 1120 is a crucial document for personal service corporations (PSCs) in the United States. This form is specifically designed to report the limitations imposed under Section 280H of the Internal Revenue Code. Personal service corporations are typically formed by professionals such as doctors, lawyers, and accountants, and they must adhere to specific tax regulations that distinguish them from other business entities.

Section 280H limits the amount of certain deductions that a PSC can claim, which makes it essential for these corporations to accurately complete this form to ensure compliance with IRS regulations. Understanding the nuances of the Schedule H Form 1120 helps PSCs navigate their tax obligations effectively.

Steps to Complete the Schedule H Form 1120

Completing the Schedule H Form 1120 involves several steps that require careful attention to detail. First, gather all necessary financial information, including income, expenses, and any applicable deductions. Next, fill out the basic identification information, including the corporation's name, address, and Employer Identification Number (EIN).

Then, proceed to report the total income and allowable deductions, ensuring that you adhere to the limitations set forth in Section 280H. It is important to double-check calculations and ensure that all figures align with your financial records. Finally, review the completed form for accuracy before submission.

Key Elements of the Schedule H Form 1120

The Schedule H Form 1120 includes several key elements that are vital for proper reporting. These elements consist of the corporation's identifying information, total income, and specific deductions that are subject to limitations under Section 280H. Additionally, the form requires the reporting of any adjustments that may affect taxable income.

Understanding these key components is essential for ensuring compliance and maximizing allowable deductions. Each section of the form plays a critical role in determining the overall tax liability of the personal service corporation.

IRS Guidelines for Personal Service Corporations

The IRS provides specific guidelines for personal service corporations regarding the completion and submission of the Schedule H Form 1120. These guidelines outline the eligibility criteria for PSCs and the specific deductions that can be claimed under Section 280H. It is important for corporations to familiarize themselves with these guidelines to avoid potential penalties for non-compliance.

Additionally, the IRS outlines the filing deadlines and any required documentation that must accompany the form. Adhering to these guidelines ensures that personal service corporations remain compliant with federal tax laws.

Filing Deadlines for the Schedule H Form 1120

Filing deadlines for the Schedule H Form 1120 are crucial for personal service corporations to avoid penalties. Generally, the form must be filed by the 15th day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this typically means a deadline of March 15. However, if the deadline falls on a weekend or holiday, it is extended to the next business day.

It is advisable for PSCs to mark their calendars and prepare their documentation well in advance to ensure timely submission and compliance with IRS regulations.

Penalties for Non-Compliance with Schedule H Form 1120

Failure to comply with the requirements of the Schedule H Form 1120 can result in significant penalties for personal service corporations. The IRS may impose fines for late filing, inaccuracies, or failure to report required information. These penalties can add up quickly, impacting the corporation's financial standing.

To mitigate the risk of penalties, it is essential for PSCs to ensure accurate and timely completion of the form, as well as adherence to all IRS guidelines. Consulting with a tax professional can also provide valuable insights into maintaining compliance.

Quick guide on how to complete what is a personal service corporation

Effortlessly prepare what is a personal service corporation on any device

Digital document management has become increasingly popular among both companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without delays. Manage what is a personal service corporation on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign what is a personal service corporation without hassle

- Obtain what is a personal service corporation and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Mark essential sections of the documents or redact sensitive information with specific tools offered by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to finalize your changes.

- Select your preferred method to send the form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign what is a personal service corporation and guarantee outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to what is a personal service corporation

Create this form in 5 minutes!

How to create an eSignature for the what is a personal service corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask what is a personal service corporation

-

What is a personal service corporation and how does it differ from other business structures?

A personal service corporation, or PSC, is a type of corporation composed primarily of employees who offer personal services, such as doctors, lawyers, or accountants. Unlike traditional corporations, PSCs often face unique tax implications and regulatory advantages, making it important to evaluate their structure when considering business operations.

-

What are the benefits of using airSlate SignNow for a personal service corporation?

AirSlate SignNow offers a streamlined solution for personal service corporations to manage their document signing needs efficiently. With features such as eSigning, secure storage, and easy sharing options, it helps PSCs save time and resources while ensuring compliance with legal requirements.

-

How much does airSlate SignNow cost for personal service corporations?

AirSlate SignNow provides flexible pricing plans designed to cater to the needs of personal service corporations. Whether you are a small firm or a larger PSC, you can select a plan that suits your budget, ensuring that you get the best value for your investment.

-

What features does airSlate SignNow offer that are beneficial for personal service corporations?

AirSlate SignNow includes features essential for personal service corporations, such as customizable templates, automated workflows, and a user-friendly interface. These functionalities help streamline operations, making it easier for PSCs to obtain signatures and manage documents efficiently.

-

Can airSlate SignNow integrate with other tools used by personal service corporations?

Yes, airSlate SignNow seamlessly integrates with various popular applications, enhancing workflow efficiency for personal service corporations. Whether it's CRM systems or document management tools, these integrations allow PSCs to synchronize their processes and improve productivity.

-

Is airSlate SignNow secure for my personal service corporation's documents?

Absolutely! AirSlate SignNow prioritizes the security of your documents, employing advanced encryption and authentication methods. Personal service corporations can rest assured that their sensitive information is safe, complying with industry standards to protect against unauthorized access.

-

How does eSigning work in airSlate SignNow for personal service corporations?

The eSigning process in airSlate SignNow is straightforward and efficient, making it ideal for personal service corporations. Users can upload documents, add signature fields, and invite signers via email, allowing for real-time updates and tracking throughout the signing lifecycle.

Get more for what is a personal service corporation

Find out other what is a personal service corporation

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip