the VitalityLife Discretionary Trust for Use with 2016-2026

What is the VitalityLife Discretionary Trust?

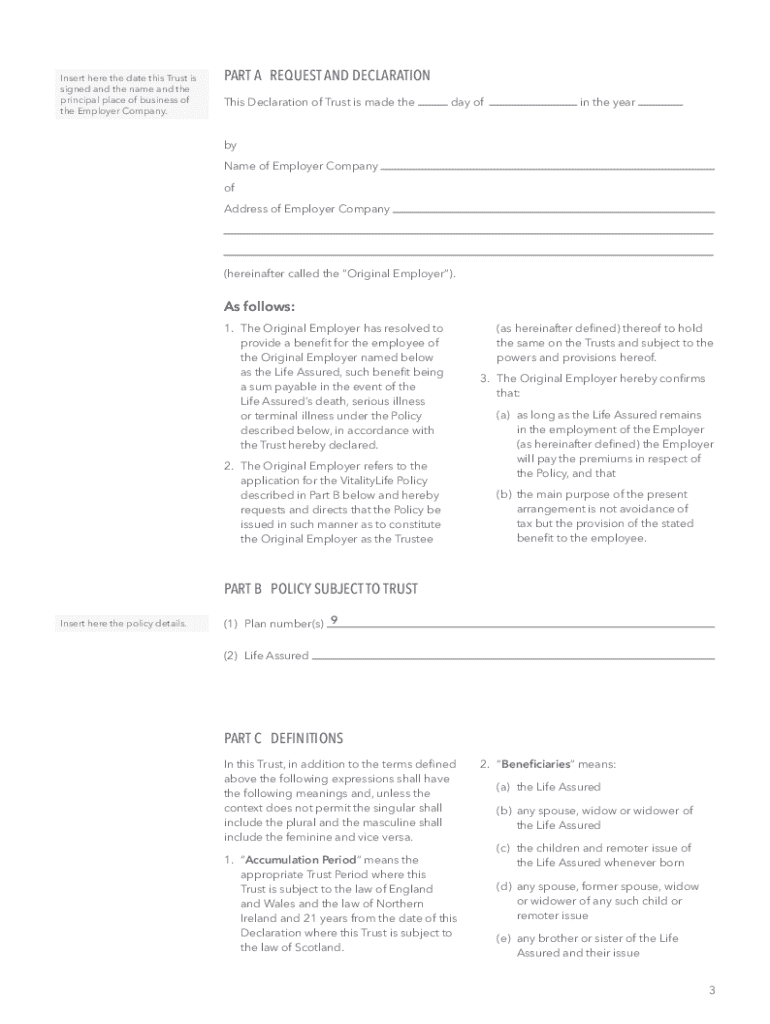

The VitalityLife Discretionary Trust is a legal arrangement designed to manage and distribute assets for the benefit of designated beneficiaries. This trust allows the trustee to exercise discretion in deciding how and when to distribute assets, providing flexibility in financial management. It is particularly useful for individuals looking to protect their assets while ensuring that their loved ones are provided for in a structured manner.

How to Use the VitalityLife Discretionary Trust

Using the VitalityLife Discretionary Trust involves several steps. First, the trust document must be created, outlining the terms and conditions, including the roles of the trustee and beneficiaries. Next, assets are transferred into the trust, which may include cash, property, or investments. Finally, the trustee manages these assets according to the trust's guidelines, ensuring that distributions are made in line with the beneficiaries' needs and the trust's objectives.

Steps to Complete the VitalityLife Discretionary Trust

Completing the VitalityLife Discretionary Trust involves the following steps:

- Consult with a legal professional to draft the trust document.

- Identify the beneficiaries and the trustee.

- Transfer assets into the trust, ensuring proper documentation.

- Review and update the trust periodically to reflect any changes in circumstances.

Legal Use of the VitalityLife Discretionary Trust

The VitalityLife Discretionary Trust is legally recognized in the United States and can serve various purposes, such as estate planning, asset protection, and tax planning. It is essential to comply with state laws and regulations governing trusts to ensure that the trust is valid and enforceable. Consulting with an attorney who specializes in trust law can help navigate these legal requirements.

Key Elements of the VitalityLife Discretionary Trust

Key elements of the VitalityLife Discretionary Trust include:

- Trustee: The individual or entity responsible for managing the trust.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Discretionary Powers: The trustee's authority to decide how and when to distribute assets.

- Trust Document: The legal document outlining the terms and conditions of the trust.

Eligibility Criteria for the VitalityLife Discretionary Trust

To establish a VitalityLife Discretionary Trust, the grantor must meet specific eligibility criteria, including:

- Being of legal age to create a trust, typically eighteen years or older.

- Having the legal capacity to manage assets and make decisions regarding the trust.

- Identifying clear beneficiaries who will benefit from the trust.

Create this form in 5 minutes or less

Find and fill out the correct the vitalitylife discretionary trust for use with

Create this form in 5 minutes!

How to create an eSignature for the the vitalitylife discretionary trust for use with

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The VitalityLife Discretionary Trust For Use With?

The VitalityLife Discretionary Trust For Use With is a financial tool designed to provide flexibility in managing assets for beneficiaries. It allows for the distribution of funds based on the needs of the beneficiaries, ensuring that their financial requirements are met effectively.

-

How does The VitalityLife Discretionary Trust For Use With benefit my estate planning?

Incorporating The VitalityLife Discretionary Trust For Use With into your estate planning can help you manage your assets more efficiently. It provides a structured approach to asset distribution, potentially reducing tax liabilities and ensuring that your beneficiaries receive support according to their individual needs.

-

What are the costs associated with The VitalityLife Discretionary Trust For Use With?

The costs of setting up The VitalityLife Discretionary Trust For Use With can vary based on the complexity of your estate and the services required. Typically, you may incur legal fees for drafting the trust document and ongoing management fees, which can be discussed with your financial advisor.

-

Can The VitalityLife Discretionary Trust For Use With be integrated with other financial products?

Yes, The VitalityLife Discretionary Trust For Use With can be integrated with various financial products, including life insurance and investment accounts. This integration allows for a more comprehensive financial strategy, ensuring that all aspects of your estate are managed effectively.

-

What features does The VitalityLife Discretionary Trust For Use With offer?

The VitalityLife Discretionary Trust For Use With offers several key features, including flexible asset distribution, tax efficiency, and protection from creditors. These features make it an attractive option for individuals looking to secure their beneficiaries' financial future.

-

Who should consider using The VitalityLife Discretionary Trust For Use With?

Individuals with signNow assets or complex family situations should consider using The VitalityLife Discretionary Trust For Use With. It is particularly beneficial for those who want to ensure that their assets are managed and distributed according to their wishes while providing for their beneficiaries' varying needs.

-

How can I get started with The VitalityLife Discretionary Trust For Use With?

To get started with The VitalityLife Discretionary Trust For Use With, consult with a financial advisor or estate planning attorney. They can guide you through the process of setting up the trust and help you understand the implications for your specific situation.

Get more for The VitalityLife Discretionary Trust For Use With

- Marriage certificate request form cook county find laws

- Letter of medical necessity healthpartners form

- Decleration of guarantor saskatchewan form

- Minnesota uniform formulary exception form

- Sip top up mandate form 05 jan 15 icici prudential mutual fund

- Rti referral form examples

- Delinquent earned income tax department form

- Form it 607 claim for excelsior jobs program tax credit tax year

Find out other The VitalityLife Discretionary Trust For Use With

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document