Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

What is the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

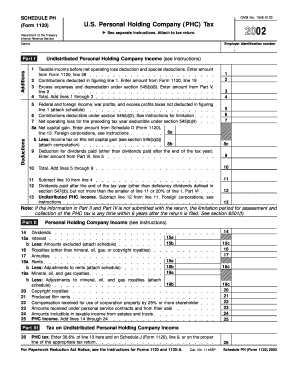

The Schedule PH Form 1120 is a tax form used by U.S. personal holding companies (PHCs) to report their income, deductions, and tax liability. A personal holding company is defined as a corporation that meets specific criteria set by the Internal Revenue Service (IRS), primarily focused on the nature of its income and the percentage of ownership. This form helps the IRS assess whether the company is subject to additional taxes due to its classification as a PHC. It is essential for PHCs to accurately complete this form to ensure compliance with federal tax regulations.

Steps to complete the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

Completing the Schedule PH Form 1120 involves several key steps:

- Gather financial records: Collect all relevant financial documents, including income statements and balance sheets for the tax year.

- Determine PHC status: Verify that the corporation qualifies as a personal holding company based on IRS criteria.

- Fill in income details: Report all sources of income, including dividends, interest, and rents, on the form.

- List deductions: Include any allowable deductions, such as business expenses and losses, to reduce taxable income.

- Calculate tax liability: Use the provided tax rates to compute the total tax owed by the PHC.

- Review for accuracy: Double-check all entries to ensure that the information is complete and accurate.

- Submit the form: File the completed Schedule PH Form 1120 with the IRS by the designated deadline.

Legal use of the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

The Schedule PH Form 1120 serves a legal purpose by ensuring that personal holding companies comply with U.S. tax laws. By accurately reporting income and deductions, PHCs fulfill their legal obligations to the IRS. Failure to file this form or to report income correctly can lead to penalties, including additional taxes and interest on unpaid amounts. It is crucial for PHCs to understand the legal implications of their tax filings and to maintain proper documentation to support their claims.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule PH Form 1120 are crucial for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of the corporation's tax year. For most corporations operating on a calendar year, this means the deadline is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations may also request an extension, but this does not extend the time to pay any taxes owed.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule PH Form 1120. These guidelines include instructions on determining PHC status, reporting income correctly, and calculating taxes owed. The IRS also outlines the penalties for non-compliance and offers resources for corporations needing assistance. It is advisable for PHCs to refer to the latest IRS publications and instructions to ensure they meet all requirements and avoid potential issues.

Required Documents

To complete the Schedule PH Form 1120, several documents are necessary:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, such as dividends, interest, and rents.

- Documentation of allowable deductions, including business expenses.

- Previous tax returns, if applicable, for reference.

Having these documents organized and readily available can facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete schedule ph form 1120 fill in version u s personal holding company phc tax

Prepare [SKS] effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides all the resources necessary to generate, modify, and electronically sign your documents promptly. Manage [SKS] on any gadget with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to alter and electronically sign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate.

- Use the features we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your requirements in document management in just a few clicks from any device of your preference. Modify and electronically sign [SKS] and guarantee exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

Create this form in 5 minutes!

How to create an eSignature for the schedule ph form 1120 fill in version u s personal holding company phc tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax?

The Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax is a specific tax form that corporations classified as personal holding companies must file. It helps in reporting income and calculating the tax owed for such entities. Understanding this form is crucial for compliance and accurate financial reporting.

-

How can airSlate SignNow help with the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax?

airSlate SignNow enables users to easily create, fill in, and eSign the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax. With its intuitive platform, you can streamline the process of completing and submitting your tax forms, ensuring accuracy and efficiency.

-

What features does airSlate SignNow offer for managing my Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax?

airSlate SignNow provides features such as document templates, cloud storage, and real-time collaboration for managing your Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax. These tools enhance productivity and help ensure that all necessary information is correctly entered and stored securely.

-

Is there a cost associated with using airSlate SignNow for the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. You'll find that the cost is competitive, especially considering the time and resources saved when managing your Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax through an efficient eSignature platform.

-

Does airSlate SignNow integrate with other software for tax purposes?

Absolutely! airSlate SignNow integrates smoothly with various accounting and tax software to facilitate the management of your Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax. These integrations help automate workflows and reduce the risk of errors in document handling.

-

Can I track my Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax submissions with airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax submissions in real-time. You’ll receive notifications when documents are viewed and signed, giving you assurance and transparency in the process.

-

What benefits of using airSlate SignNow apply to the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax?

Using airSlate SignNow for the Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax can drastically reduce the time spent on paperwork and improve overall accuracy. The platform’s user-friendly interface promotes efficiency, ensuring your tax filings are done correctly and on time.

Get more for Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

- Disbursement request form 245098951

- Insurance agency business plan template form

- Mangonia park community center form

- Ignou answer sheet sample form

- Topas questionnaire form

- Application for employment overton hotel and conference center form

- Mini mental state examination form form download

- Service contract renewal letter sample doc form

Find out other Schedule PH Form 1120 Fill in Version U S Personal Holding Company PHC Tax

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed