Form 1120 POL Fill in Version U S Income Tax Return for Certain Political Organizations

What is the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

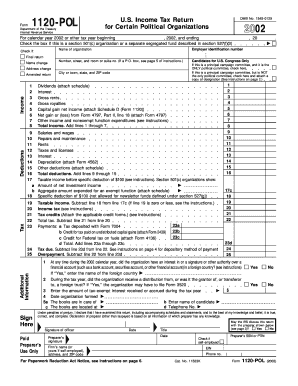

The Form 1120 POL is a specific tax return used by certain political organizations in the United States. This form is designed for organizations that are classified as political and that meet specific criteria set by the IRS. It allows these organizations to report their income, deductions, and tax liability. The form is essential for ensuring compliance with federal tax laws and maintaining the organization's tax-exempt status. Understanding the purpose and requirements of Form 1120 POL is crucial for political organizations to fulfill their legal obligations.

Steps to complete the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

Completing the Form 1120 POL involves several key steps:

- Gather necessary information: Collect all relevant financial records, including income sources, expenses, and any previous tax filings.

- Fill out the form: Enter the organization's details, including name, address, and Employer Identification Number (EIN). Accurately report income and deductions in the appropriate sections.

- Calculate tax liability: Determine the tax owed based on the income reported. Ensure all calculations are accurate to avoid penalties.

- Review the form: Double-check all entries for accuracy and completeness. Mistakes can lead to delays or additional scrutiny from the IRS.

- Submit the form: Choose the appropriate submission method, whether electronically or by mail, and ensure it is sent by the filing deadline.

How to obtain the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

The Form 1120 POL can be obtained directly from the IRS website. It is available as a downloadable PDF, allowing organizations to fill it out electronically or print it for manual completion. Additionally, organizations may contact the IRS for assistance or request a physical copy if needed. It is important to ensure that the most current version of the form is used to comply with any recent tax law changes.

Legal use of the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

The legal use of Form 1120 POL is restricted to organizations that qualify as political under IRS guidelines. This includes entities that primarily engage in political activities, such as campaigning for candidates or advocating for specific legislation. Proper use of the form is essential to maintain tax-exempt status and avoid penalties. Organizations must adhere to all applicable laws and regulations regarding political contributions and expenditures, ensuring transparency and compliance in their financial reporting.

Filing Deadlines / Important Dates

Filing deadlines for Form 1120 POL are crucial for compliance. Generally, the form must be submitted by the fifteenth day of the fifth month after the end of the organization’s tax year. For organizations operating on a calendar year, this typically means a deadline of May 15. It is important to be aware of any extensions that may apply and to keep track of any changes in deadlines announced by the IRS. Timely filing helps avoid penalties and interest on unpaid taxes.

Key elements of the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

Key elements of Form 1120 POL include sections for reporting income, deductions, and tax calculations. Organizations must provide detailed information about their revenue sources, such as contributions and grants, as well as allowable expenses related to political activities. The form also includes a section for calculating the organization's taxable income and any taxes owed. Accurate reporting of these elements is essential for compliance and for maintaining the organization's tax-exempt status.

Quick guide on how to complete form 1120 pol fill in version u s income tax return for certain political organizations

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark key sections of the documents or obscure sensitive details using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review all the information and hit the Done button to save your changes.

- Select your preferred method for delivering your form—via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious searches for forms, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication throughout every stage of the form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pol fill in version u s income tax return for certain political organizations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations?

The Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations is a specific tax form designed for political organizations to report their income and expenses. It ensures compliance with IRS regulations while helping organizations manage their financial reporting effectively. Utilizing this form is crucial for any political organization aiming to maintain transparency and accountability.

-

How does airSlate SignNow help with filling out the Form 1120 POL?

airSlate SignNow offers a streamlined platform for completing the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations. Our solution provides templates and easy-to-use tools that simplify the data entry process, ensuring that your organization can fill out and submit the form accurately and efficiently. This saves time and reduces errors for political organizations.

-

Is there a cost associated with using airSlate SignNow for Form 1120 POL?

Yes, while airSlate SignNow provides a cost-effective solution for handling the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations, there are various pricing plans available. Our plans cater to different needs and budgets, ensuring that every organization, regardless of size, can find a suitable option to manage their tax forms effectively. Visit our pricing page for more details.

-

What features does airSlate SignNow provide for managing Form 1120 POL?

airSlate SignNow includes a range of features tailored for the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations. Key features include customizable templates, electronic signatures, secure document storage, and real-time collaboration. These tools help streamline the tax preparation process for political organizations.

-

Can I integrate airSlate SignNow with other software for Form 1120 POL?

Yes, airSlate SignNow allows seamless integration with various software applications to manage the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations. By integrating with platforms like CRMs and accounting software, you can enhance your workflow, maintain accuracy, and improve overall efficiency in filing your tax return.

-

What benefits does airSlate SignNow offer for political organizations?

AirSlate SignNow provides numerous benefits for political organizations dealing with the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations. These benefits include enhanced compliance, time-saving processes, and the ability to track document statuses electronically. Organizations can focus on their mission while we take care of their document needs.

-

Is it easy to eSign the Form 1120 POL using airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign the Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations. Our platform is designed for user-friendliness, allowing users to quickly sign documents from any device without unnecessary complications. This ensures your organization can finalize tax forms expediently.

Get more for Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

Find out other Form 1120 POL Fill in Version U S Income Tax Return For Certain Political Organizations

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF