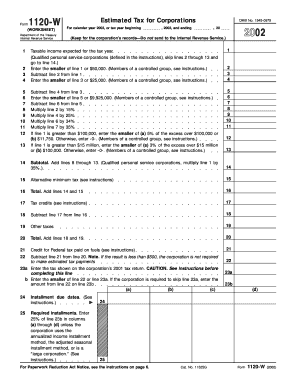

Form 1120 W Fill in Version Estimated Tax for Corporations

What is the Form 1120 W Fill in Version Estimated Tax For Corporations

The Form 1120 W Fill in Version Estimated Tax For Corporations is a tax form used by corporations in the United States to calculate and report their estimated tax payments. This form allows corporations to estimate their tax liabilities for the current tax year, ensuring they meet their payment obligations to the Internal Revenue Service (IRS). By accurately completing this form, corporations can avoid underpayment penalties and manage their cash flow effectively throughout the year.

How to use the Form 1120 W Fill in Version Estimated Tax For Corporations

Using the Form 1120 W Fill in Version involves several steps. First, corporations need to gather their financial information, including income, deductions, and credits. Next, they should follow the instructions provided with the form to calculate their estimated tax liability based on their projected income for the year. After completing the form, corporations can submit it to the IRS along with their estimated tax payments. It is essential to keep a copy for their records and to ensure compliance with IRS regulations.

Steps to complete the Form 1120 W Fill in Version Estimated Tax For Corporations

Completing the Form 1120 W Fill in Version requires careful attention to detail. Here are the general steps involved:

- Gather all necessary financial documents, including income statements and previous tax returns.

- Determine the corporation's expected taxable income for the current year.

- Calculate allowable deductions and credits to arrive at the estimated tax liability.

- Fill out the form accurately, ensuring all calculations are correct.

- Review the completed form for any errors before submission.

- Submit the form to the IRS along with the estimated tax payment.

Filing Deadlines / Important Dates

Corporations must adhere to specific filing deadlines to avoid penalties. The estimated tax payments for the current tax year are typically due on the fifteenth day of April, June, September, and January of the following year. It is crucial for corporations to mark these dates on their calendars to ensure timely submission of Form 1120 W and corresponding payments. Late submissions can result in interest charges and penalties imposed by the IRS.

Required Documents

To complete the Form 1120 W Fill in Version, corporations need several documents. These include:

- Previous year’s tax return for reference.

- Financial statements showing income and expenses.

- Documentation for any deductions or credits being claimed.

- Records of prior estimated tax payments made during the year.

Having these documents on hand will facilitate a smoother and more accurate completion of the form.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 1120 W Fill in Version. Corporations should refer to the IRS instructions accompanying the form for detailed information on eligibility criteria, calculation methods, and submission procedures. Adhering to these guidelines is essential to ensure compliance and avoid potential issues with the IRS.

Quick guide on how to complete form 1120 w fill in version estimated tax for corporations

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS apps and enhance any document-based process today.

How to Edit and eSign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 w fill in version estimated tax for corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 1120 W Fill in Version Estimated Tax For Corporations?

The Form 1120 W Fill in Version Estimated Tax For Corporations is a tax form used by corporations to estimate their tax liabilities for the year. It allows businesses to report projected income and calculate estimated tax payments, ensuring compliance with federal tax regulations.

-

Why should I use the Form 1120 W Fill in Version Estimated Tax For Corporations?

Using the Form 1120 W Fill in Version Estimated Tax For Corporations helps corporations manage their tax obligations efficiently. It simplifies the process of estimating tax payments, reducing the risk of penalties and ensuring that businesses remain compliant with the IRS requirements.

-

What features does airSlate SignNow offer for Form 1120 W Fill in Version Estimated Tax For Corporations?

airSlate SignNow provides features such as eSigning, document tracking, and secure storage for your Form 1120 W Fill in Version Estimated Tax For Corporations. These tools enable businesses to streamline their tax filing processes, making it easier and faster to submit important documents.

-

Is airSlate SignNow cost-effective for filing Form 1120 W Fill in Version Estimated Tax For Corporations?

Yes, airSlate SignNow offers a cost-effective solution for businesses needing to file the Form 1120 W Fill in Version Estimated Tax For Corporations. With competitive pricing plans, companies can choose an option that fits their budget while still accessing robust features that enhance productivity.

-

Can I integrate airSlate SignNow with other accounting software for Form 1120 W Fill in Version Estimated Tax For Corporations?

Absolutely! airSlate SignNow seamlessly integrates with a variety of accounting software, making it easier to manage your Form 1120 W Fill in Version Estimated Tax For Corporations alongside other financial documents. This integration facilitates smoother workflows and improved data accuracy.

-

How does airSlate SignNow ensure the security of my Form 1120 W Fill in Version Estimated Tax For Corporations?

airSlate SignNow employs top-notch security measures, including encryption and secure cloud storage, to protect your Form 1120 W Fill in Version Estimated Tax For Corporations. This ensures that sensitive financial information is safeguarded against unauthorized access.

-

Can I store multiple versions of the Form 1120 W Fill in Version Estimated Tax For Corporations with airSlate SignNow?

Yes, airSlate SignNow allows you to store multiple versions of the Form 1120 W Fill in Version Estimated Tax For Corporations. This feature is particularly useful for businesses that need to keep track of different submissions or modifications made to the tax form over time.

Get more for Form 1120 W Fill in Version Estimated Tax For Corporations

Find out other Form 1120 W Fill in Version Estimated Tax For Corporations

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement