Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

What is the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

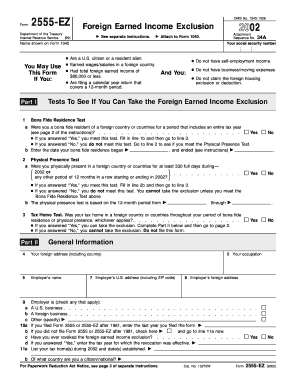

The Form 2555 EZ Fill in Version is a simplified tax form used by U.S. citizens and resident aliens to claim the Foreign Earned Income Exclusion. This exclusion allows eligible taxpayers to exclude a certain amount of their foreign-earned income from U.S. taxation, thereby reducing their overall tax liability. The form is specifically designed for individuals who meet specific criteria, such as living and working outside the United States for a designated period. By using this form, taxpayers can benefit from significant tax savings while complying with U.S. tax laws.

Eligibility Criteria

To qualify for the Foreign Earned Income Exclusion using Form 2555 EZ, taxpayers must meet certain eligibility criteria. First, they must have foreign-earned income, which includes wages, salaries, or professional fees earned while working abroad. Second, they must meet the physical presence test or the bona fide residence test. The physical presence test requires individuals to be physically present in a foreign country for at least 330 full days during a 12-month period. Alternatively, the bona fide residence test applies to those who have established a permanent residence in a foreign country. Meeting these criteria is essential for successfully claiming the exclusion.

Steps to Complete the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

Completing the Form 2555 EZ involves several key steps. Begin by gathering all necessary information, including details about your foreign-earned income and your residency status. Next, fill out the personal information section, which includes your name, address, and Social Security number. Then, report your foreign-earned income in the designated section. Ensure that you accurately calculate the exclusion amount based on the IRS guidelines. After completing the form, review all entries for accuracy before submitting it with your tax return. Following these steps helps ensure a smooth filing process.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with Form 2555 EZ. Typically, U.S. citizens and resident aliens are required to file their tax returns by April 15 each year. However, if you are living abroad, you may qualify for an automatic extension until June 15. If additional time is needed, you can request an extension until October 15. It is important to file the form by the appropriate deadline to avoid penalties and ensure compliance with IRS regulations.

Required Documents

When preparing to file Form 2555 EZ, certain documents are necessary to support your claim for the Foreign Earned Income Exclusion. These documents may include proof of foreign residency, such as a lease agreement or utility bills, and documentation of your foreign-earned income, such as pay stubs or tax statements from your employer. Additionally, any relevant travel records that demonstrate your physical presence in a foreign country may be required. Having these documents readily available can streamline the filing process and help substantiate your exclusion claim.

Form Submission Methods (Online / Mail / In-Person)

Form 2555 EZ can be submitted through various methods, depending on your preference and circumstances. Taxpayers can file the form electronically using tax preparation software that supports IRS forms. This method allows for quicker processing and confirmation of receipt. Alternatively, you can print the completed form and mail it to the appropriate IRS address based on your location. In-person submission is generally not an option for this form, as the IRS does not accept walk-in filings for individual tax returns. Choosing the right submission method can enhance the efficiency of your filing experience.

Quick guide on how to complete form 2555 ez fill in version foreign earned income exclusion

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your files promptly without any hold-ups. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The simplest method to modify and eSign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download to your computer.

No more worrying about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you choose. Alter and eSign [SKS] and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

Create this form in 5 minutes!

How to create an eSignature for the form 2555 ez fill in version foreign earned income exclusion

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

The Form 2555 EZ Fill in Version Foreign Earned Income Exclusion is a simplified tax form designed for U.S. citizens living abroad. It allows you to exclude a specific amount of your foreign earned income from U.S. taxation, making tax filing easier and more efficient for expatriates.

-

How can I fill out the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

You can fill out the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion easily using airSlate SignNow’s user-friendly interface. With guided prompts and automated calculations, the platform ensures accuracy and saves you time in the completion process.

-

What are the benefits of using airSlate SignNow for the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

Using airSlate SignNow to complete the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion streamlines the process, reduces errors, and allows you to eSign documents securely. Additionally, it simplifies document management, ensuring you have all necessary forms at your fingertips.

-

Is there a cost associated with using airSlate SignNow for the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs, starting from a basic plan to more comprehensive options. Each plan provides access to features that facilitate the completion and signing of the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion.

-

Can I integrate airSlate SignNow with other software when working on the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

Absolutely! airSlate SignNow integrates with popular applications such as Google Drive, Dropbox, and CRM systems, allowing you to manage files and forms efficiently. This seamless integration enhances your workflow while working on the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion.

-

What features does airSlate SignNow provide for completing the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

airSlate SignNow offers features such as document templates, real-time collaboration, and secure signing capabilities for the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion. These tools ensure that you can work efficiently and securely with all necessary tax forms.

-

How secure is airSlate SignNow when handling the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and security protocols to protect your data when processing the Form 2555 EZ Fill in Version Foreign Earned Income Exclusion, ensuring your personal and financial information remains confidential.

Get more for Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

Find out other Form 2555 EZ Fill in Version Foreign Earned Income Exclusion

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now