Form 4136 Fill in Version Credit for Federal Tax Paid on Fuels

What is the Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

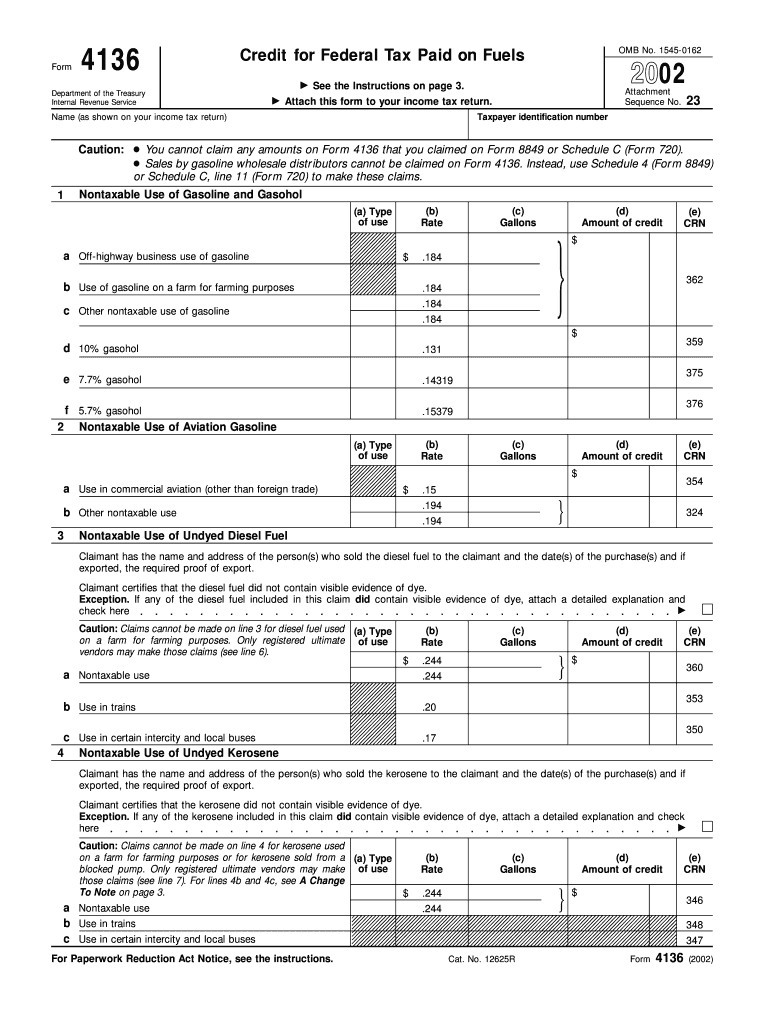

The Form 4136 is a tax form used by taxpayers in the United States to claim a credit for federal tax paid on fuels. This credit is applicable to various types of fuels, including gasoline and diesel, which are used in certain business operations or for specific purposes. The form allows individuals and businesses to recover some of the federal excise taxes that they have paid on these fuels, thereby reducing their overall tax liability. Understanding the purpose of this form is essential for eligible taxpayers seeking to maximize their tax benefits.

How to use the Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

Using the Form 4136 involves several key steps. First, gather all necessary information regarding the fuel purchases made during the tax year. This includes details like the amount of fuel purchased, the type of fuel, and the federal excise tax paid. Next, accurately fill out the form by entering the required information in the designated fields. It is important to ensure that all data is correct to avoid potential issues with the IRS. Once completed, the form can be submitted with your tax return, allowing you to claim the credit for the federal tax paid on fuels.

Steps to complete the Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

Completing the Form 4136 involves a systematic approach:

- Collect documentation of fuel purchases, including receipts and invoices.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Detail the types and amounts of fuel purchased, along with the corresponding federal excise tax paid.

- Calculate the total credit you are eligible for based on the information provided.

- Review the form for accuracy before submission.

Key elements of the Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

Key elements of the Form 4136 include the identification of the taxpayer, details about the fuel types, and the calculation of the credit amount. The form requires specific information such as the total gallons of fuel purchased, the rate of tax paid, and any applicable adjustments. Understanding these elements is crucial, as they directly impact the amount of credit you can claim. Accuracy in reporting these details ensures compliance with IRS regulations and maximizes your potential refund.

Eligibility Criteria

To be eligible for the credit claimed on Form 4136, taxpayers must meet certain criteria. Generally, the credit is available to individuals and businesses that have paid federal excise taxes on fuels used for non-taxable purposes, such as off-highway use or in specific agricultural activities. Additionally, the taxpayer must have the necessary documentation to support their claim, including proof of fuel purchases and the taxes paid. Familiarizing yourself with these eligibility requirements can help ensure that you qualify for the credit.

Filing Deadlines / Important Dates

Filing deadlines for Form 4136 typically align with the annual tax return deadlines. Taxpayers must submit the form along with their tax return, which is usually due on April fifteenth of each year. However, if that date falls on a weekend or holiday, the deadline may be extended to the next business day. It is important to keep track of these dates to ensure timely submission and avoid penalties associated with late filing.

Quick guide on how to complete form 4136 fill in version credit for federal tax paid on fuels

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the right form and store it securely online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and eSign your documents without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Alter and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to confirm your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

Create this form in 5 minutes!

How to create an eSignature for the form 4136 fill in version credit for federal tax paid on fuels

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

The 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels' is a tax form that allows businesses and individuals to claim a credit for federal excise taxes paid on certain fuels. It is essential for those who have used fuels for specific purposes, such as off-road vehicles. Understanding this form can help you maximize your tax credits effectively.

-

How can airSlate SignNow help with the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

airSlate SignNow offers an efficient way to fill out and eSign the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels.' Our platform enables users to create and manage their documents electronically, reducing errors and ensuring compliance. This streamlines the process of claiming your fuel tax credits.

-

Are there any costs associated with using airSlate SignNow for the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

Yes, airSlate SignNow provides various pricing plans based on your business needs. The cost-effective solution includes features tailored for efficiently managing documents like the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels.' You can choose a plan that fits your budget and requirements.

-

What features of airSlate SignNow make it ideal for filing the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

airSlate SignNow provides features such as cloud storage, real-time collaboration, and electronic signatures, which enhance the filing experience for the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels.' These features not only save time but also improve accuracy, ensuring your forms are submitted correctly.

-

Can I integrate airSlate SignNow with other software to manage the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

Absolutely! airSlate SignNow allows integrations with various popular software and applications, enabling you to seamlessly manage the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels' along with your other financial documents. This enhances productivity and streamlines your workflow.

-

What are the benefits of using airSlate SignNow for the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

Using airSlate SignNow to handle the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels' provides numerous benefits, including reduced paperwork, improved compliance, and faster processing times. Our user-friendly interface and features tailored for tax forms make it a preferred choice for businesses.

-

How secure is my data when using airSlate SignNow for the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels'?

Security is a top priority at airSlate SignNow. When using our platform to fill out the 'Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels,' your data is protected by encryption and strict access controls. This ensures that your sensitive tax information remains safe and confidential.

Get more for Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

- Valogram form

- Certified corrections program owner tenant city of chicago cityofchicago form

- Apdcl voluntary load declaration online apply form

- Jackson pollock nomogram form

- Atlanta commercial board forms

- Pop up shop application form ealing news extra

- Stc 211 pdf download form

- Field trip garland isd form

Find out other Form 4136 Fill in Version Credit For Federal Tax Paid On Fuels

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney