Form 4626 Fill in Version Alternative Minimum Tax Corporations

What is the Form 4626?

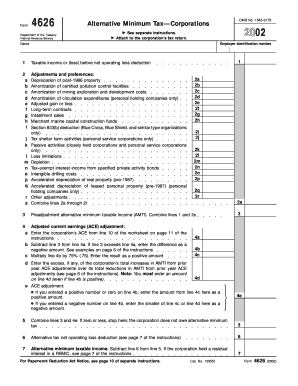

The Form 4626, officially known as the Alternative Minimum Tax - Corporations, is a tax form used by corporations to calculate their alternative minimum tax (AMT) liability. This form is essential for ensuring that corporations pay a minimum amount of tax, regardless of deductions and credits that might otherwise reduce their tax liability. The AMT is designed to prevent high-income earners from using loopholes to avoid paying taxes. Understanding the purpose and function of Form 4626 is crucial for compliance with U.S. tax regulations.

Steps to Complete the Form 4626

Completing Form 4626 requires careful attention to detail. Here are the general steps to follow:

- Gather necessary financial documents, including income statements and prior year tax returns.

- Begin filling out the form by entering your corporation's identifying information, such as name, address, and Employer Identification Number (EIN).

- Calculate the alternative minimum taxable income (AMTI) using the provided instructions, ensuring all adjustments and preferences are accounted for.

- Determine the AMT liability by applying the appropriate tax rate to the AMTI.

- Complete any additional sections required for specific deductions or credits.

- Review the form for accuracy and completeness before submission.

How to Obtain the Form 4626

Form 4626 can be obtained through several means. The most straightforward way is to visit the official IRS website, where the form is available for download in PDF format. Additionally, tax professionals and accounting firms often provide copies of this form as part of their services. It is important to ensure that you are using the most current version of the form, as tax regulations and requirements may change annually.

Key Elements of the Form 4626

Understanding the key elements of Form 4626 is vital for accurate completion. The form includes sections for:

- Corporate identification information

- Calculation of alternative minimum taxable income

- Adjustments and preferences that affect AMTI

- Tax computation and credits

- Signature and date lines for corporate officers

Familiarity with these elements ensures that corporations can effectively navigate the form and comply with tax obligations.

Filing Deadlines / Important Dates

Corporations must be aware of specific filing deadlines related to Form 4626. Typically, the form is due on the same date as the corporation's income tax return, which is generally the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the deadline is April 15. It is crucial to file on time to avoid penalties and interest on unpaid taxes.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting Form 4626. These guidelines include detailed instructions on how to calculate alternative minimum taxable income, what adjustments to make, and how to report any credits. It is advisable for corporations to refer to the IRS instructions for the most accurate and up-to-date information, as these guidelines can change from year to year based on tax law revisions.

Quick guide on how to complete form 4626 fill in version alternative minimum tax corporations

Complete Form 4626 Fill in Version Alternative Minimum Tax Corporations effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Form 4626 Fill in Version Alternative Minimum Tax Corporations on any platform with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Form 4626 Fill in Version Alternative Minimum Tax Corporations without difficulty

- Locate Form 4626 Fill in Version Alternative Minimum Tax Corporations and click on Get Form to commence.

- Use the tools available to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, SMS, or invite link, or download it to your computer.

Erase concerns about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 4626 Fill in Version Alternative Minimum Tax Corporations and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4626 fill in version alternative minimum tax corporations

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 4626?

Form 4626 is a tax form used for claiming the investment credit for businesses. It allows eligible businesses to document their qualifying investments, ensuring they can accurately report and benefit from applicable tax credits.

-

How can airSlate SignNow help with Form 4626?

airSlate SignNow provides tools to seamlessly create, send, and eSign Form 4626 documentation. With its intuitive interface, you can efficiently handle multiple signatures and keep track of your tax forms, including Form 4626, in one secure place.

-

Is there a cost associated with using airSlate SignNow for Form 4626?

Yes, airSlate SignNow offers various pricing plans, ensuring that you find a solution that fits your budget. Regardless of the plan you choose, you will gain access to features that facilitate the completion and signing of Form 4626 and other documents.

-

What features does airSlate SignNow provide for managing Form 4626?

With airSlate SignNow, you benefit from features like customizable templates, automated reminders, and secure storage, all tailored to assist with Form 4626 management. These tools simplify the eSigning process and help you maintain compliance effortlessly.

-

Can I track the status of Form 4626 submissions in airSlate SignNow?

Absolutely! airSlate SignNow offers real-time tracking for all sent documents, including Form 4626. This feature allows you to monitor who has signed, who still needs to sign, and any potential delays in the process.

-

Does airSlate SignNow integrate with other software for Form 4626 filing?

Yes, airSlate SignNow integrates with many popular software solutions, making it easier to manage your Form 4626 and other document needs. This ensures that your workflow remains efficient by connecting with tools you already use.

-

What are the benefits of using airSlate SignNow for Form 4626?

Using airSlate SignNow for Form 4626 offers numerous benefits including streamlined document handling, enhanced security, and user-friendly features. These advantages lead to signNow time savings, allowing businesses to focus more on their core operations.

Get more for Form 4626 Fill in Version Alternative Minimum Tax Corporations

Find out other Form 4626 Fill in Version Alternative Minimum Tax Corporations

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors