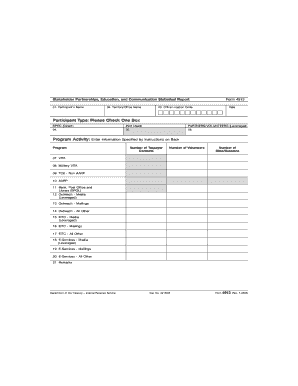

Form 4913 Rev July Fill in Version

What is the Form 4913 Rev July Fill In Version

The Form 4913 Rev July Fill In Version is a specific document used for various administrative purposes, particularly in tax-related contexts. This form is designed to collect essential information from individuals or businesses, ensuring compliance with federal regulations. It often serves as a means for reporting, applying for benefits, or submitting necessary documentation to the relevant authorities.

How to use the Form 4913 Rev July Fill In Version

Using the Form 4913 Rev July Fill In Version involves several straightforward steps. First, ensure you have the most current version of the form, which is available for download. Next, fill in the required fields with accurate information, paying close attention to any specific instructions provided within the form. After completing the form, you can submit it via the designated method, whether that be electronically or through traditional mail.

Steps to complete the Form 4913 Rev July Fill In Version

Completing the Form 4913 Rev July Fill In Version requires careful attention to detail. Follow these steps for a successful submission:

- Download the form from a reliable source.

- Review any instructions that accompany the form.

- Fill in personal or business information as required.

- Double-check all entries for accuracy.

- Sign and date the form where indicated.

- Submit the form according to the specified submission guidelines.

Key elements of the Form 4913 Rev July Fill In Version

The Form 4913 Rev July Fill In Version contains several key elements that are crucial for its validity. These elements include:

- Identification Information: This includes names, addresses, and identification numbers pertinent to the individual or business.

- Purpose of the Form: A clear statement of why the form is being submitted.

- Signature Section: A designated area for the signer to affirm the accuracy of the information provided.

- Date of Submission: This helps in tracking the timeline of the submission process.

Legal use of the Form 4913 Rev July Fill In Version

The legal use of the Form 4913 Rev July Fill In Version is essential for ensuring compliance with applicable laws and regulations. This form may be required for specific legal proceedings, tax filings, or other formal processes. It is important to use the form correctly and to keep a copy for your records, as it may serve as a legal document in case of audits or disputes.

Form Submission Methods

The Form 4913 Rev July Fill In Version can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online Submission: Many forms can be submitted electronically through official platforms.

- Mail: Physical copies of the form can be sent to the appropriate address.

- In-Person Submission: Some situations may allow for direct delivery to a designated office.

Quick guide on how to complete form 4913 rev july fill in version

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained signNow traction among companies and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to swiftly create, edit, and electronically sign your documents without delays. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to Easily Modify and eSign [SKS]

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using specialized tools provided by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4913 Rev July Fill In Version

Create this form in 5 minutes!

How to create an eSignature for the form 4913 rev july fill in version

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4913 Rev July Fill In Version?

The Form 4913 Rev July Fill In Version is a customizable document that allows users to fill in required fields electronically. This version simplifies data entry and enhances accessibility for businesses needing to submit the form efficiently.

-

How does airSlate SignNow facilitate the use of Form 4913 Rev July Fill In Version?

airSlate SignNow offers an intuitive platform for using the Form 4913 Rev July Fill In Version, enabling users to fill out and sign documents online. It enhances the user experience by providing a seamless process from form completion to eSignature.

-

Is there a cost associated with using the Form 4913 Rev July Fill In Version on airSlate SignNow?

Using the Form 4913 Rev July Fill In Version through airSlate SignNow is part of our cost-effective solution plans. Pricing varies depending on the features and the number of users, ensuring that businesses can choose the best option for their needs.

-

What features are included with the Form 4913 Rev July Fill In Version?

The Form 4913 Rev July Fill In Version in airSlate SignNow includes features such as customizable templates, eSigning capabilities, and collaboration tools. These features help streamline document management and improve workflow efficiency.

-

Can I integrate the Form 4913 Rev July Fill In Version with other applications?

Yes, airSlate SignNow allows for seamless integration of the Form 4913 Rev July Fill In Version with various applications like Google Drive, Salesforce, and more. This ensures that your document workflows are connected with the tools you already use.

-

What are the benefits of using airSlate SignNow for Form 4913 Rev July Fill In Version?

Using airSlate SignNow for the Form 4913 Rev July Fill In Version offers numerous benefits, including time savings, improved accuracy, and enhanced security. The platform's user-friendly interface ensures that even those unfamiliar with digital documentation can easily navigate the process.

-

Are there any mobile options for accessing the Form 4913 Rev July Fill In Version?

Yes, airSlate SignNow provides mobile compatibility for the Form 4913 Rev July Fill In Version, allowing users to access and complete forms on-the-go. This flexibility ensures that you can manage your documentation from anywhere, at any time.

Get more for Form 4913 Rev July Fill In Version

- Contrato servicios profesionales puerto rico form

- Assurance questionnaire form

- Mood tracker downloadable mood chart for bipolar disorder download this mood tracker to help keep your doctor informed of your

- Formulario para id california

- Addc application for connection e services form

- Ccg 0106 form

- Cape form 15828585

- City of deltona permit search form

Find out other Form 4913 Rev July Fill In Version

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online