Form 6069 Rev August Fill in Version Return of Excise Tax on Excess Contributions to Black Lung Benefit Trust under Section 4953

Understanding Form 6069 Rev August Fill in Version

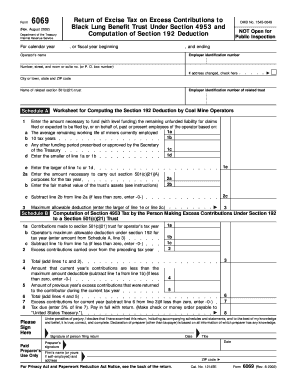

The Form 6069 Rev August is a crucial document for reporting excise tax on excess contributions to the Black Lung Benefit Trust under Section 4953. This form is designed for organizations that have made contributions exceeding the allowable limits. It also includes a computation of the Section 192 deduction, which is vital for ensuring compliance with tax regulations. Understanding the purpose and requirements of this form is essential for accurate reporting and avoiding penalties.

Steps to Complete Form 6069 Rev August

Completing the Form 6069 Rev August involves several key steps:

- Gather Required Information: Collect details about contributions made to the Black Lung Benefit Trust, including amounts and dates.

- Calculate Excess Contributions: Determine any contributions that exceed the limits set by the IRS.

- Complete the Form: Fill in the necessary fields, ensuring accuracy in all calculations.

- Review for Accuracy: Double-check all entries to prevent errors that could lead to penalties.

- Submit the Form: Follow the appropriate submission method, whether online or via mail.

Obtaining Form 6069 Rev August

The Form 6069 Rev August can be obtained from the IRS website or through authorized tax professionals. It is important to ensure you have the most current version of the form to comply with the latest tax regulations. Keeping a copy of the form for your records is advisable after completion.

Legal Use of Form 6069 Rev August

This form is legally required for organizations that have made excess contributions to the Black Lung Benefit Trust. Failing to file the form or filing it incorrectly can result in penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is crucial for compliance and financial integrity.

Key Elements of Form 6069 Rev August

Key elements of the Form 6069 Rev August include:

- Identification Information: Details about the organization filing the form.

- Contribution Amounts: Total contributions made to the Black Lung Benefit Trust.

- Excess Contribution Calculation: A section to calculate any contributions that exceed the allowable limits.

- Section 192 Deduction Computation: Information related to the deduction for contributions.

Filing Deadlines for Form 6069 Rev August

It is essential to be aware of the filing deadlines for the Form 6069 Rev August to avoid penalties. Typically, this form must be filed by the due date of the organization’s tax return. Keeping track of these deadlines ensures compliance and helps maintain good standing with the IRS.

Quick guide on how to complete form 6069 rev august fill in version return of excise tax on excess contributions to black lung benefit trust under section

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or anonymize sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or mislaid documents, tedious form hunts, or mistakes that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 6069 rev august fill in version return of excise tax on excess contributions to black lung benefit trust under section

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction?

The Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction is a tax form used to report excess contributions to the black lung benefit trust. This form is crucial for ensuring compliance with IRS regulations and calculating any potential deductions under Section 192.

-

How can airSlate SignNow help with the Form 6069 Rev August Fill in Version?

AirSlate SignNow streamlines the process of filling out and submitting the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction. Our platform allows you to easily eSign and send documents securely, ensuring that your submissions are accurate and timely.

-

What are the pricing options for using airSlate SignNow for my Form 6069 Rev August Fill in Version needs?

AirSlate SignNow offers several pricing plans tailored to meet various business needs. Depending on your requirements for processing the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction, you can choose from monthly or annual subscription models that suit your budget.

-

What features does airSlate SignNow offer for managing forms like the Form 6069 Rev August Fill in Version?

AirSlate SignNow provides a range of features such as customizable templates, document tracking, and cloud storage that can assist you in managing the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction. These tools enhance efficiency and make it easier for businesses to handle important tax documents.

-

Are there any integrations available with airSlate SignNow for handling the Form 6069 Rev August Fill in Version?

Yes, airSlate SignNow integrates seamlessly with various business applications such as CRM systems, cloud storage services, and productivity tools. This enables users to manage the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction more efficiently within their existing workflows.

-

How secure is airSlate SignNow for sending the Form 6069 Rev August Fill in Version?

Security is a top priority at airSlate SignNow, especially for sensitive documents like the Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction. Our platform uses advanced encryption and compliance measures to ensure that your documents are protected throughout the signing and submission process.

-

Can I track the status of my Form 6069 Rev August Fill in Version once sent through airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking options that allow you to monitor the status of your Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953 And Computation Of Section 192 Deduction. You will receive notifications when the document is viewed and signed, keeping you informed throughout the process.

Get more for Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953

Find out other Form 6069 Rev August Fill in Version Return Of Excise Tax On Excess Contributions To Black Lung Benefit Trust Under Section 4953

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe

- Sign Hawaii Notice of Rescission Later

- Sign Missouri Demand Note Online

- How To Sign New York Notice to Stop Credit Charge

- How Do I Sign North Dakota Notice to Stop Credit Charge

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple