IRA Distribution Form AdvisorFlex 2017

What is the IRA Distribution Form AdvisorFlex

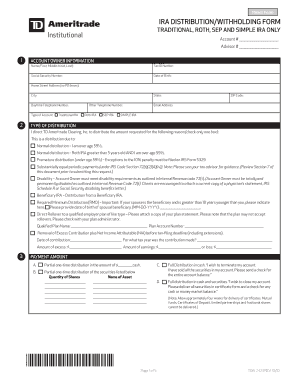

The IRA Distribution Form AdvisorFlex is a crucial document used by individuals to request distributions from their Individual Retirement Accounts (IRAs). This form allows account holders to specify the amount and type of distribution they wish to receive, whether as a lump sum or periodic payments. It is essential for ensuring that distributions comply with IRS regulations and for maintaining accurate records for tax purposes. Understanding the purpose and requirements of this form is vital for anyone considering taking funds from their retirement savings.

How to use the IRA Distribution Form AdvisorFlex

Using the IRA Distribution Form AdvisorFlex involves several straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from your financial institution or advisor. Next, fill out your personal information, including your name, account number, and contact details. Specify the type of distribution you are requesting and the amount. It is also important to indicate your preferred payment method, whether by check or direct deposit. After completing the form, review it for accuracy before submitting it to your IRA custodian for processing.

Steps to complete the IRA Distribution Form AdvisorFlex

Completing the IRA Distribution Form AdvisorFlex requires attention to detail. Follow these steps:

- Obtain the form from your financial institution or advisor.

- Fill in your personal information accurately, including your full name and account number.

- Indicate the type of distribution you are requesting, such as a one-time withdrawal or recurring payments.

- Specify the amount of money you wish to withdraw from your IRA.

- Select your preferred payment method, ensuring you provide the necessary banking details if opting for direct deposit.

- Review the completed form for any errors or omissions.

- Submit the form to your IRA custodian via the preferred method, which may include online submission, mailing, or in-person delivery.

Key elements of the IRA Distribution Form AdvisorFlex

The IRA Distribution Form AdvisorFlex includes several key elements that are essential for processing your request. These elements typically include:

- Account Holder Information: Name, address, and contact details.

- Account Number: The unique identifier for your IRA.

- Distribution Type: Options for lump-sum or periodic distributions.

- Amount Requested: The specific dollar amount you wish to withdraw.

- Payment Method: Choices between check or direct deposit.

- Signature: Required to authorize the distribution request.

Legal use of the IRA Distribution Form AdvisorFlex

The IRA Distribution Form AdvisorFlex is legally binding and must be completed accurately to ensure compliance with IRS regulations. Proper use of this form helps avoid penalties associated with premature withdrawals and ensures that distributions are processed correctly. It is important to be aware of the tax implications of IRA distributions, as they may affect your overall tax liability. Consulting with a financial advisor or tax professional can provide guidance on the legal aspects of using this form.

Form Submission Methods

Once the IRA Distribution Form AdvisorFlex is completed, it can be submitted through various methods, depending on the policies of your financial institution. Common submission methods include:

- Online Submission: Many institutions allow you to upload the completed form through their secure online portal.

- Mail: You can send the form via postal service to the address specified by your IRA custodian.

- In-Person: Some institutions may allow you to submit the form directly at a local branch.

Create this form in 5 minutes or less

Find and fill out the correct ira distribution form advisorflex

Create this form in 5 minutes!

How to create an eSignature for the ira distribution form advisorflex

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRA Distribution Form AdvisorFlex?

The IRA Distribution Form AdvisorFlex is a digital document designed to facilitate the distribution process of IRA funds. It simplifies the submission of withdrawal requests, ensuring compliance with IRS regulations. By using this form, advisors can streamline their clients' distribution processes efficiently.

-

How does the IRA Distribution Form AdvisorFlex benefit financial advisors?

The IRA Distribution Form AdvisorFlex provides financial advisors with a user-friendly tool to manage client distributions effectively. It reduces paperwork and minimizes errors, allowing advisors to focus on providing better service. Additionally, it enhances client satisfaction by speeding up the distribution process.

-

Is there a cost associated with using the IRA Distribution Form AdvisorFlex?

Yes, there may be a cost associated with using the IRA Distribution Form AdvisorFlex, depending on the subscription plan chosen. airSlate SignNow offers various pricing tiers to accommodate different business needs. It's advisable to review the pricing details on our website for the most accurate information.

-

Can the IRA Distribution Form AdvisorFlex be integrated with other software?

Absolutely! The IRA Distribution Form AdvisorFlex can be seamlessly integrated with various CRM and financial management software. This integration allows for a more streamlined workflow, enabling advisors to manage client documents and distributions in one place.

-

What features does the IRA Distribution Form AdvisorFlex offer?

The IRA Distribution Form AdvisorFlex includes features such as eSigning, document tracking, and customizable templates. These features enhance the user experience by making the distribution process faster and more efficient. Additionally, it ensures that all documents are securely stored and easily accessible.

-

How secure is the IRA Distribution Form AdvisorFlex?

The IRA Distribution Form AdvisorFlex is designed with security in mind, utilizing advanced encryption and secure cloud storage. This ensures that sensitive client information remains protected throughout the distribution process. Compliance with industry standards further enhances the security of your documents.

-

Can clients fill out the IRA Distribution Form AdvisorFlex online?

Yes, clients can easily fill out the IRA Distribution Form AdvisorFlex online. The form is designed to be user-friendly, allowing clients to complete it from any device. This convenience helps to expedite the distribution process and reduces the need for physical paperwork.

Get more for IRA Distribution Form AdvisorFlex

- Electrical permit application state of rhode island ribcc ri form

- Form medi cal point of service pos networkinternet agreement dhcs ca

- Asiana airlines mileage redemption form

- Far bar licensee disclosure of personal intrest in property form

- Formu 340891237

- Form it 203 nonresident and part year resident it203 tax ny

- Temporary use permit tup application application for temporary use permit in austin texas form

- Bloodborne pathogens and standard precautions hcpro form

Find out other IRA Distribution Form AdvisorFlex

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure