Form 6252 Fill in Version Installment Sale Income

What is the Form 6252 Fill in Version Installment Sale Income

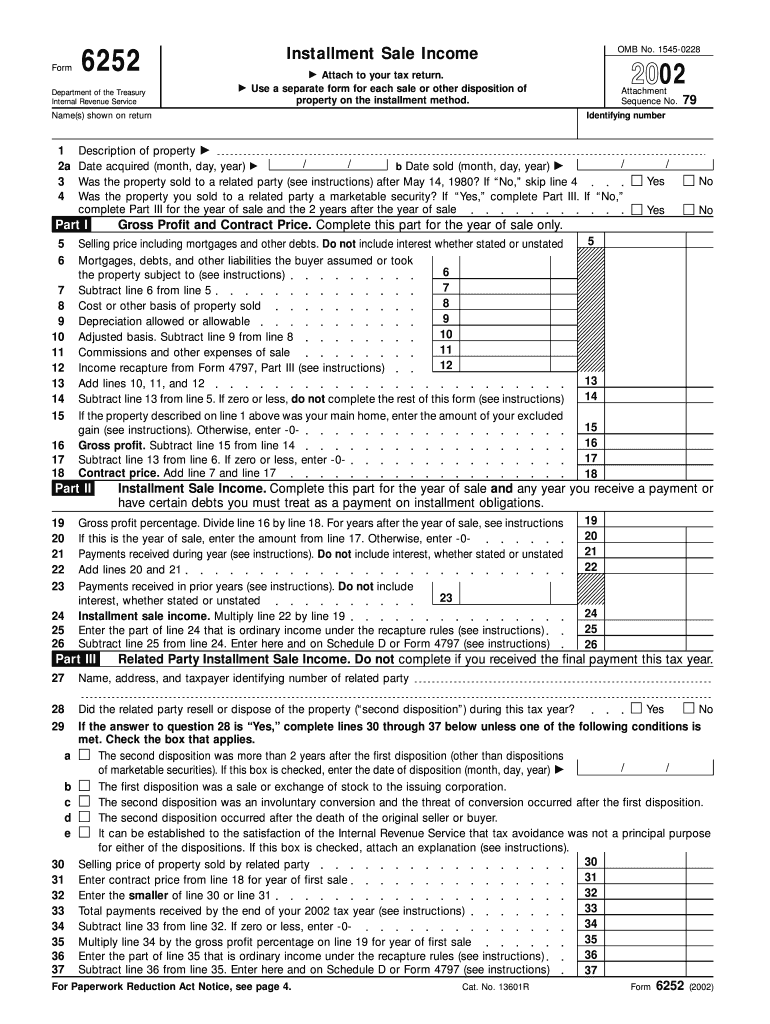

The Form 6252, known as the Installment Sale Income form, is used by taxpayers in the United States to report income from the sale of property when payments are received over time. This form is particularly relevant for transactions involving real estate or other assets sold through installment agreements. The key purpose of Form 6252 is to ensure that taxpayers accurately report the income they receive in the year it is earned, rather than when the sale is finalized. This method of reporting aligns with the IRS guidelines on installment sales, allowing for a more manageable tax burden over multiple years.

How to use the Form 6252 Fill in Version Installment Sale Income

Using the Form 6252 involves several steps to ensure accurate reporting of installment sale income. Taxpayers must first gather relevant information about the sale, including the total sales price, the amount received in the current tax year, and the adjusted basis of the property sold. Once this information is collected, the form can be filled out by entering the required data in the appropriate sections. It is important to follow the IRS instructions carefully to avoid errors that could lead to penalties or delays in processing. After completing the form, it should be included with the taxpayer's annual tax return.

Steps to complete the Form 6252 Fill in Version Installment Sale Income

Completing Form 6252 involves a series of steps that ensure all necessary information is accurately reported. The process typically includes:

- Step 1: Gather information about the sale, including the sale price and payment details.

- Step 2: Calculate the gross profit from the sale by subtracting the adjusted basis from the total sales price.

- Step 3: Determine the amount of income to report for the current year based on the payments received.

- Step 4: Fill out each section of the form, ensuring all calculations are correct.

- Step 5: Review the completed form for accuracy and attach it to your tax return.

Key elements of the Form 6252 Fill in Version Installment Sale Income

Several key elements are essential when filling out Form 6252. These include:

- Sales Price: The total amount for which the property was sold.

- Adjusted Basis: The original cost of the property, adjusted for improvements and depreciation.

- Payments Received: The amount of cash or property received during the tax year.

- Gross Profit Percentage: This is calculated to determine the portion of each payment that is taxable income.

Legal use of the Form 6252 Fill in Version Installment Sale Income

The legal use of Form 6252 is governed by IRS regulations regarding installment sales. Taxpayers must use this form to report income from sales that qualify under the installment method, which allows for tax deferral until payments are received. Accurate completion of Form 6252 is crucial, as failure to report income correctly can result in penalties or audits. It is advisable for taxpayers to consult with a tax professional if they have questions about their specific situation or the legal implications of their installment sales.

Filing Deadlines / Important Dates

Filing deadlines for Form 6252 align with the annual tax return deadlines. Typically, individual taxpayers must file their returns by April 15 of the following year. If additional time is needed, taxpayers can request an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. It is important to keep track of any changes in tax law that may affect these dates.

Quick guide on how to complete form 6252 fill in version installment sale income

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the right format and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly and without hassle. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and electronically sign [SKS] with ease

- Find [SKS] and click on Get Form to commence.

- Utilize the available tools to complete your form.

- Highlight important sections of your documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure outstanding communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 6252 Fill in Version Installment Sale Income

Create this form in 5 minutes!

How to create an eSignature for the form 6252 fill in version installment sale income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 6252 Fill in Version Installment Sale Income?

Form 6252 Fill in Version Installment Sale Income is a tax form used to report income from an installment sale of property. This form enables sellers to report their income over the period they receive payments, which can provide tax benefits. Using airSlate SignNow simplifies the process of filling and eSigning this form securely and efficiently.

-

How can airSlate SignNow help with Form 6252 Fill in Version Installment Sale Income?

airSlate SignNow offers intuitive tools to complete and eSign Form 6252 Fill in Version Installment Sale Income electronically. The platform streamlines the data entry process, ensuring accuracy while allowing for remote collaboration. This means you can complete your tax forms quickly and get them filed on time.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides flexible pricing plans designed to meet the needs of various users. You can choose from monthly or annual subscriptions, with different tiers offering expanded features. Whether you need basic eSigning or advanced toolsets for managing forms like Form 6252 Fill in Version Installment Sale Income, there's a plan that fits your budget.

-

Is airSlate SignNow secure for handling sensitive information?

Yes, airSlate SignNow prioritizes security by implementing advanced encryption protocols to safeguard sensitive information, including data from Form 6252 Fill in Version Installment Sale Income. The platform is compliant with industry standards to protect your documents and personal information, ensuring peace of mind as you eSign your forms.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow efficiency. Whether you’re managing customer relations or accounting, connecting with platforms like CRM systems or cloud storage can simplify handling forms, including Form 6252 Fill in Version Installment Sale Income.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a robust suite of features for efficient document management, including customizable templates, real-time tracking, and automated reminders. These features are particularly beneficial when handling forms like Form 6252 Fill in Version Installment Sale Income, as they help streamline the completion and signing process.

-

How user-friendly is airSlate SignNow for beginners?

airSlate SignNow is designed to be user-friendly, even for those new to digital document management. The platform’s intuitive interface makes it easy to navigate, fill out, and eSign forms like Form 6252 Fill in Version Installment Sale Income without requiring extensive training.

Get more for Form 6252 Fill in Version Installment Sale Income

- Trust deed sample pakistan form

- Sample job application rphsbusinessorg form

- Quicklink to expense reimbursement form stjoronk

- Aktiebok mall gratis form

- Modified july government of pakistan planning commission pc1 form social sectors 1 name of the project strengthening of

- Electrical hours verification form 100072122

- 5th grade language arts form

- 5th grade possessing the land answer key form

Find out other Form 6252 Fill in Version Installment Sale Income

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile