Form 8736 Rev October Fill in Version Application for Automatic Extension of Time to File U S Return for a Partnership, REMIC, O

Understanding Form 8736 Rev October Fill in Version

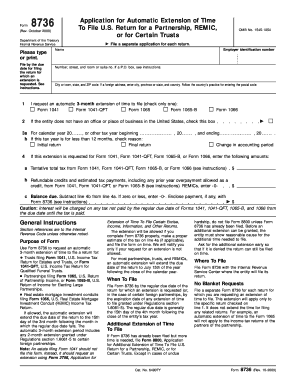

The Form 8736 Rev October is an application designed for partnerships, Real Estate Mortgage Investment Conduits (REMICs), and certain trusts seeking an automatic extension of time to file their U.S. tax returns. This form is essential for entities that require additional time to prepare their tax documents, ensuring compliance with IRS regulations while avoiding penalties for late filing.

How to Use Form 8736 Rev October

To use Form 8736 Rev October effectively, entities must complete the form accurately and submit it to the IRS by the specified deadline. The form requires basic information about the entity, including its name, address, and taxpayer identification number. After filling out the form, it can be submitted electronically or via mail, depending on the preference of the entity and the guidelines provided by the IRS.

Steps to Complete Form 8736 Rev October

Completing Form 8736 Rev October involves several key steps:

- Gather necessary information, including the entity's name, address, and taxpayer identification number.

- Fill in the required fields on the form, ensuring accuracy to avoid delays.

- Review the form for completeness and correctness.

- Submit the form electronically or by mail to the appropriate IRS address.

Key Elements of Form 8736 Rev October

The key elements of Form 8736 Rev October include:

- Entity Information: Basic details about the partnership, REMIC, or trust.

- Taxpayer Identification Number: Required for identification and processing.

- Signature: Must be signed by an authorized representative of the entity.

- Filing Period: Indicate the tax year for which the extension is requested.

Filing Deadlines for Form 8736 Rev October

It is crucial to be aware of the filing deadlines associated with Form 8736 Rev October. Generally, the form must be submitted by the original due date of the tax return for which the extension is requested. Missing this deadline can result in penalties and interest on any taxes owed.

IRS Guidelines for Form 8736 Rev October

The IRS provides specific guidelines for completing and submitting Form 8736 Rev October. These guidelines include instructions on eligibility, required information, and submission methods. It is important to follow these guidelines closely to ensure compliance and avoid issues with the IRS.

Quick guide on how to complete form 8736 rev october fill in version application for automatic extension of time to file u s return for a partnership remic or

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without any delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

How to Modify and Electronically Sign [SKS] with Ease

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using the tools that airSlate SignNow offers for that purpose.

- Generate your electronic signature with the Sign feature, which only takes a few seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8736 Rev October Fill in Version Application For Automatic Extension Of Time To File U S Return For A Partnership, REMIC, O

Create this form in 5 minutes!

How to create an eSignature for the form 8736 rev october fill in version application for automatic extension of time to file u s return for a partnership remic or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 8736 Rev October Fill in Version Application For Automatic Extension Of Time To File U S Return For A Partnership, REMIC, Or For Certain Trusts?

The Form 8736 Rev October Fill in Version Application For Automatic Extension Of Time To File U S Return For A Partnership, REMIC, Or For Certain Trusts is a crucial document that allows partnerships, REMICs, and certain trusts to apply for an automatic extension to file their U.S. tax returns. This form enables organizations to avoid penalties associated with late filing, ensuring compliance with IRS regulations while allowing extra time to prepare documents.

-

How can I fill out the Form 8736 Rev October Fill in Version using airSlate SignNow?

Filling out the Form 8736 Rev October Fill in Version using airSlate SignNow is straightforward. You can easily upload the form, fill in the necessary fields online, and eSign it securely. Our platform's user-friendly interface ensures that you can complete and submit your application efficiently.

-

What are the pricing options for using airSlate SignNow to submit the Form 8736 Rev October Fill in Version?

airSlate SignNow offers several pricing options tailored for businesses of all sizes. You can choose from a monthly or annual subscription, which allows you unlimited access to eSigning and document management features, specifically for forms like the Form 8736 Rev October Fill in Version. Visit our pricing page for more details and to find the best plan for your needs.

-

What features does airSlate SignNow offer for the Form 8736 Rev October Fill in Version?

airSlate SignNow provides several powerful features for the Form 8736 Rev October Fill in Version, including customizable templates, secure eSigning, and automatic reminders. With real-time tracking and notifications, users can stay informed throughout the document's lifecycle, ensuring that deadlines are met promptly.

-

Are there integration options with other apps for managing the Form 8736 Rev October Fill in Version?

Yes, airSlate SignNow supports numerous integrations with popular applications, enabling seamless management of the Form 8736 Rev October Fill in Version. You can connect with CRMs, cloud storage solutions, and workflow platforms, enhancing productivity through streamlined document processes.

-

What benefits do I gain from using airSlate SignNow for the Form 8736 Rev October Fill in Version?

Using airSlate SignNow for the Form 8736 Rev October Fill in Version provides signNow benefits, including enhanced efficiency, reduced paperwork, and improved accuracy. The platform's intuitive design helps you complete and sign forms quickly, while secure cloud storage ensures your documents are safe and accessible.

-

Can I track the status of my Form 8736 Rev October Fill in Version application when using airSlate SignNow?

Absolutely! With airSlate SignNow, you can track the status of your Form 8736 Rev October Fill in Version application in real-time. Our platform provides notifications and tracking tools, so you are always aware of who has signed and at what stage your document is in the process.

Get more for Form 8736 Rev October Fill in Version Application For Automatic Extension Of Time To File U S Return For A Partnership, REMIC, O

- Printable renewal application for naeyc form

- Illinois form hearing

- Nc uniform application

- Nikah nama form in bangla

- Yii 11 application development cookbook form

- Sba form 1031 portfolio financing report 2007

- City of chicago finance form

- Texas motor vehicle seller financed sales tax andor surcharge report form

Find out other Form 8736 Rev October Fill in Version Application For Automatic Extension Of Time To File U S Return For A Partnership, REMIC, O

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors