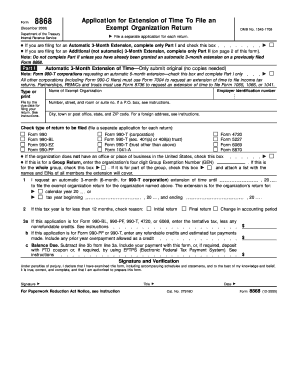

Form 8868 Rev December Fill in Version Application for Extension of Time to File an Exempt Organization Return

What is the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

The Form 8868 Rev December is an official document used by exempt organizations in the United States to request an extension of time to file their annual returns. This form is essential for organizations that need additional time beyond the standard filing deadline to prepare their returns accurately. By submitting this application, organizations can avoid penalties associated with late filings, ensuring compliance with IRS regulations. The form is specifically designed for tax-exempt entities, including charities and non-profit organizations, allowing them to maintain their tax-exempt status while managing their filing obligations.

How to use the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

To use the Form 8868 Rev December, organizations must first ensure they meet the eligibility criteria for requesting an extension. The form can be completed electronically or on paper. When filling out the form, organizations should provide accurate information, including their name, address, and Employer Identification Number (EIN). It is important to indicate the type of return for which the extension is being requested. After completing the form, organizations should submit it to the IRS by the original due date of their return to ensure the extension is granted. This proactive approach helps avoid late filing penalties.

Steps to complete the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

Completing the Form 8868 Rev December involves several key steps:

- Gather necessary information, including your organization’s name, address, and EIN.

- Indicate the type of return you are requesting an extension for, ensuring that the information matches your previous filings.

- Fill out the form accurately, checking for any errors that could delay processing.

- Sign and date the form, ensuring that the signature is from an authorized individual within the organization.

- Submit the form to the IRS by the original due date of your return, either electronically or by mail.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with Form 8868 is crucial for exempt organizations. The form must be submitted by the original due date of the return for which the extension is being requested. Typically, this is the fifteenth day of the fifth month after the end of the organization’s tax year. For example, if an organization operates on a calendar year basis, the deadline would be May 15. Organizations should also be aware that an automatic extension of six months is granted upon timely submission of Form 8868, allowing additional time to file the necessary returns.

Legal use of the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

The legal use of Form 8868 Rev December is governed by IRS regulations. Organizations must ensure they are eligible for an extension and that they adhere to the guidelines set forth by the IRS. Filing the form correctly and on time is essential to avoid penalties. Organizations should keep a copy of the submitted form for their records, as it serves as proof of the extension request. It is important to note that while the form provides an extension for filing, it does not extend the time to pay any taxes owed, if applicable.

Required Documents

When completing the Form 8868 Rev December, organizations should have the following documents ready:

- The most recent tax return filed by the organization.

- Any prior correspondence with the IRS regarding the organization’s tax status.

- Details of any changes in the organization’s structure or operations that may affect its tax-exempt status.

- Documentation of any payments made towards taxes, if applicable.

Quick guide on how to complete form 8868 rev december fill in version application for extension of time to file an exempt organization return

Fulfill [SKS] effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, since you can easily access the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage [SKS] on any operating system with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Retrieve Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or conceal sensitive data using tools that airSlate SignNow specifically provides for this purpose.

- Generate your signature with the Sign feature, which takes a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Finished button to finalize your edits.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require you to print new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Alter and eSign [SKS] and ensure excellent communication at every stage of the form development process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

Create this form in 5 minutes!

How to create an eSignature for the form 8868 rev december fill in version application for extension of time to file an exempt organization return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return?

Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return is a tax form that non-profit organizations use to request an extension of time to file their annual return. This form allows organizations additional time to prepare their documents while remaining compliant with IRS regulations.

-

How can airSlate SignNow help with filing Form 8868?

airSlate SignNow streamlines the process of completing and eSigning the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return. With our intuitive platform, you can easily fill out the required information, add electronic signatures, and securely share the form with relevant parties.

-

Is there a cost associated with using airSlate SignNow for Form 8868?

Yes, airSlate SignNow offers various pricing plans to suit different organizational needs, including options that cater specifically to users needing to file Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return. Our plans are designed to provide cost-effective solutions while ensuring you have all necessary features for smooth document management.

-

What features does airSlate SignNow offer for eSigning Form 8868?

With airSlate SignNow, you gain access to features such as customizable templates, automated reminders, and real-time tracking when eSigning Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return. These features enhance efficiency and ensure that your filing process is timely and compliant.

-

Can I integrate airSlate SignNow with other tools for filing Form 8868?

Yes, airSlate SignNow supports various integrations with popular tools that can enhance your workflow when filing the Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return. This includes integrations with platforms like Dropbox, Google Drive, and various CRM systems, making it easy to manage your documents.

-

What are the benefits of using airSlate SignNow for non-profits seeking to file Form 8868?

Using airSlate SignNow offers numerous benefits for non-profits filing Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return, including simplified document management and enhanced collaboration. Our platform ensures a secure and efficient way to eSign and submit your necessary filings without hassle.

-

Is it easy to use airSlate SignNow for first-time users filing Form 8868?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for first-time users working on Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return. Our step-by-step guides and customer support ensure that you have all the help you need to complete your filings confidently.

Get more for Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

Find out other Form 8868 Rev December Fill in Version Application For Extension Of Time To File An Exempt Organization Return

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile