Form 8882 Fill in Version Credit for Employer Provided Child Care Facilities and Services

Understanding Form 8882: Credit for Employer-Provided Child Care Facilities and Services

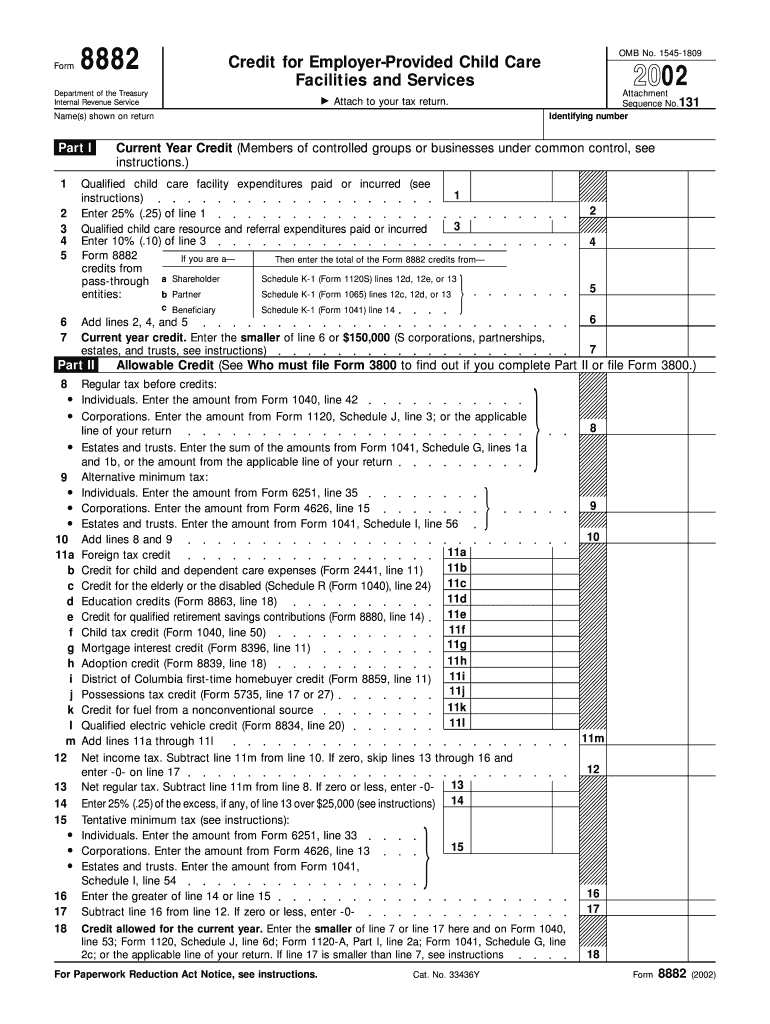

Form 8882 is a tax form used by businesses to claim a credit for expenses related to providing child care facilities and services for their employees. This credit is designed to encourage employers to support their workforce by offering child care options, which can enhance employee satisfaction and productivity. The credit can cover a variety of costs, including the construction, renovation, or expansion of child care facilities, as well as direct payments for child care services provided to employees.

How to Use Form 8882

To effectively use Form 8882, businesses must first determine their eligibility for the credit. This involves reviewing the specific expenses that qualify and ensuring they meet the IRS guidelines. Once eligibility is confirmed, employers should accurately fill out the form by providing detailed information about their child care facilities and services, including costs incurred and the number of employees benefiting from these services. After completion, the form should be submitted along with the business's tax return.

Steps to Complete Form 8882

Completing Form 8882 involves several key steps:

- Gather necessary documentation, including receipts for child care expenses and details about the facilities.

- Fill out the form by providing your business information and detailing the child care services offered.

- Calculate the credit amount based on eligible expenses and follow the instructions provided on the form.

- Review the completed form for accuracy before submission.

- Attach Form 8882 to your business tax return and file it with the IRS.

Eligibility Criteria for Form 8882

To qualify for the credit claimed on Form 8882, businesses must meet certain eligibility criteria. These include:

- The business must provide child care facilities or services directly to employees.

- Expenses must be incurred for the purpose of establishing or maintaining child care services.

- The services must be available to all employees, not just a select group.

It is essential for businesses to review these criteria carefully to ensure compliance and maximize their potential credit.

Required Documents for Form 8882

When filing Form 8882, businesses should prepare and include several key documents:

- Receipts for all eligible child care expenses.

- Documentation of the child care facilities, including any construction or renovation details.

- Records of the number of employees utilizing the child care services.

Having these documents readily available can help streamline the filing process and support the claims made on the form.

Filing Deadlines for Form 8882

Form 8882 must be filed in accordance with the business's tax return deadlines. Generally, this means it should be submitted by the due date of the tax return for the year in which the expenses were incurred. Businesses should be aware of any extensions that may apply to their tax filings, as these could affect the submission timeline for Form 8882.

Quick guide on how to complete form 8882 fill in version credit for employer provided child care facilities and services

Effortlessly Prepare [SKS] on Any Device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, enabling you to access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to generate, modify, and eSign your files swiftly without delays. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to Modify and eSign [SKS] Effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools designed by airSlate SignNow for such purposes.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors requiring new printed copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services

Create this form in 5 minutes!

How to create an eSignature for the form 8882 fill in version credit for employer provided child care facilities and services

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services?

Form 8882 is a tax credit form that allows businesses to claim a credit for expenses incurred in providing child care facilities and services to employees. This credit helps employers offset costs and encourages the provision of such services. Utilizing airSlate SignNow can streamline the process of submitting Form 8882 efficiently.

-

How can airSlate SignNow assist with Form 8882 Fill in Version submissions?

airSlate SignNow offers an easy-to-use platform for electronically signing and sending documents, including Form 8882 Fill in Version. Our solution simplifies the document management process, ensuring that you can quickly assemble and submit all necessary paperwork. This way, your business can focus more on providing child care benefits.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting with a free trial. Each plan includes robust features to help manage documents effectively, including support for Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services. To find the plan that suits you, you can visit our pricing page.

-

What features does airSlate SignNow provide for eSigning documents?

airSlate SignNow includes features such as user-friendly document creation, collaborative editing, and secure electronic signatures. These features are essential when working with Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services, as they help ensure compliance and facilitate smooth submission. This makes document handling less cumbersome for employers.

-

Are there integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates with a variety of popular applications and platforms, enhancing your workflow efficiency. This includes HR software and tax management systems, which can help in keeping track of Form 8882 Fill in Version submissions. Seamless integrations enable a holistic approach to managing employee benefits.

-

What benefits can employers gain by utilizing Form 8882 Fill in Version?

By using Form 8882 Fill in Version, employers can receive tax credits that substantially reduce the financial burden of providing child care benefits to their employees. This not only improves employee satisfaction and retention but also fosters a positive workplace environment. airSlate SignNow further aids this process by providing a streamlined method for document submission.

-

How secure is the document processing with airSlate SignNow?

Security is a top priority for airSlate SignNow, which implements advanced encryption methods to protect sensitive information. When processing documents like Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services, you can trust that your data remains confidential. We comply with all necessary regulations to ensure your documents are handled securely.

Get more for Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services

Find out other Form 8882 Fill in Version Credit For Employer Provided Child Care Facilities And Services

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document

- How Can I eSign Illinois Healthcare / Medical Presentation

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document