Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

What is the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

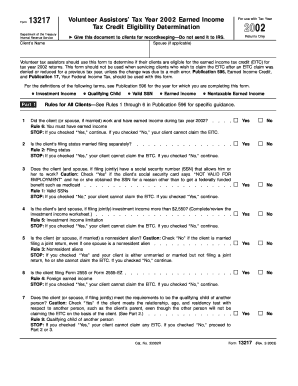

The Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination is a crucial document used by volunteer tax preparers to assess a taxpayer’s eligibility for the Earned Income Tax Credit (EITC). This form helps ensure that eligible individuals receive the financial benefits they qualify for, based on their income and family size. It is particularly important for those who may not be familiar with tax regulations, as it provides a structured way to evaluate eligibility and gather necessary information.

How to use the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

Using the Form 13217 involves several steps that guide volunteer tax preparers through the eligibility assessment process. First, the volunteer must gather relevant information from the taxpayer, including income details and family composition. Next, the form is filled out with this data, following the instructions provided. Once completed, the form serves as a record of the eligibility determination, which can be referenced during the tax filing process. This ensures that both the volunteer and the taxpayer have a clear understanding of the eligibility status for the EITC.

Steps to complete the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

Completing the Form 13217 requires a systematic approach. The following steps outline the process:

- Collect necessary information from the taxpayer, including income, filing status, and number of dependents.

- Review the eligibility criteria for the Earned Income Tax Credit to ensure the taxpayer qualifies.

- Fill out the form accurately, ensuring all sections are completed based on the information provided.

- Double-check the entries for accuracy and completeness before finalizing the form.

- Provide a copy of the completed form to the taxpayer for their records.

Eligibility Criteria

To qualify for the Earned Income Tax Credit, certain eligibility criteria must be met. These typically include:

- Filing status: The taxpayer must meet specific filing status requirements, such as single, married filing jointly, or head of household.

- Income limits: The taxpayer's earned income and adjusted gross income must fall below certain thresholds, which vary based on filing status and number of dependents.

- Qualifying children: The taxpayer may need to have qualifying children who meet age, residency, and relationship tests.

- Citizenship: The taxpayer must be a U.S. citizen or resident alien for the entire tax year.

Required Documents

When completing the Form 13217, certain documents are essential to verify the taxpayer's eligibility. These documents may include:

- Proof of income, such as W-2 forms or pay stubs.

- Social Security numbers for the taxpayer and any qualifying children.

- Documentation of any other income sources, such as self-employment income or unemployment benefits.

- Information regarding any other tax credits or deductions the taxpayer may be claiming.

Form Submission Methods

The Form 13217 can be submitted through various methods, depending on the volunteer program's guidelines. Typically, the options include:

- Online submission through designated tax preparation software used by the volunteer program.

- Mailing the completed form to the appropriate tax authority.

- In-person submission at designated tax assistance locations, where volunteers can assist with the filing process.

Quick guide on how to complete form 13217 volunteer assistors tax year earned income tax credit eligibility determination

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest method to edit and eSign [SKS] without difficulty

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight signNow sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over lost or mislaid documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

Create this form in 5 minutes!

How to create an eSignature for the form 13217 volunteer assistors tax year earned income tax credit eligibility determination

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination?

The Form 13217 is a critical document used by volunteer tax preparers to determine eligibility for the Earned Income Tax Credit. This form is vital for ensuring that low-income families receive the tax credits they qualify for, maximizing their financial benefits during tax season.

-

How can airSlate SignNow assist with the Form 13217 process?

airSlate SignNow simplifies the completion and eSigning of the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination. Our platform allows users to securely send, receive, and manage signed documents, making the tax preparation process efficient and streamlined.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow provides several pricing plans tailored to meet different business needs. We offer competitive rates that cater to both small organizations and large enterprises, ensuring access to features that assist in processing the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination.

-

What features does airSlate SignNow offer for tax documents?

Our platform includes robust features such as customizable templates, automated reminders, and secure storage. With airSlate SignNow, users can easily manage their Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination documents to enhance workflow and reduce processing time.

-

Is airSlate SignNow compliant with IRS regulations?

Yes, airSlate SignNow adheres to the highest security standards and complies with IRS regulations relevant to tax documents. This compliance ensures that the handling of the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination meets legal requirements, providing peace of mind for users.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integration with popular applications such as Google Drive, Dropbox, and CRM systems. This seamless connectivity allows for effective management of the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination and other documents across platforms.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for tax filing streamlines the process, reduces the risk of errors, and accelerates document turnaround time. By leveraging our platform for the Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination, users can enhance their productivity and ensure timely submissions.

Get more for Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

Find out other Form 13217 Volunteer Assistors' Tax Year Earned Income Tax Credit Eligibility Determination

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF