Mortgage Loan Applliicatiion Mortgage Loan App Cat on Albertamortgages Form

Understanding the Mortgage Loan Application

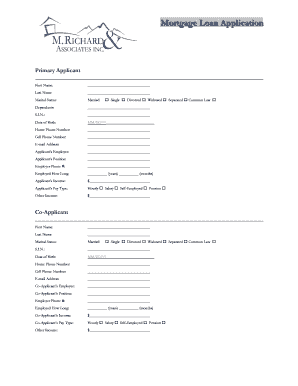

The Mortgage Loan Application is a crucial document used by lenders to assess a borrower's eligibility for a mortgage. This form collects essential information about the applicant's financial situation, including income, debts, and credit history. It typically includes sections for personal information, employment details, and financial disclosures. Understanding this application is vital for anyone looking to secure a mortgage, as it directly influences the approval process and loan terms.

Steps to Complete the Mortgage Loan Application

Completing the Mortgage Loan Application involves several key steps. First, gather necessary documents, such as proof of income, tax returns, and bank statements. Next, fill out the application form accurately, ensuring all information is current and truthful. Pay special attention to financial sections, as discrepancies can lead to delays or denials. After completing the form, review it for accuracy and completeness before submitting it to the lender.

Required Documents for the Mortgage Loan Application

When preparing to submit the Mortgage Loan Application, specific documents are required to support your financial claims. Commonly needed documents include:

- Two years of tax returns

- Recent pay stubs or proof of income

- Bank statements for the last two to three months

- Documentation of any additional income sources, such as bonuses or rental income

- Details of current debts, including credit card statements and loan information

Having these documents ready can streamline the application process and help ensure a smoother approval experience.

Eligibility Criteria for the Mortgage Loan Application

Eligibility for a mortgage loan typically depends on several factors, including credit score, income level, and debt-to-income ratio. Most lenders require a minimum credit score, often around six hundred, although this can vary. Additionally, stable employment and sufficient income to cover monthly mortgage payments are crucial. Understanding these criteria can help applicants prepare effectively and improve their chances of approval.

Application Process and Approval Time

The application process for a mortgage loan usually begins with submitting the Mortgage Loan Application to a lender. After submission, the lender will review the application and verify the provided information. This process may take anywhere from a few days to several weeks, depending on the lender's workload and the complexity of the application. Once approved, the lender will issue a loan estimate, detailing the terms and costs associated with the mortgage.

Legal Use of the Mortgage Loan Application

The Mortgage Loan Application is a legally binding document. It is essential for applicants to provide accurate and truthful information, as any misrepresentation can lead to legal consequences, including loan denial or fraud charges. Understanding the legal implications of signing this application is crucial for protecting oneself throughout the mortgage process.

Quick guide on how to complete mortgage loan applliicatiion mortgage loan app cat on albertamortgages

Complete [SKS] seamlessly on any device

Web-based document management has gained traction among enterprises and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed materials, allowing you to obtain the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize pertinent sections of your files or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of missing or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Mortgage Loan Applliicatiion Mortgage Loan App Cat On Albertamortgages

Create this form in 5 minutes!

How to create an eSignature for the mortgage loan applliicatiion mortgage loan app cat on albertamortgages

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for completing a Mortgage Loan Application using airSlate SignNow?

The process for completing a Mortgage Loan Application using airSlate SignNow is streamlined and user-friendly. You can easily upload your documents, fill out the necessary information, and eSign directly within the platform. This ensures that your Mortgage Loan Application is submitted efficiently and securely.

-

How much does the Mortgage Loan Application service cost with airSlate SignNow?

Pricing for the Mortgage Loan Application service varies based on your needs and the features you choose. airSlate SignNow offers competitive rates, making it a cost-effective solution for completing your Mortgage Loan Application. You can request a quote to find the plan that best fits your requirements.

-

What features does the airSlate SignNow platform offer for Mortgage Loan Applications?

airSlate SignNow provides a range of features specifically designed for Mortgage Loan Applications. These include document management, easy eSigning, templates for common forms, and integration with popular CRM systems. These tools enhance the overall efficiency of your Mortgage Loan Application process.

-

Can I integrate other tools with airSlate SignNow for my Mortgage Loan Application?

Yes, airSlate SignNow allows for seamless integration with various applications to enhance your Mortgage Loan Application workflow. You can connect it with tools like CRM systems, cloud storage, and more, which helps streamline your operations and improves efficiency. This makes your Mortgage Loan Application process smarter and faster.

-

What are the benefits of using airSlate SignNow for Mortgage Loan Applications?

Using airSlate SignNow for your Mortgage Loan Application brings numerous benefits, including increased speed and security in document handling. The platform simplifies the eSigning process, allowing for quicker turnaround times. Moreover, its user-friendly interface ensures a smooth experience for both lenders and applicants.

-

Is airSlate SignNow compliant with regulations for Mortgage Loan Applications?

Absolutely, airSlate SignNow is built with compliance in mind, meeting industry standards for security and data protection. This is particularly important when dealing with sensitive information like that found in Mortgage Loan Applications. Rest assured that your data is safe and secure throughout the process.

-

What type of customer support does airSlate SignNow provide for Mortgage Loan Applications?

airSlate SignNow offers robust customer support options to assist with any questions regarding your Mortgage Loan Application. Whether you need guidance on features or technical assistance, their team is ready to help via chat, email, or phone. You can count on prompt and helpful responses to ensure a smooth experience.

Get more for Mortgage Loan Applliicatiion Mortgage Loan App Cat On Albertamortgages

Find out other Mortgage Loan Applliicatiion Mortgage Loan App Cat On Albertamortgages

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure