Form W 8ECI Rev

What is the Form W-8ECI Rev

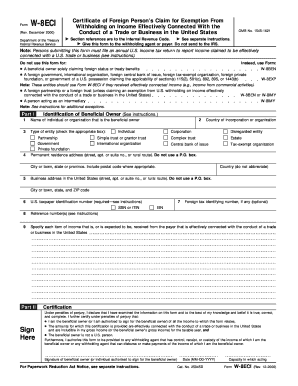

The Form W-8ECI Rev is a tax document used by foreign entities to certify that income received is effectively connected with a trade or business in the United States. This form is essential for non-U.S. persons who earn income from U.S. sources and wish to claim a reduced withholding tax rate or exemption under U.S. tax laws. By completing this form, foreign entities can ensure compliance with Internal Revenue Service (IRS) regulations while accurately reporting their income.

How to use the Form W-8ECI Rev

The Form W-8ECI Rev is utilized primarily by foreign businesses and individuals to report income that is effectively connected with a U.S. trade or business. To use this form, the entity must fill it out accurately and submit it to the withholding agent or payer. This ensures that the correct amount of tax is withheld from payments made to them. It is important to keep a copy of the completed form for record-keeping and future reference.

Steps to complete the Form W-8ECI Rev

Completing the Form W-8ECI Rev involves several key steps:

- Provide the name of the foreign entity and its country of incorporation.

- Indicate the type of entity (e.g., corporation, partnership).

- List the U.S. taxpayer identification number (if applicable) and foreign tax identifying number.

- Detail the income that is effectively connected with a U.S. trade or business.

- Sign and date the form, certifying that the information provided is accurate.

Each section must be filled out carefully to avoid delays or issues with tax compliance.

Legal use of the Form W-8ECI Rev

The legal use of the Form W-8ECI Rev is governed by U.S. tax laws, which require foreign entities to report income that is effectively connected with a U.S. trade or business. This form serves as a declaration to the IRS that the income is subject to U.S. taxation, allowing the entity to claim any applicable benefits under tax treaties. Failure to submit this form when required can lead to higher withholding tax rates and potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form W-8ECI Rev vary based on the type of income and the specific circumstances of the foreign entity. Generally, the form should be submitted before the payment is made to ensure the correct withholding rate is applied. It is advisable to check with the IRS or a tax professional for specific deadlines relevant to individual situations, especially as tax laws can change.

Required Documents

To complete the Form W-8ECI Rev, certain documents may be required, including:

- Proof of foreign status, such as a passport or government-issued identification.

- Documentation of the entity's tax identification number.

- Records of income that is effectively connected with a U.S. trade or business.

Having these documents ready can streamline the process of completing and submitting the form.

Eligibility Criteria

Eligibility to use the Form W-8ECI Rev is primarily for foreign entities that earn income from U.S. sources and can demonstrate that this income is effectively connected with a trade or business in the United States. This includes corporations, partnerships, and other business entities that meet the IRS guidelines. It is important for entities to assess their eligibility based on their specific income sources and business activities.

Quick guide on how to complete form w 8eci rev

Complete Form W 8ECI Rev effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without any hold-ups. Handle Form W 8ECI Rev on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Form W 8ECI Rev with ease

- Locate Form W 8ECI Rev and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form W 8ECI Rev and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form w 8eci rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form W 8ECI Rev. used for?

Form W 8ECI Rev. is used by foreign entities to signNow that they are engaged in a trade or business within the United States. Completing this form allows them to claim a reduced rate of withholding tax under U.S. tax laws, ensuring compliance and facilitating smoother financial transactions.

-

How can I easily fill out Form W 8ECI Rev. using airSlate SignNow?

With airSlate SignNow, you can quickly complete Form W 8ECI Rev. through our user-friendly interface. Our platform allows you to upload the form, fill in the necessary information, and add your electronic signature with just a few clicks, making the process efficient and hassle-free.

-

What are the benefits of using airSlate SignNow for Form W 8ECI Rev.?

Using airSlate SignNow for Form W 8ECI Rev. streamlines the document signing process, saving you time and reducing paperwork. Our secure platform ensures that your documents are safely stored and easily accessible, which supports efficient management of your financial and tax-related documentation.

-

Does airSlate SignNow offer any integrations to assist with Form W 8ECI Rev.?

Yes, airSlate SignNow integrates with various applications like Google Drive, Dropbox, and CRM systems to enhance the experience when handling Form W 8ECI Rev. These integrations allow you to import data easily and maintain organized records, facilitating seamless document management.

-

Is airSlate SignNow suitable for businesses of all sizes to manage Form W 8ECI Rev.?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, making it ideal for managing Form W 8ECI Rev. Whether you are a small startup or a large corporation, our cost-effective solution scales to meet your needs efficiently, ensuring that you can handle compliance documents effortlessly.

-

What support is available for users of airSlate SignNow for Form W 8ECI Rev.?

airSlate SignNow provides comprehensive support for users dealing with Form W 8ECI Rev. Our customer service team is available via chat, email, or phone to assist you with any questions or issues, ensuring you can complete your documentation smoothly.

-

How is pricing structured for using airSlate SignNow with Form W 8ECI Rev.?

The pricing for airSlate SignNow is structured based on the subscription plan you choose, providing different tiers that cater to various needs. These plans include the features necessary to efficiently manage Form W 8ECI Rev. while remaining budget-friendly for businesses.

Get more for Form W 8ECI Rev

- College of education ctu online ctu online edu form

- Ksou migration certificate form

- Official form 201

- Fillable online pdf only fincen gov fax email print form

- One page service agreement template form

- One page loan agreement template form

- One page non disclosure agreement template form

- Monitor plan contract template form

Find out other Form W 8ECI Rev

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy