Schedule H Form 1040 Household Employment Taxes

Understanding the Schedule H Form 1040 Household Employment Taxes

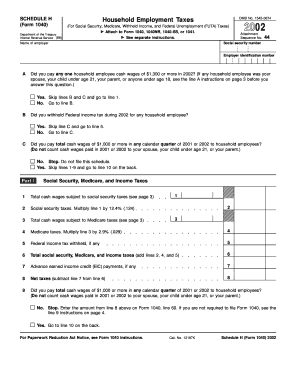

The Schedule H Form 1040 is a crucial document for taxpayers who employ household workers, such as nannies, caregivers, or housekeepers. This form is used to report household employment taxes, including Social Security and Medicare taxes, that are owed on wages paid to these workers. If you pay any employee $2,400 or more in a calendar year, you are required to file this form. Understanding its purpose helps ensure compliance with tax regulations and avoids potential penalties.

Steps to Complete the Schedule H Form 1040 Household Employment Taxes

Completing the Schedule H Form 1040 involves several key steps:

- Gather Information: Collect details about your household employee, including their name, address, and Social Security number.

- Calculate Wages: Determine the total wages paid to your household employee during the year.

- Calculate Taxes: Use the IRS guidelines to calculate the Social Security and Medicare taxes owed based on the wages.

- Fill Out the Form: Enter the required information in the appropriate sections of the form.

- Review and Submit: Double-check the information for accuracy before submitting the form with your tax return.

Legal Use of the Schedule H Form 1040 Household Employment Taxes

The Schedule H Form 1040 serves a legal purpose by ensuring that household employers comply with federal tax laws. Filing this form is necessary to report employment taxes accurately and pay the required amounts. Failure to file can result in penalties and interest on unpaid taxes. It is important for employers to keep accurate records of wages paid and taxes withheld to support their filings.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Schedule H Form 1040 is essential for compliance. Generally, this form must be submitted along with your annual tax return by April 15 of the following year. If you file for an extension, the deadline may vary, but it is crucial to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Key Elements of the Schedule H Form 1040 Household Employment Taxes

The Schedule H Form 1040 includes several key elements that taxpayers must complete:

- Employee Information: Name, address, and Social Security number of the household employee.

- Wages Paid: Total wages paid to the employee during the tax year.

- Taxes Owed: Calculated amounts for Social Security and Medicare taxes.

- Signature: The employer's signature certifying the accuracy of the information provided.

Examples of Using the Schedule H Form 1040 Household Employment Taxes

There are various scenarios where the Schedule H Form 1040 is applicable. For instance, if a family hires a nanny and pays her $3,000 for the year, they must report this amount using the form. Similarly, if someone employs a caregiver for an elderly relative and pays $2,500, they are also required to file. These examples illustrate the importance of the form in ensuring compliance with tax obligations for household employment.

Quick guide on how to complete schedule h form 1040 household employment taxes

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-centric operation today.

The easiest way to modify and electronically sign [SKS] without any hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Highlight important sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for these purposes.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to store your changes.

- Select how you wish to share your form, by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule H Form 1040 Household Employment Taxes

Create this form in 5 minutes!

How to create an eSignature for the schedule h form 1040 household employment taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule H Form 1040 Household Employment Taxes?

The Schedule H Form 1040 Household Employment Taxes is used to report household employment taxes for individuals who employ domestic workers. This form allows you to calculate and pay Social Security, Medicare, and Federal Unemployment Taxes related to household employment. Understanding how to complete this form is crucial for compliance with tax obligations.

-

How can airSlate SignNow help with Schedule H Form 1040 Household Employment Taxes?

airSlate SignNow provides an easy-to-use platform for electronically signing and managing documents, including tax forms like the Schedule H Form 1040. Our solution ensures that you can quickly fill out and submit necessary tax documents securely. This streamlines your workflow, making tax season less stressful.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers several features, including document editing, eSignature capabilities, secure cloud storage, and easy sharing options. These tools simplify the preparation and submission process for essential documents like the Schedule H Form 1040 Household Employment Taxes. With these features, you can keep all your tax documents organized and accessible.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, there is a subscription cost associated with using airSlate SignNow. However, the pricing is designed to be cost-effective, providing value for those who need to manage documents like the Schedule H Form 1040 Household Employment Taxes. Depending on your needs, various pricing plans can accommodate individual and business users.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enhancing your tax management processes. You can easily connect our platform with accounting software to streamline the flow of information for the Schedule H Form 1040 Household Employment Taxes and ensure accuracy in your submissions.

-

What are the benefits of using airSlate SignNow for household employment taxes?

Using airSlate SignNow simplifies the process of preparing and signing essential documents, such as the Schedule H Form 1040 Household Employment Taxes. Our platform enhances efficiency, reduces the likelihood of errors, and provides a secure environment for your sensitive information. This all contributes to smoother tax reporting and compliance.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes security and confidentiality when handling sensitive tax information, including the Schedule H Form 1040 Household Employment Taxes. Our platform employs advanced encryption technologies and complies with industry standards to safeguard your data. You can trust us to keep your documents secure.

Get more for Schedule H Form 1040 Household Employment Taxes

- Assignment of benefits roofing form pdf

- Transcript request form shawano school district

- Physician authorization for restortive service form

- Birmingham permit office form

- Form pa cs 611 vap

- 3r and 5 endorsement form

- Neale donald walsch pdf form

- Acting evaluation form houston independent school district houstonisd

Find out other Schedule H Form 1040 Household Employment Taxes

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later