Form 3468 Fill in Version Investment Credit

What is the Form 3468 Fill in Version Investment Credit

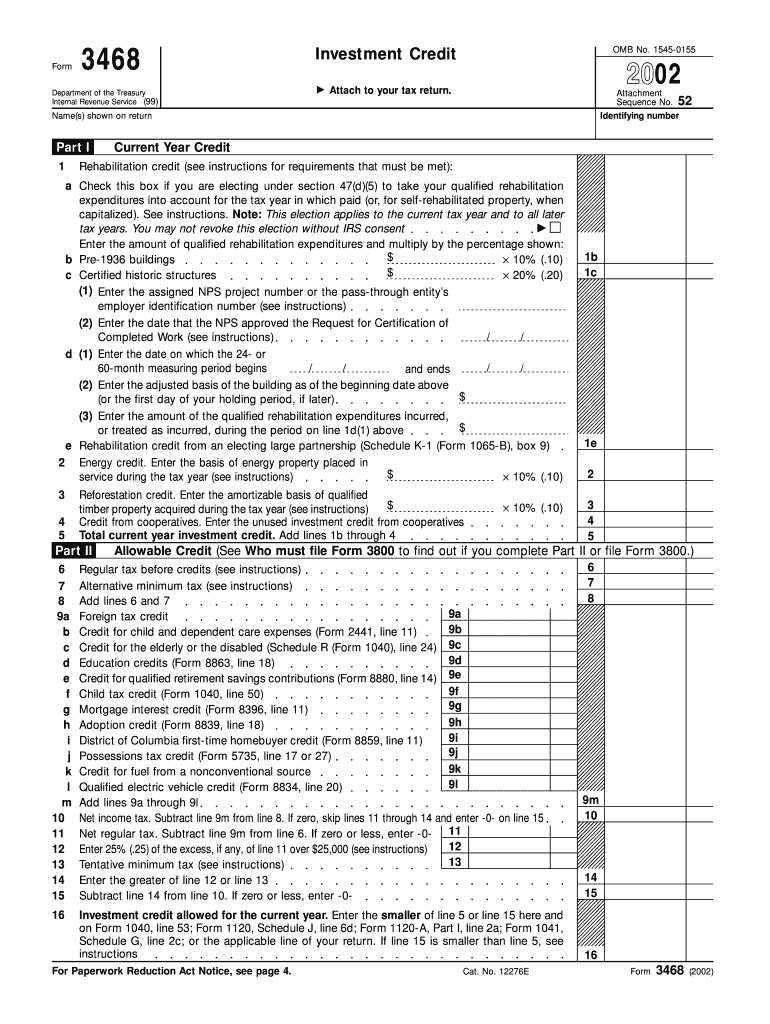

The Form 3468 Fill in Version Investment Credit is a tax form used by businesses in the United States to claim the investment credit. This credit is designed to incentivize businesses to invest in certain types of property, such as equipment and facilities, which can enhance productivity and stimulate economic growth. By completing this form, taxpayers can reduce their federal tax liability based on the amount invested in qualified property during the tax year.

How to use the Form 3468 Fill in Version Investment Credit

To effectively use the Form 3468 Fill in Version Investment Credit, taxpayers must first gather all necessary information about their investments. This includes details about the type of property, the date of acquisition, and the cost associated with the investment. Once the information is compiled, the form can be filled out accurately, ensuring that all sections are completed as required. After completing the form, it should be submitted with the taxpayer's federal income tax return.

Steps to complete the Form 3468 Fill in Version Investment Credit

Completing the Form 3468 involves several key steps:

- Gather all relevant documentation related to the investment, including purchase invoices and dates.

- Fill out the identification section, providing your name, address, and taxpayer identification number.

- Detail the qualified property, including descriptions and costs associated with each item.

- Calculate the investment credit by following the instructions provided on the form.

- Review the completed form for accuracy before submission.

Eligibility Criteria

To qualify for the investment credit claimed on Form 3468, taxpayers must meet specific eligibility criteria. Generally, the property must be new or used, and it should be placed in service during the tax year for which the credit is being claimed. Additionally, the property must be used predominantly in a trade or business. Taxpayers should also ensure that they are not claiming the credit for property that has been previously claimed or for which they have already received a tax benefit.

Filing Deadlines / Important Dates

Filing deadlines for the Form 3468 Fill in Version Investment Credit align with the general tax return deadlines. Typically, individual taxpayers must file their returns by April 15, while corporations may have different deadlines based on their fiscal year. It is crucial to keep track of these dates to ensure timely submission and to avoid any penalties associated with late filings.

Form Submission Methods (Online / Mail / In-Person)

The Form 3468 can be submitted through various methods. Taxpayers have the option to file electronically using tax preparation software that supports the form. Alternatively, the form can be printed and mailed to the appropriate IRS address. For those who prefer in-person submission, visiting a local IRS office may be an option, although this method is less common. Always ensure that the form is sent to the correct address based on the taxpayer's location and the type of return being filed.

Quick guide on how to complete form 3468 fill in version investment credit

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and without issues. Manage [SKS] on any device with the airSlate SignNow applications for Android or iOS and enhance any document-driven process today.

How to Edit and eSign [SKS] with Ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow for this task.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text (SMS), or invite link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tiresome form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign [SKS] and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 3468 Fill in Version Investment Credit

Create this form in 5 minutes!

How to create an eSignature for the form 3468 fill in version investment credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 3468 Fill in Version Investment Credit?

The Form 3468 Fill in Version Investment Credit is a tax form used to claim investment tax credit for qualified investments. It's designed to simplify the process of reporting these credits to the IRS. By using this form, businesses can receive signNow tax savings, making it a valuable tool in your financial strategy.

-

How can airSlate SignNow help with the Form 3468 Fill in Version Investment Credit?

airSlate SignNow provides an intuitive platform for businesses to send, fill out, and eSign the Form 3468 Fill in Version Investment Credit seamlessly. Our solution streamlines document management, helping you focus on maximizing your tax credits without the hassle of paperwork. With advanced features, you can ensure every detail is accurate and compliant.

-

Is there a cost associated with using airSlate SignNow for the Form 3468 Fill in Version Investment Credit?

Yes, airSlate SignNow offers competitive pricing plans tailored to fit various business needs. While there is a cost associated with our eSigning services, the benefits of using the Form 3468 Fill in Version Investment Credit can lead to greater tax savings, ultimately making it a cost-effective solution. We also provide a free trial to explore our features.

-

What features does airSlate SignNow offer for filling out the Form 3468 Fill in Version Investment Credit?

airSlate SignNow includes features like templates, real-time collaboration, and mobile access to simplify filling out the Form 3468 Fill in Version Investment Credit. Our user-friendly interface makes it easy to input necessary information and ensure accuracy. Additionally, you can track document status and receive notifications when actions are needed.

-

Are there integrations available for the Form 3468 Fill in Version Investment Credit with airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with various popular applications, allowing you to streamline your workflow when managing the Form 3468 Fill in Version Investment Credit. This connectivity enhances your overall productivity and ensures that all relevant data is in one place for easy accessibility.

-

What are the benefits of using airSlate SignNow for the Form 3468 Fill in Version Investment Credit?

Using airSlate SignNow for the Form 3468 Fill in Version Investment Credit provides numerous benefits including enhanced efficiency, reduced paperwork, and improved compliance. Our platform minimizes the risk of errors in your tax submissions. By leveraging our technology, businesses can save time and ensure they accurately claim their investment tax credits.

-

Can I access the Form 3468 Fill in Version Investment Credit on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and fill out the Form 3468 Fill in Version Investment Credit wherever you are. This mobile functionality ensures that you can manage your important documents on the go, providing flexibility and convenience for busy professionals.

Get more for Form 3468 Fill in Version Investment Credit

Find out other Form 3468 Fill in Version Investment Credit

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form