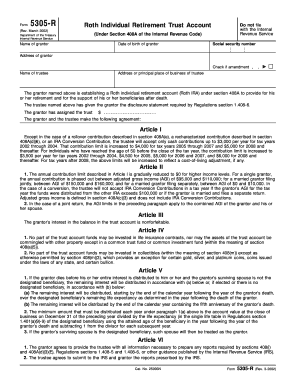

Form 5305 R Roth Individual Retirement Trust Account under Section 408A of the Internal Revenue Code Date of Birth of Grantor Re

Understanding the Form 5305 R Roth Individual Retirement Trust Account

The Form 5305 R Roth Individual Retirement Trust Account is a crucial document for establishing a Roth IRA under Section 408A of the Internal Revenue Code. This form is specifically designed for individuals who wish to create a retirement account that allows for tax-free growth and tax-free withdrawals in retirement. The form outlines the terms and conditions of the account, ensuring compliance with IRS regulations. It is essential for the grantor to provide accurate information, including their date of birth, to avoid any issues with the account's validity.

Steps to Complete the Form 5305 R Roth Individual Retirement Trust Account

Completing the Form 5305 R requires careful attention to detail. First, the grantor must fill in their personal information, including name, address, and date of birth. Next, the form requires the selection of a trustee, who will manage the account. The grantor should also specify the investment options and contributions. It is important to review the completed form for accuracy before submission. Any errors may lead to delays or complications with the account setup.

Obtaining the Form 5305 R Roth Individual Retirement Trust Account

The Form 5305 R can be obtained directly from the IRS website or through financial institutions that offer Roth IRAs. Many banks and investment firms provide this form as part of their account opening process. It is advisable to ensure that the most current version of the form is used to comply with IRS requirements. If assistance is needed, financial advisors can help navigate the process of obtaining and completing the form.

Legal Use of the Form 5305 R Roth Individual Retirement Trust Account

The legal use of the Form 5305 R is governed by IRS regulations, which specify how Roth IRAs must be established and maintained. The form serves as a declaration of the grantor's intent to create a Roth IRA and outlines the responsibilities of both the grantor and the trustee. Adhering to the guidelines set forth in the form is essential for ensuring that the account retains its tax-advantaged status. Failure to comply with these regulations may result in penalties or loss of tax benefits.

Key Elements of the Form 5305 R Roth Individual Retirement Trust Account

Several key elements must be included in the Form 5305 R to ensure its validity. These include the grantor's personal information, the name and address of the trustee, and the specific terms of the account. The form also requires a signature from the grantor, indicating their agreement to the terms. Additionally, it is important to include the date of birth of the grantor, as this information is necessary for IRS records and compliance.

Eligibility Criteria for the Form 5305 R Roth Individual Retirement Trust Account

To be eligible to establish a Roth IRA using the Form 5305 R, the grantor must meet certain criteria. Primarily, the individual must have earned income that falls within the IRS limits for contributions. Additionally, there are income thresholds that may affect the ability to contribute to a Roth IRA. Understanding these eligibility requirements is crucial for individuals looking to maximize their retirement savings through this account type.

Quick guide on how to complete form 5305 r roth individual retirement trust account under section 408a of the internal revenue code date of birth of grantor

Finish [SKS] effortlessly on any device

Managing documents online has become prevalent among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed papers, as you can easily find the right template and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and eSign your documents quickly without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

How to edit and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of the documents or hide sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require new copies to be printed. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Re

Create this form in 5 minutes!

How to create an eSignature for the form 5305 r roth individual retirement trust account under section 408a of the internal revenue code date of birth of grantor

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

The Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. is a regulatory document that allows you to establish a Roth IRA trust account. This account provides tax-free growth on investments and allows for tax-free withdrawals after certain conditions are met. By utilizing this form, you can ensure compliant handling of your retirement savings.

-

How does airSlate SignNow simplify the process of handling the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

airSlate SignNow streamlines the management of the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. by providing easy eSigning and document sharing features. Our platform ensures that you can quickly obtain signatures and store documents securely without any hassle. This signNow efficiency helps in compliance and smooth operation of your retirement account.

-

What are the pricing options for using airSlate SignNow for the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. Our affordable solutions provide businesses with an easy way to handle document management effectively. You can choose from flexible subscription tiers tailored to your specific usage requirements.

-

What features does airSlate SignNow offer for managing retirement account forms like the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

airSlate SignNow includes features such as advanced eSignature capabilities, customizable templates, and secure cloud storage that simplify handling retirement account forms like the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. These features ensure that all documents remain compliant and accessible with ease, making your document workflow seamless.

-

Are there integrations available with airSlate SignNow for managing the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

Yes, airSlate SignNow seamlessly integrates with various popular applications and platforms. This makes it easier to manage the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. directly within your established workflows. Integrations with CRM software and cloud storage solutions enhance document management efficiency.

-

What benefits can I expect from using airSlate SignNow for retirement account documents like the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

By utilizing airSlate SignNow for retirement account documents, you can expect increased efficiency, enhanced security, and simplified compliance with the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. Our solution minimizes turnaround time for document signing and guarantees that your sensitive information is well protected.

-

Can I use airSlate SignNow for multiple retirement accounts including the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev.?

Absolutely! airSlate SignNow supports the management of multiple document types, including various retirement accounts and forms, such as the Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Rev. This flexibility allows you to manage all your retirement-related documents in one place, streamlining your workflow.

Get more for Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Re

Find out other Form 5305 R Roth Individual Retirement Trust Account Under Section 408A Of The Internal Revenue Code Date Of Birth Of Grantor Re

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure

- Help Me With eSign Texas Plumbing Business Plan Template

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure