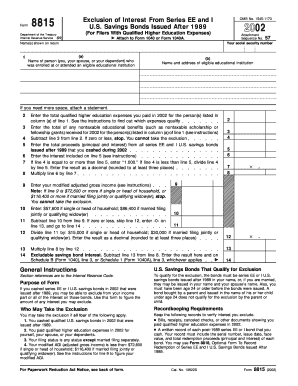

Savings Bonds Issued After 1989 for Filers with Qualified Higher Education Expenses Attach to Form 1040 or Form 1040A

Understanding Savings Bonds Issued After 1989

Savings bonds issued after 1989 are a type of U.S. government debt security designed to encourage saving among individuals. These bonds can be particularly beneficial for filers who have qualified higher education expenses. When used appropriately, the interest earned on these bonds may be excluded from federal income tax, provided that the funds are used for qualified education costs. This makes them an attractive option for families planning for education expenses.

How to Use Savings Bonds for Education Expenses

To utilize savings bonds for qualified higher education expenses, filers must ensure that the bonds are redeemed in the same year that the education expenses are incurred. The interest from these bonds can be tax-exempt if the taxpayer meets certain income limits and uses the money for eligible education costs, such as tuition and fees. It is important to keep records of the expenses and the bonds redeemed to support any claims made on tax returns.

Steps to Complete Form 1040 or Form 1040A

When filing Form 1040 or Form 1040A, filers should follow these steps to report savings bond interest:

- Gather all necessary documentation, including the savings bond information and proof of qualified education expenses.

- Complete the relevant sections of Form 1040 or Form 1040A, ensuring to include the amount of interest earned from the savings bonds.

- Attach any required documentation that supports the exclusion of interest from taxable income.

- Review the completed form for accuracy before submission.

Eligibility Criteria for Tax Exclusion

To qualify for the tax exclusion on savings bond interest, filers must meet specific criteria. The bonds must be issued in the name of the taxpayer or their spouse, and the funds must be used for qualified higher education expenses. Additionally, the taxpayer's modified adjusted gross income must fall below certain thresholds set by the IRS. It is advisable to consult IRS guidelines or a tax professional to confirm eligibility.

Required Documents for Filing

When filing taxes with savings bonds, filers should prepare the following documents:

- Form 1040 or Form 1040A, depending on the taxpayer's situation.

- Documentation of the savings bonds, including purchase dates and amounts.

- Proof of qualified higher education expenses, such as tuition bills or receipts.

- Any additional forms required by the IRS related to education credits or deductions.

IRS Guidelines for Reporting Savings Bonds

The IRS provides specific guidelines regarding the reporting of savings bond interest. Filers should refer to IRS Publication 550, which outlines the treatment of interest earned on savings bonds. It is essential to follow these guidelines to ensure compliance and maximize potential tax benefits. Understanding these regulations can help filers avoid errors that may lead to penalties or missed tax advantages.

Quick guide on how to complete savings bonds issued after 1989 for filers with qualified higher education expenses attach to form 1040 or form 1040a

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign [SKS] seamlessly

- Locate [SKS] and click Get Form to begin.

- Leverage the tools available to fill out your document.

- Emphasize relevant parts of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as an ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share the form, whether by email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure excellent communication throughout the entire form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses Attach To Form 1040 Or Form 1040A

Create this form in 5 minutes!

How to create an eSignature for the savings bonds issued after 1989 for filers with qualified higher education expenses attach to form 1040 or form 1040a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses?

Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses are a type of U.S. government bond that, under certain conditions, can be redeemed tax-free to help pay for qualified education expenses. When filing taxes, the interest income received from these bonds may be excluded from gross income if the criteria are met.

-

How do I claim Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses on my taxes?

To claim Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses, you need to attach a completed Form 1040 or Form 1040A to your tax return. Make sure you meet the eligibility requirements to exclude the interest income from being taxed.

-

What are the eligibility requirements for using Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses?

Eligibility for Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses depends on your adjusted gross income and whether you are using the proceeds for qualified higher education expenses. Review IRS guidelines to confirm if you qualify for the exclusion.

-

Are there any limitations on the amount of Savings Bonds I can use for education expenses?

Yes, there are limitations on the amount you can claim using Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses. Typically, the maximum amount that can be excluded from income is capped depending on the filing status and other factors. It’s essential to consult IRS guidelines or a tax professional for specific limits.

-

How can airSlate SignNow help with my tax document filing related to Savings Bonds?

airSlate SignNow streamlines the process of sending and eSigning vital tax documents, including those related to Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses. Our easy-to-use platform ensures that all documents are securely signed and quickly filed, saving you valuable time.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like customizable templates, secure eSigning, automated reminders, and cloud storage to ensure your tax documents, including those related to Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses, are managed efficiently and securely.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax documentation?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing tax documentation, including Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses. Our pricing plans are flexible, ensuring that businesses of all sizes can benefit from our electronic signature solutions without breaking the bank.

Get more for Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses Attach To Form 1040 Or Form 1040A

- Thlopthlocco tribal town enrollment form

- Desert bowler form

- Financial needs analysis questionnaire unstoppable crew unstoppablecrew form

- Create an alien project form

- Reveille peak ranch waiver form

- We are vertigo waiver form

- Destimoney trading software form

- Relationship of transported particle size to water velocity worksheet answer key form

Find out other Savings Bonds Issued After 1989 For Filers With Qualified Higher Education Expenses Attach To Form 1040 Or Form 1040A

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe