Form 8818 Rev December Fill in Uncle Fed's Tax*Board

What is the Form 8818 Rev December Uncle Fed's Tax Board?

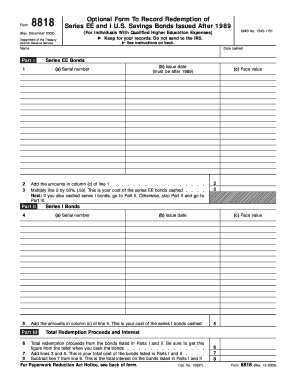

The Form 8818 Rev December, commonly referred to as Uncle Fed's Tax Board, is an official document used by taxpayers in the United States to report certain tax-related information. This form is specifically designed for individuals who need to claim a tax credit or report tax information related to specific transactions. It is essential for ensuring compliance with IRS regulations and for accurately reflecting tax obligations on individual tax returns.

How to use the Form 8818 Rev December Uncle Fed's Tax Board

Using the Form 8818 Rev December involves filling out the necessary information accurately. Taxpayers should begin by gathering all relevant financial documents, including income statements and prior tax returns. Once the form is obtained, individuals can fill it out by entering the required details in the designated fields. It is crucial to double-check all entries for accuracy before submission to avoid potential issues with the IRS.

Steps to complete the Form 8818 Rev December Uncle Fed's Tax Board

Completing the Form 8818 Rev December involves several key steps:

- Obtain the form from the IRS website or a tax professional.

- Gather all necessary documentation, such as income statements and previous tax returns.

- Carefully fill out the form, ensuring all information is accurate and complete.

- Review the completed form for any errors or omissions.

- Submit the form either electronically or by mail, following the IRS guidelines.

Key elements of the Form 8818 Rev December Uncle Fed's Tax Board

The Form 8818 Rev December includes several critical elements that taxpayers must understand. These elements typically consist of personal identification information, income details, and specific tax credit claims. Each section of the form is designed to capture essential data that the IRS requires to process tax returns accurately. Understanding these key elements helps ensure that taxpayers provide all necessary information to avoid delays or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8818 Rev December are crucial for compliance. Typically, the form must be submitted by the tax return deadline, which is usually April 15 for individual taxpayers. However, if additional time is needed, taxpayers may file for an extension. It is important to stay informed about any changes in deadlines or requirements announced by the IRS to ensure timely submission.

Penalties for Non-Compliance

Failure to submit the Form 8818 Rev December or inaccuracies in the information provided can lead to penalties imposed by the IRS. These penalties may include fines or interest on unpaid taxes. Taxpayers should be aware of the importance of compliance and the potential financial implications of not adhering to IRS regulations. Ensuring that the form is completed accurately and submitted on time can help avoid these issues.

Quick guide on how to complete form 8818 rev december fill in uncle feds taxboard

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the appropriate form and securely save it online. airSlate SignNow equips you with all the features necessary to create, alter, and electronically sign your documents promptly without delay. Manage [SKS] from any device using the airSlate SignNow apps available for Android or iOS, and simplify your document-related processes today.

How to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for this task.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and hit the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Edit and electronically sign [SKS] to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 8818 Rev December Fill In Uncle Fed's Tax*Board

Create this form in 5 minutes!

How to create an eSignature for the form 8818 rev december fill in uncle feds taxboard

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

Form 8818 Rev December Fill In Uncle Fed's Tax*Board is a tax form used by individuals to claim a credit for taxes withheld. With airSlate SignNow, you can easily fill in and eSign this form digitally, streamlining your tax preparation process.

-

How does airSlate SignNow simplify the process of managing Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

airSlate SignNow offers a user-friendly platform that allows you to fill in and sign Form 8818 Rev December Fill In Uncle Fed's Tax*Board online. The platform eliminates the need for printing, scanning, or mailing, saving you time and reducing errors in the process.

-

What are the pricing options for using airSlate SignNow with Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

airSlate SignNow provides flexible pricing plans tailored to different business needs. Whether you are a small business or a larger enterprise, we offer cost-effective solutions to digitally manage your forms, including Form 8818 Rev December Fill In Uncle Fed's Tax*Board.

-

Can I integrate airSlate SignNow with other applications to manage Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow. This allows for efficient management of Form 8818 Rev December Fill In Uncle Fed's Tax*Board alongside your existing business tools.

-

What features does airSlate SignNow offer for handling Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

With airSlate SignNow, you can take advantage of features such as real-time collaboration, templates, and advanced security options. These tools are designed to ensure that your Form 8818 Rev December Fill In Uncle Fed's Tax*Board is handled efficiently and securely.

-

How does using airSlate SignNow benefit my business when working with Form 8818 Rev December Fill In Uncle Fed's Tax*Board?

Using airSlate SignNow enhances productivity by simplifying the signing and filling process for Form 8818 Rev December Fill In Uncle Fed's Tax*Board. It reduces paperwork, speeds up document turnaround times, and helps ensure compliance with tax regulations.

-

Is it safe to eSign Form 8818 Rev December Fill In Uncle Fed's Tax*Board with airSlate SignNow?

Absolutely! airSlate SignNow utilizes industry-standard security protocols to protect your information. eSigning Form 8818 Rev December Fill In Uncle Fed's Tax*Board on our platform ensures that your personal and sensitive data remains secure.

Get more for Form 8818 Rev December Fill In Uncle Fed's Tax*Board

Find out other Form 8818 Rev December Fill In Uncle Fed's Tax*Board

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors